Key ESG FinTech investment stats in Q2 2023:

• The United States led the way for ESG FinTech deal activity with six transactions in Q2

• ESG FinTech deal activity reached 19 funding rounds globally, down 30% from Q1 2023

• ESG FinTech companies raised a combined $51m in the second quarter, a 60% reduction from Q1 2023

ESG FinTech has experienced a downturn, globally in Q2 2023 with both investment and deal activity dropping from the previous quarter. Global ESG FinTech deal activity recorded a total of 19 deals in Q2 2023, marking a 30% decrease compared to the deal count in Q1 2023. In Q2 2023, ESG FinTech firms collectively secured $51 million in funding, indicating a 60% decline in comparison to the funding obtained in Q1 2023.

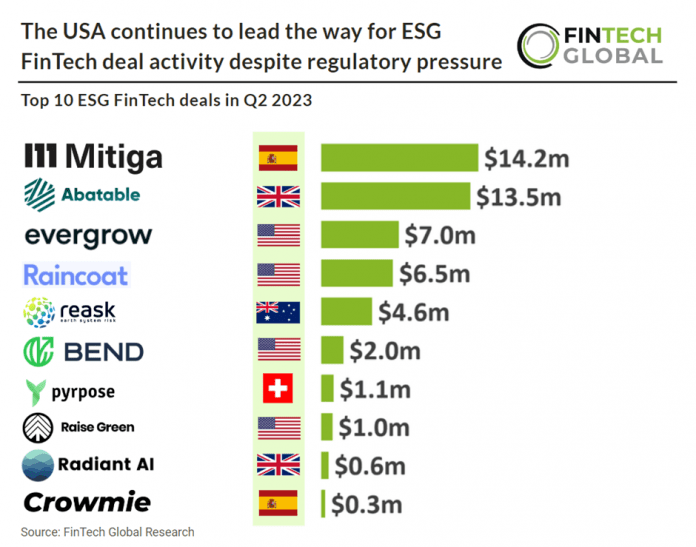

Mitiga, a climate risk scoring service, had the largest ESG FinTech deal in Q2 2023, raising $14.2m in their latest Series A funding round, led by Kibo Ventures. With the newly acquired funding, Mitiga Solutions intends to establish itself as the standard in Climate Score, providing firms with the necessary tools to assess, measure, and report climate hazard-associated risks. It aims to enhance its physics-based models to prevent natural hazards from escalating into disasters. At its core, Mitiga Solutions unifies scientific models with cutting-edge technology to better gauge the impact of natural hazards. This approach allows insurance, real estate, energy, and financial companies to understand and address the risks and uncertainties brought about by climate change. The company employs high-performance computing, artificial intelligence, and scientific models to streamline risk modelling capabilities and insurance products.

The USA was the most active ESG FinTech country in Q2 2023 with six deals, a 37% share of total deals. The UK and Spain were the joint second most active ESG FinTech countries with three deals each, a 16% share of deals.

The USA’s ESG sector continues to fracture in 2023. The scope and influence of state-level anti-ESG laws are broadening, presenting a dilemma for companies striving to meet investor expectations while navigating an increasingly complex array of regulations aimed at restricting the incorporation of ESG considerations. States like Kentucky have enacted legislation that prohibits the inclusion of non-pecuniary interests in fiduciary decisions. In 2023, several large states introduced varying fiduciary duty laws, further complicating the landscape. Meanwhile, state pension funds in states like New York and California adopt ESG goals, adding another layer of complexity. Critics argue that ESG is a form of economic boycott, particularly against industries like fossil fuels, potentially harming states dependent on such sectors. New laws extend anti-boycott measures to encompass companies considering ESG factors. This has prompted some states to divest funds from companies engaged in ESG-related activities. In Utah, a law was enacted to prevent companies from conspiring to eliminate options for boycotted companies. Critics view ESG as a shadow regulatory system with ulterior motives, leading to efforts to prohibit financial institutions from using a “social credit score” that includes ESG criteria. While ESG experts reject comparisons to China’s Social Credit System, some states like Florida have passed laws against using such scores for lending decisions.