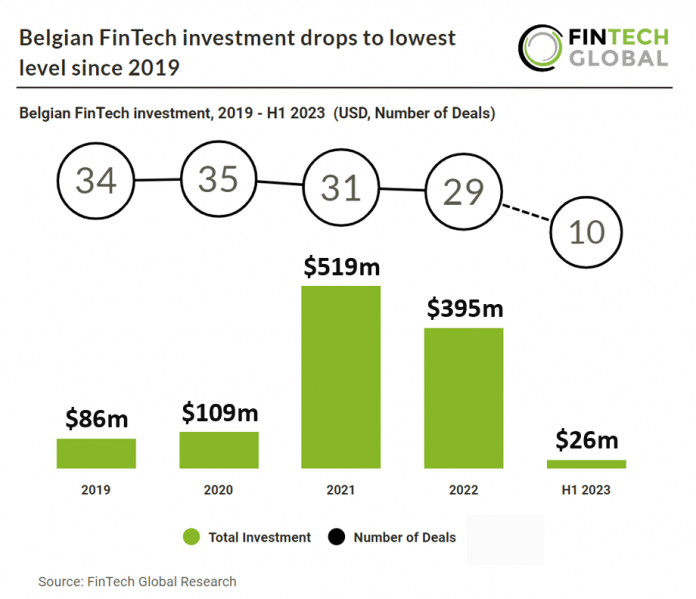

Key FinTech investment stats in Belgium during 2019 – H1 2023

• Belgian FinTech deal activity is on track to reach 20 transactions in 2023, a 32% drop from last year

• Belgian FinTech companies raised a combined $26m in H1 2023, a 91% drop from H1 2022

• Belgian FinTech companies have raised $1.13bn over the past five years

Belgium’s FinTech sector has seen a fall in both investment and deal activity in the first six months of 2023 2023 and is on track to report their lowest investment results over the past five years. The number of Belgian FinTech deals is projected to hit 20 in 2023, based on H1 results, indicating a 32% decrease compared to the previous year’s deal activity. In H1 2023, FinTech deal activity reached 10 deals in the country, a 44% drop from H1 2022. In the first half of 2023, Belgian FinTech enterprises collectively raised $26m in funding, marking a substantial 91% reduction compared to the funding raised during the same period in 2022. Over the last five years, Belgian FinTech firms have amassed a total funding of $1.13bn.

PV01, which provide more efficient debt capital markets for traditional and digital assets, had the largest Belgian FinTech deal in H1 2023, raising $9m in their latest venture funding round, led by Tioga Capital Partners. PV01 is designed to underwrite and tokenize bonds and operate as a dealer by providing liquidity in those securities, all on public blockchains. The result will be a more efficient way for issuers to raise capital and investors to purchase high-quality debt, providing broader access to investment opportunities through tokenization. PV01’s model provides better visibility into ownership using smart contracts and a frictionless method of transferring debt. “Historically it has been difficult for investors, especially smaller ones, to hold bonds. They typically are only accessible to large institutional participants leaving many investors on the outside looking in,” said Max Boonen, CEO and Founder of PV01.

Belgium has introduced an FDI screening mechanism set to be effective from July 1, 2023. This aligns with other EU countries adopting national measures for the EU’s FDI Regulation. The new system will impact companies by adding compliance requirements and potentially altering planned transactions. The mechanism covers vital sectors like infrastructure, technology, defense, and energy. Mandatory notification is necessary, and transactions can’t close before clearance, with penalties for violations. The process involves a 30-day preliminary assessment and up to another month for a detailed review. The Interfederal Screening Commission will oversee notifications, with the competent minister making decisions based on national security and public order concerns.