As the new year gets underway, there were few FinTech funding rounds to report on in the first week of 2023, with a smattering of investments made.

In one of the bigger investments in the week, Southeast Asian banking and digital finance firm Akulaku raked in an impressive $200m from a Japanese investor.

Such an investment represents a growing interest in digital finance platforms and digital technologies in the financial world in general. Such is the move to digital that recent research by Mastercard found that over half of people in the UK think physical wallets will become less relevant as digital payments continue to grow.

As 2022 came to an end last week, the FinTech sector has had the opportunity to take stock of another prosperous and exciting year for the industry. While some national FinTech sectors saw a bump as the cost-of-living crisis bit hard, many markets managed to stay resilient in the face of hardship.

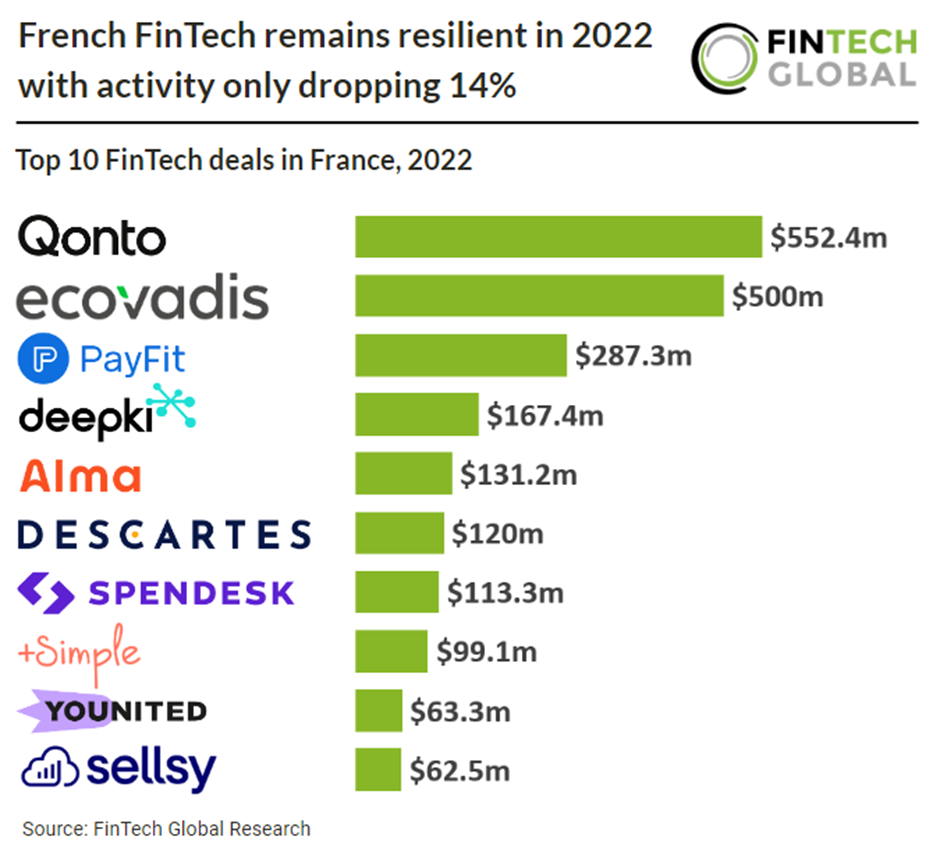

Such a market was France, who only saw activity drop 14% year-on-year compared to the boom year of 2021.

According to FinTech Global research, French FinTech companies announced 36 deals in Q4 2022, which brough the country’s total for the year to 167 deals. FinTech Investment in the country set new records during 2022, with French companies in Q4 raising $1.49bn, pushing the years total to $4.9bn, increasing 44% from 2021 levels.

New French FinTech legislation relating to Crypto, meanwhile, went into affect on the 1st January. The country has implemented a specific tax framework for crypto assets via its 2022 Finance bill. Capital gains on crypto-assets will be taxable as non-commercial income for those not managing personal wealth, while for individuals, exchanges between “qualifying” crypto-assets are tax-neutral.

Markets who did not cope as well as France, however, include those of the Philippines and Czechia.

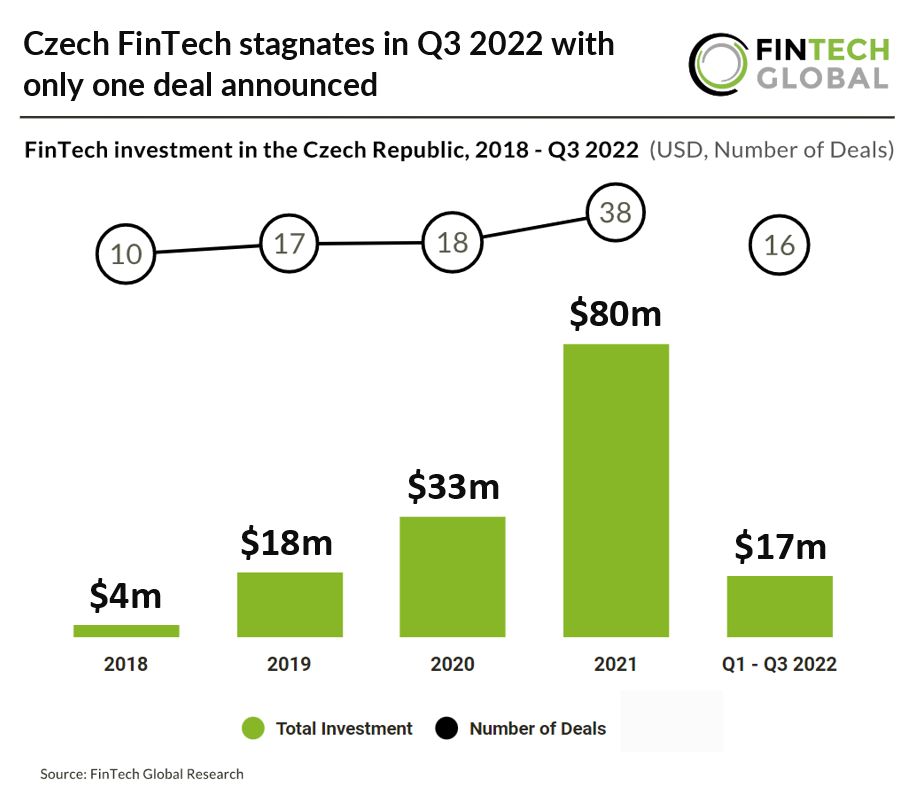

In the third quarter of 2022, Czechia saw its FinTech sector stagnate with only one deal being announced. FinTech investment in the country is expected to reach $22.8m in 2022 based on the first three months of 2022, a 71% drop from 2021.

FinTech Global research also found that deal activity in the country has also dropped from 2021 levels. Deal activity in the country expected to reach 21 deals in 2022 although a lacking third quarter indicates this could be even lower.

Prague, the country’s capital was home to the most start-ups in the first three months of 2022 with 11 deals announced in total, a 69% share of deals. Praha was the second most active city with four deals in total.

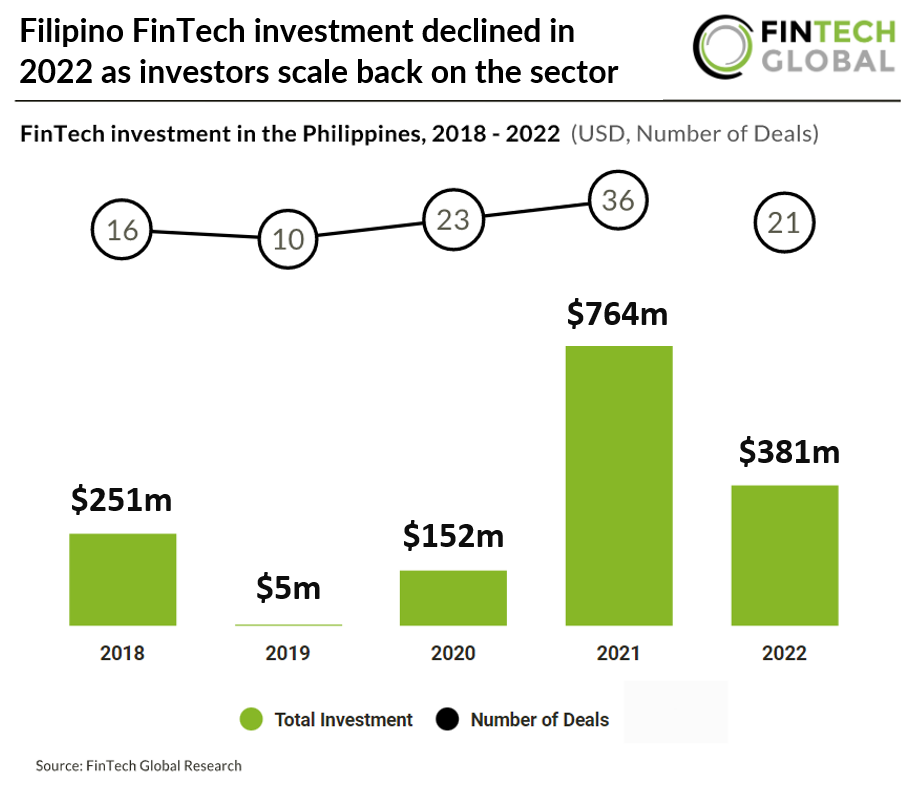

Meanwhile, the Philippines reported its lowest quarter for deal activity in Q4 2022 with only three companies raising deals, a 67% reduction from Q1 2022 activity, FinTech Global found.

FinTech investment in the Philippines reached $381m for the year, a 51% drop from 2021 levels. The country however had a high average deal size at 18m in 2022 signalling investors willingness to back established companies instead of early-stage startups.

In other news, the Filipino government has committed to ramp up the country’s digital economy. Finance Chief Benjamin Diokno said on Dec 6th 2022 at the Digital Banking Asia 2022 Conference that the Marcos administration would ‘continue to invest in the digital economy amid the important role of technology in finance’.

Here are this week’s deals.

Southeast Asian banking platform Akulaku lands $200m

Akulaku, a banking and digital finance platform in Southeast Asia, has received a $200m investment from Japanese megabank Mitsubishi UFJ Financial Group (MUFG).

Founded in 2016, Akulaku is a banking and digital finance platform in Southeast Asia, with a presence in Indonesia, the Philippines, and Malaysia. Akulaku exists to help meet the daily financial needs of underserved customers in emerging markets through digital banking, digital financing, digital investment, and insurance brokerage services.

According to Akulaku, the investment provides additional support for the company’s projected growth as it advances towards its mission of providing banking services across Southeast Asia with an emphasis on reaching underserved customers and markets.

The company’s future growth plans align with MUFG’s, and the companies’ joint expansion into new territories, markets, and products will accelerate heading into 2023.

CLM provider SirionLabs scores $110m in its Series D

SirionLabs, which offers an AI-powered contract lifecycle management (CLM) platform, has closed its Series D funding round on $110m.

With the capital, the company will expand its leadership position in the market, as well as bolster its product innovation. As part of the development, SirionLabs plans to bolster its AI capabilities and integrations with enterprise platforms, including SAP S/4HANA®, Salesforce and Microsoft 365.

The FinTech company is currently expanding its R&D to hubs around the world to leverage local talent in AI, user experience, data science and design thinking.

SirionLabs is a smart contracting platform that helps companies create, manage and measure contracts. It claims to offer complete contract visibility by leveraging AI-powered extraction of legacy contract data, modern search tools and advanced analytics.

Money View edges closer to unicorn status with $75m Series E

Money View, an Indian FinTech company, has raised $75m in Series E funding, valuing the company at $900m.

According to a report from Deal Street Asia, the round was led by the UK-based asset manager Apis Partners.

Money View was co-founded by Puneet Agarwal and Sanjay Aggarwal in 2014. The company offers an online credit platform with a full suite of personalised credit products. Its features include personal loans, cards, BNPL and personal financial management solutions.

The company has partnered with over 15 financial institutions to offer credit and financial products on its platform.

Australia-based Grapple scores $35m debt facility

Australia-based Grapple, which offers working capital loans to SMEs, has reportedly collected $35m in a warehouse debt facility from Sydney-based financier Global Credit Investments (GCI).

With the funds, Grapple hopes to scale and maintain its growth trajectory, according to a report from FinTech Futures. Funds will also help the Fintech company to meet their surging demand for its solution.

Founded in 2018, Grapple allows suppliers to be paid in full instantly, with Grapple paying the invoice on the customer’s behalf. The customer then pays Grapple back over four instalments.

Rural-focused FinTech SarvaGram lands $35m

SarvaGram, an India-based rural FinTech company, has scored $35m in a Series C investment round.

The round saw participation from Elevar Equity, Temasek, Elevation Capital and TVS Capital Funds.

Founded in 2019, SarvaGram offers customised financial and lending products to residents in rural India, which to date encompasses more than 80 million households, according to SarvaGram.

The company said that its tech solution takes a “360-degree view” of rural households to better understand their potential and risks.

Investment firm Manafa lands $28m Series A

Manafa, a Saudi Arabian debt and investment firm, has scored $28m in a Series A round co-led by STV and Wa’ed Ventures.

Founded in 2018, Manafa is a FinTech and investment company which provides a crowdfunding platform in equity and debt financing.

According to Asia Tech Daily, the company provides financial products tailored to fulfil the needs of small and medium enterprises in various sectors by providing the financing.

The model enables institutional investors like financial institutions and investment funds or individual investors to access SMEs financing opportunities through debt and equity securities.

MicroVest backs school finance company Varthana with $7m

Varthana, a Bengaluru-based school finance company, has raised $7m in funding on its mission to support affordable education in rural India.

According to a report from VC Circle, the funding was secured from MicroVest, a global investment firm based in the US.

Established in 2013, Varthana is on a mission to transform education in India by catering to needs of affordable private schools through financial assistance and academic support. Its loans are custom-built to suit the wide range of projects that help school leaders unlock their school’s potential, as well as for college-going students to achieve their educational goals.

Varthana operates in the deeper geographies of India and works among EWS (economically weaker sections), low and middle-income groups. The company has a presence in 15 states through 40 branches.

Dutch InsurTech Alicia lands €7m seed

Alicia, a Dutch provider of insurance-as-a-service for freelancers, has scored €7m in seed investment.

Taking part in the round was Volta Ventures, Achmea Innovation Fund and the Randstad Innovation Fund.

Founded in 2019, Alicia claims its strategy is making insurance accessible for freelancers at any time.

The company identifies and solves protection gaps in the platform economy by offering personalised and pay-per-use insurance directly embedded into online platforms.

Alicia, which is headquartered in Rotterdam, also offers its solutions in Belgium, France, Spain, Germany and the UK.

MSafe bags $5m for its first multi-signature wallet solution

MSafe, which is developing the first multi-signature wallet solution on the Aptos / Move blockchain ecosystem, has received $5m in its seed round.

Jump Crypto served as the lead investor, with contributions also coming from Circle Ventures, Coinbase Ventures, Superscrypt (founded by Temasek), Redpoint Ventures, SV Angel, Shima Capital, Spartan Group and more.

With the capital injection, the company plans to hire more staff, bolster its product portfolio and scale product adoption.

MSafe launched the first multi-signature wallet on Aptos mainnet in Oct 2022. Since then, it has been adopted by decentralised exchange, decentralised finance, NFT developers and more.

India’s game-based savings app Fello nets $4m

Fello, which claims to be India’s first game-based savings app, has reportedly raised $4m in a funding round led by US-based Courtside Ventures.

With the capital, the company plans to deepen its gamified financial products, hire more staff and expand its user base in Tier-1 and Tier-2 cities in India.

Fello claims to be the first game-based savings app in India. Its platform empowers users to grow their money and earn weekly rewards by just saving in secure assets.

The platform, which is available through Google Play and the Apple Store, allows users to grow savings by 10% p.a. by investing in digital gold and Fello’s digital token, Fello Flo. A user earns Fello tokens for every rupee saved and earns a weekly Tambola ticket for every INR 500 ($6) saved.

Veteran-owned AmeriVet Securities bags $4m

AmeriVet Securities (AVI), a veteran-owned finance broker on a mission to provide first class capital markets and financial services across multiple lines of business, has raised $4m.

AVI’s mission is to provide first class capital markets and financial services across multiple lines of business, while producing meaningful opportunities and results within the veteran community.

The company’s products include Investment Grade Corporates, Municipal Bonds, U.S. Treasuries, Equities, Commercial Paper, Cash Management, ABS, RMBS, Liability Management and Issuer Reverse Inquiry Opportunities.

AVI underwent a relaunch in 2018, since then, the firm said its deal flow total value has continued to increase year-over-year. AVI adds value to clients by bringing Tier II and Tier III investors into the underwriting syndicate, increasing the breadth of the offering.

Digital asset platform ML Tech snares $1.9m funding

ML Tech, a Miami-based provider of a non-custodial digital asset investment management platform, has scored $1.9m in strategic funding.

The round saw participation from investors such as Hyperithm, Nascent and Belvedere Strategic Capital.

ML Tech is a non-custodial investment platform connecting institutional investors to top trading strategies.

Institutional investors can choose from a curated selection of fully automated crypto strategies to help ensure success aligned with their investment goals.

Centbee bags $1m to support Bitcoin remittances

Centbee, a facilitator of digital money payments on the Bitcoin blockchain BSV, has secured $1m in its pre-Series A round.

The round was headed by Calvin Ayre, who is the founder of bitcoin VC company Ayre Ventures.

Founded in 2017, Centbee is a digital cash wallet that makes it easier for global consumers to buy, spend and send digital cash to their friends and family on their mobile phone using the BSV blockchain.

According to Tech EU, Centbee’s crypto infrastructure enables customers to send digital money payments to friends and family overseas using a cross-border remittances service called Minit Money.

The firm also offers a number of digital cash products and services through a separate decentralised finance app.

Insurer BMS Group secures investment from Eurazeo

BMS Group, an independent specialty insurance and reinsurance broker, has secured an investment from Eurazeo which sees the business valued at £1.75bn.

Existing shareholders British Columbia Investment Management Corporation (BCI), Preservation Capital Partners (PCP), management and staff will continue to be invested in the business.

Operating across 14 countries, with 28 offices, BMS Group said this additional investment will enable an acceleration in its pace of growth across its core trading divisions as well as focused investment to continue to deliver results for clients.

BMS’ management team, led by chief executive officer Nick Cook, will all remain in their roles following completion of the transaction, which is subject to regulatory approvals.

Copyright © 2023 FinTech Global