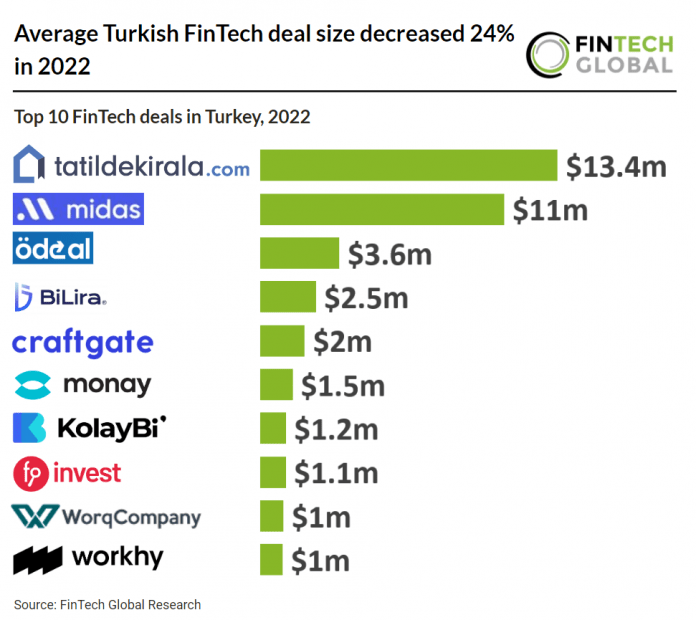

Key Turkish FinTech investment stats in 2022:

• Turkish FinTech deal activity in 2022 reached 42 deals in total, a 12.5% decrease from 2021 levels

• Turkish FinTech companies raised a combined $46m in 2022, down 12% from the previous year

• Average FinTech deal size in Turkey decreased 24% to $1.69m in 2022

Turkey’s FinTech sector saw decline in both investment and deal activity in 2022. Turkish FinTech investment reached $46m in 2022, a 12% drop from 2021. Turkish FinTech deal activity saw a similar 12.5% drop to 42 deals over the same period. Average FinTech deal size in Turkey decreased 24% to $1.69m in 2022.

TatildeKirala.com, an online marketplace for short term rentals, was the largest FinTech deal in Turkey during 2022, raising $13.4m in their latest Seed funding round, led by Re-Pie Asset Management. Ruşen Mat, the founder and CEO stated that they will go through significant changes in the business model of the company in 2023 and that they have the chance to use a $5m resource in this project in addition to the investment provided by Re-pie Portfolio for this new business model, signalling that they have entered a very exciting period.

FinTech subsectors, RegTech and WealthTech, were the most active in Turkey during 2022, with nine deals each. The second most active was Blockchain & Crypto with seven deals.

Of the 42 Turkish deals announced in 2022, only eight were raised in the local Turkish Lira, one was raised in Euros and the rest were in US dollars. On March 16th 2023, policies in the draft manifesto sources of Erdogan’s party indicate that the party will return to orthodox economic policy. Erdogan’s party has currently been driving low interest rates although this has caused very high inflation rates which peaked at 85% in 2022. The decline in the Turkish lira has led to a reduction in the standard of living, which has negatively affected Erdogan’s popularity and this reversal is an attempt to improve public sentiment.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global