Bud Financial, a leading AI-powered financial data platform for banks, has launched an agnetic AI banking capability to help individuals optimise their finances.

This new feature, a consumer agent embedded into Bud’s GenAI and customer-facing product suite, is set to assist users in optimising their personal finances, according to FF News.

The company, known for its innovative solutions, has now announced the release of its first agentic banking capability designed for financial institutions.

The driving force behind the introduction of Bud’s agentic banking capability is the need for better financial management tools for consumers.

With banking habits evolving and customer needs shifting, financial institutions are seeking ways to help their clients make smarter financial decisions.

Bud’s new consumer agent directly addresses this demand by autonomously managing finances, making it easier for customers to maximise their interest earnings and avoid unnecessary overdraft fees.

The newly launched consumer agent is designed to understand a user’s financial history and current situation. By continuously analysing this information, the agent autonomously performs tasks like moving money between accounts, ensuring financial obligations are met, and preventing users from incurring overdraft fees.

Its primary objective is to help users optimise their savings and make smarter financial decisions without requiring lifestyle changes.

What sets Bud’s agentic AI apart from traditional AI agents is its ability to perform multiple tasks for both businesses and consumers. This innovation is expected to be a game-changer for banking institutions, streamlining processes not only for customers but also for back and middle-office operations.

The agentic AI is capable of applications across fraud detection, AML compliance, marketing, pricing, credit decisions, and risk management.

Additionally, Bud’s initial testing has delivered significant results. For a US bank’s customer base, the consumer agent demonstrated that it could generate at least $500 in additional profit for over 27% of users annually.

It also effectively shielded low-income customers from overdraft fees, saving an average of $460 in fees and in some cases, avoiding fees amounting to thousands of dollars.

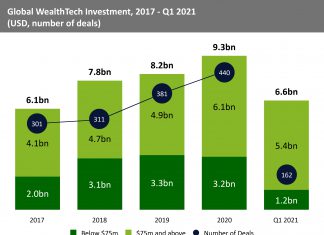

Bud plans to enhance the consumer agent’s capabilities in the near future, adding features such as credit score management, debt optimisation, and WealthTech integration, further expanding its ability to manage and optimise user finances.

Bud Financial CEO and Co-Founder Edward Maslaveckas said, “At Bud, we already have a technology stack that understands financial data like no one else in the market. That means our agentic capabilities are built on top of reliable individual context, something which is missing from many GenAI financial agents. We know that supporting consumers with their finances grows deposits and improves customer loyalty and lifetime value. These agents are just the beginning. The learnings and techniques we have developed with the consumer agents are now being used to develop agentic models to run processes in the bank such as data analysis and personalisation. Our ‘Drive’ product customers will be able to switch these on for testing as they are released over the course of the next year. Every part of the bank can benefit from these models: fraud, AML, marketing, pricing, credit decisions, and risk management – the applications of agentic technology are far-reaching and hugely impactful for the banking sector.”

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global