Key United Kingdom FinTech investment stats in H1 2024:

- UK FinTech deal activity on track to fall by over 50% for the year

- Average deal size increased from $15.2m to $20.9m as investors adopted a more selective approach

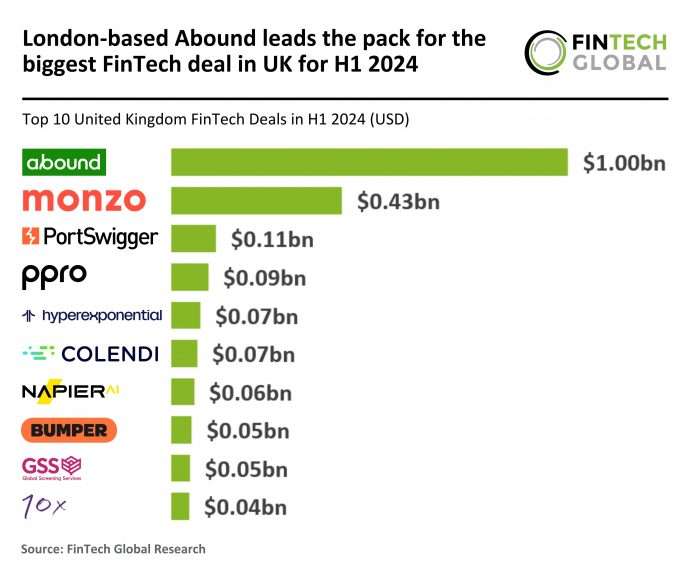

- Abound, a leading credit technology company, secured the largest deal in the UK for the first half of the year with a funding round of $1bn

In the first half of 2024, the UK FinTech sector experienced a notable drop in both deal activity and funding. Only 188 funding rounds were completed in H1 2024, marking a steep drop of 59% compared to the 457 deals closed during the first half of last year. Funding also saw a significant drop, with FinTech companies raising just $3.9bn in H1 2024, a 43% decrease from the $6.9bn raised in H1 2023. If the deal activity trend continues at the same rate, the projected total for 2024 would be 376 deals, less than half of last year’s total of 798.

The average deal value in H1 2024 was approximately $20.7m, reflecting an increase compared to the $15.1m in H1 2023. This increase in average deal value indicates that while the overall number of deals has significantly decreased, the investments being made are larger, suggesting a more selective approach by investors focusing on companies with greater growth potential or more established businesses within the FinTech sector.

Abound, a leading London-based credit technology company using Open Banking and artificial intelligence to offer more affordable loans, has secured the biggest FinTech deal in the UK for H1 2024 with a new financing round of $1bn. This significant funding follows Abound’s rapid growth and achievement of profitability just three years after its launch. The new capital includes a multi-year asset-backed debt financing arrangement from Citi, based on loan originations, and a Series B equity round led by Silicon Valley’s GSR Ventures. Abound has issued over $400m in loans to date and plans to double its workforce to 130 employees this year. The company’s AI-powered technology, Render, analyses customers’ bank transaction data to tailor loan repayment plans based on individual financial situations, contrasting with traditional credit checks that rely on broad statistical averages. With over 15m people in the UK struggling to borrow for unexpected costs, Abound aims to revolutionize credit decision-making, promoting financial inclusion by making loans accessible at more affordable rates. As a pioneer in leveraging Open Banking and AI in consumer credit decisioning, Abound is already partnering with banks and lenders across Europe to support the AI transition in the lending industry.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global