Spanish FinTech investment stats in 2022:

• Spanish FinTech deal activity reached 95 deals in 2022, a 35% drop from 2021

• Spanish FinTech investment dropped to $336m in 2022, a 63% reduction from the previous year

• Blockchain & Crypto and InsurTech were the most active FinTech subsectors with 15 deals each.

Spanish FinTech investment saw a significant 63% decline in 2022, reaching $336m in total. FinTech Deal activity also saw a 35% drop to 95 deals which is more considerable than similar countries such as Italy which saw a 14% decline. Blockchain & Crypto and InsurTech were the most active FinTech subsectors with 15 deals each, a 15.7% share of total deals. WealthTech and RegTech were second most active with 14 deals each and PropTech and PayTech were the joint third most active. Blockchain & Crypto companies accounted for 33.7% of FinTech investment in Spain during 2022.

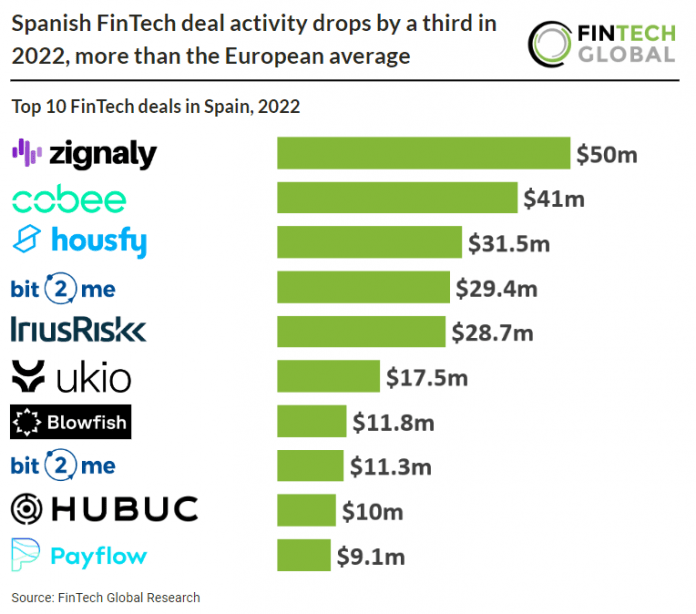

Zignaly, a crypto trading platform, was the largest FinTech deal in Spain during 2022, raising $50m in their latest venture funding round, led by The Global Emerging Markets Group. The company has earmarked the capital for global expansion. The platform allows users to copy trade industry experts and members of the platform have invested more than $120m in the portfolios of more than 300 of the platform’s vetted expert crypto traders and fund managers. Zignaly’s multi-chain, multi-exchange infrastructure (and native ZIG token) supports sales and IDOs on chains including Ethereum ERC20, BSC, Polygon, Solana, Harmony, Avalanche and other blockchains. Additionally, the company recently launched ZIGPAD, a brand new launchpad-style incubator and investment network designed to facilitate fundraising for blockchain projects and cross-chain IDOs with minimal knowledge or expertise in smart contracts.

The capital of Spain, Madrid saw the most FinTech deals raised at 34, a 35.7% share of total deals in 2022 although Barcelona was not far behind at 31 deals showing no clear singular FinTech hub in Spain.

Spain’s FinTech sandbox has processed their fourth cohort of companies in October 2022. Notably a Spanish payments technology firm has developed a euro-pegged stablecoin that is part of the latest batch of emerging projects set to undergo testing in Spain’s FinTech sandbox. The stable-token project from Monei is one of five initiatives to sit within the fourth cohort of projects to have received what is termed “favourable prior evaluation” for sandbox entry.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global