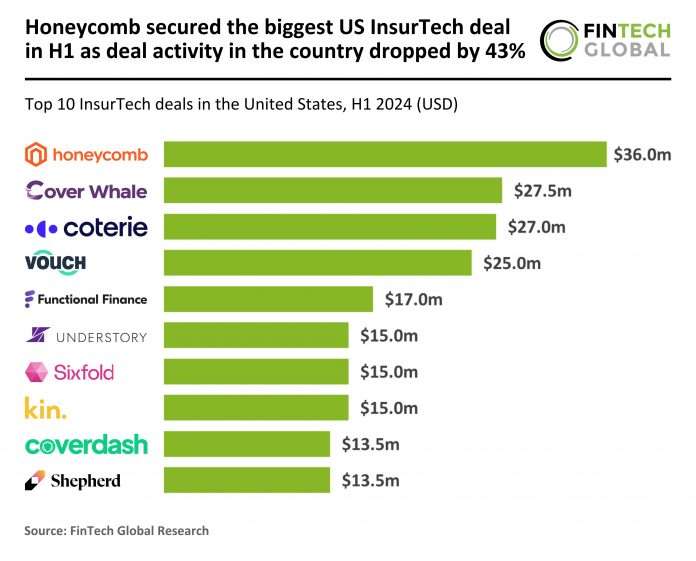

Key US InsurTech investment stats in H1 2024:

- US InsurTech deal activity for the first half of the year dropped by 43% YoY

- The top 10 deals saw five states make the list as Wisconsin and Ohio secured one top deal each

- Honeycomb secured the biggest InsurTech deal in the US during H1 2024 with a Series B funding round of $36m

In H1 2024, the US InsurTech sector saw a drop in both deal activity and funding. Only 53 deals were recorded during the first six months of 2024, marking a 43% decrease compared to the 93 completed in H1 last year. Funding also saw a steep decline, with InsurTech companies raising just $0.5bn during the first six months of 2024, a steep decline of 78% from the $2.3bn raised in H1 2023. If deal activity continues at the rate recorded in the first six months of the year, the projected total for 2024 would be 106 transactions, a 30% decrease from last year’s total of 153.

The top 10 deals in H1 2024 within the U.S. InsurTech sector were spread across five states, with California and New York emerging as the dominant players. California secured three top deals, a decline from the five it had in H1 2023, while New York increased its share, rising from two top deals in H1 2023 to three in H1 2024. Illinois also saw a notable increase, securing two top deals compared to one in the previous year. Wisconsin and Ohio made their first appearance in the top 10 list, each securing one top deal, while Texas and Georgia, which each had one top deal in H1 2023, were absent from the H1 2024 list. This shift suggests a broadening distribution of significant InsurTech deals across more states, with new entrants like Wisconsin and Ohio signalling growing activity outside traditional hubs like California and New York.

Honeycomb, a leading digital insurer specializing in property and casualty (P&C) coverage for landlords and condo associations in the U.S., has secured the biggest InsurTech deal in the country for H1 2024 with a $36m Series B funding round. The round was led by Zeev Ventures, with new investors Arkin Holdings and Launchbay Capital joining existing backers Ibex Investors, Phoenix Insurance, and IT-Farm. Honeycomb leverages cutting-edge technologies, including AI, computer vision, and aerial imagery, to underwrite risks with precision and in real time, driving rapid growth of 200-300% year over year. Headquartered in Chicago with offices across the U.S. and in Tel Aviv, Honeycomb now operates in 16 of the largest states, covering around 60% of the U.S. market and insuring over $21bn in real estate assets. With this new capital, the company plans to double its workforce to 180 employees within the next 18 months, further enhancing its proprietary AI-driven technology that offers bespoke insurance coverage, streamlines the customer and broker experience, and adapts to the evolving needs of its clients.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global