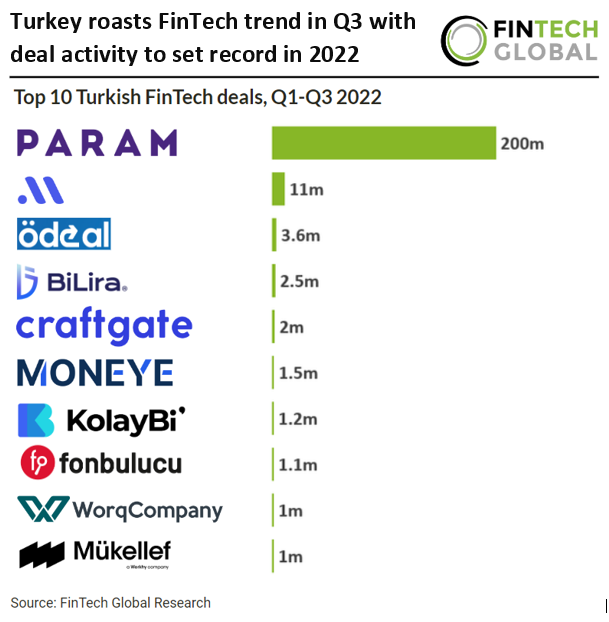

- Turkish FinTech deal activity is defying the FinTech trend in 2022. Deal activity in Turkey is expected to set new records reaching 54 deals in total for 2022, a 12% increase from 2021 levels. FinTech funding in the country is also on track to set a new record in 2022, reaching an expected $323m in funding for the year based on investment pace in the first three quarters of 2022. This was bolstered by a sizeable $200m deal from Param which accounted for 83% of investment in Q1-Q3 2022.

- Param, a financial technology company that provides prepaid cards, online payment system, credit and other fintech operational solutions, raised $200m from EBRD, CEECAT Capital and Alpha Associates. As part of the investment the company consolidated all of its business under the ParamTech brand. The company obtained the first electronic money license in Turkey and also implemented the first “Buy Now, Pay Later” model in the countrywith the initiative of Kredim. With its restructuring, Param offers more than 30 products developed by its 250-person technology team for different needs, including “E-Money”, “e-Wallet”, “Buy Now, Pay Later” and “Open Banking”.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global