All eyes are on the banking sector after Silicon Valley Bank (SVB), Signature Bank, First Republic Bank (FRC) and now Credit Suisse collapsed. There is a possibility that some large neobanks listed could be in the firing lines. Monzo’s auditors EY gave a ‘material uncertainty” warning and labelled the bank’s ability to operate as a ‘going concern’ in July 2021. Although this trouble was sorted, widespread account withdrawals due to panic, are likely and may affect operations going forward. The neobanks listed have nowhere near as many total assets as a bank like SVB ($211bn at the point of collapse compared to £5.2bn of Monzo in Feb 2022) so a crash would be less significant. A collapse would likely lower the trust that neobanks have had to build.

There has been a restoration of relative calm in the banking sector, possible solely through the injection of massive amounts of emergency funds from lenders as a last resort, namely central banks, and a few of the industry’s most powerful entities. This being said, markets remain on edge, benchmark indexes of shares in US and European banks have lost 20% and 13% respectively since the close of trading last Wednesday (15th March 2023).

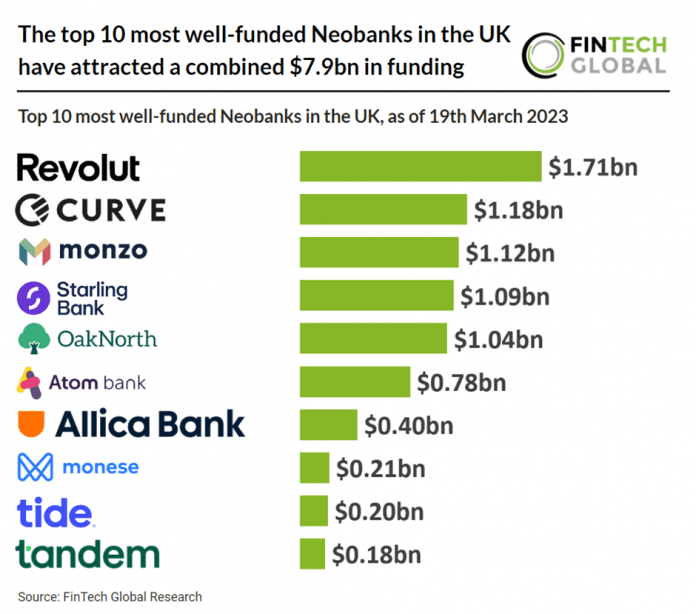

Revolut, a British-Lithuanian Neobank and financial technology company, is the most well-funded Neobank in the UK with $1.71bn in total funding as of 19th March 2023. Revolut’s latest funding round occurred in July 2021 and raised $800m. The round, led by SoftBank Vision Fund, Tiger Global Management valued the company at $33bn however an internal US investor Triplepoint Venture Growth has cut its internal valuation of its Revolut shares by 15pc in March 2023. The markdown implies a current valuation of $28bn.

UK Neobanks are continuing to grow in popularity and customers. According to Insider Intelligence, forecasts for 2023 account holders are as follows Monzo (6.6 million), Revolut (4.1 million), Starling (2.2 million) and Monese (1.6 million). To compare these figures to traditional banks, HSBC has over 14.75 million active customers as of 2021.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global