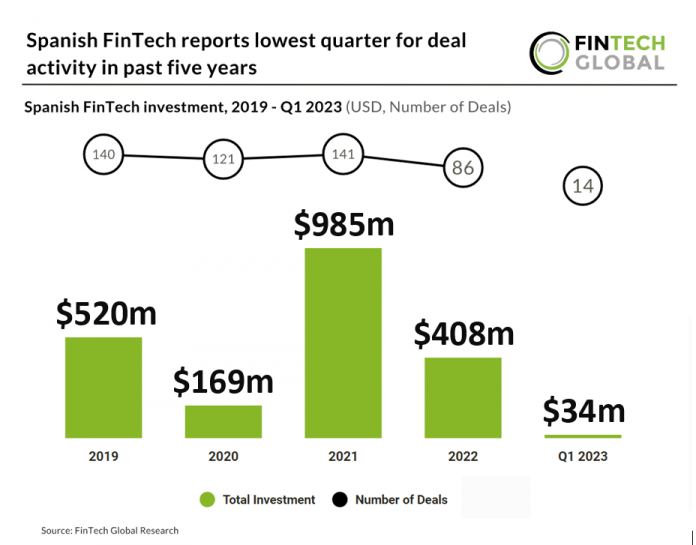

Spanish FinTech investment stats in Q1 2023:

• Spanish FinTech deal activity totalled at 14 deals in Q1 2023, a 59% drop YoY

• Spanish FinTech investment reached $34m in Q1 2023, a 70% drop from Q1 2022

• Lending Technology was the most active Spanish FinTech subsector with five deals

Spanish FinTech has seen a shaky start to the year with both investment and deal activity dropping considerably from 2022 levels. Spanish FinTech deal activity saw its lowest quarter for deal activity in the past five years. Spanish FinTech deal activity reached 14 deals in Q1 2023, a 59% drop from Q1 2022. Spanish FinTech investment saw a slightly more significant 70% drop to $34m in Q1 2023 from Q1 the previous year.

Myinvestor, a Spanish neobank, was the largest FinTech deals in Q1 2023, raising $16m in their latest Convertible Note funding round from AXA Group, El Corte Inglés Seguros and Andbank. The financing round is added to the 20 million raised just a year ago. The ultimate goal of the company, led by Nuria Rocamora, is to achieve profitability throughout this financial year. With this capital in the form of debt convertible into shares, the company prepares the ground for the first positive year in its income statement. It seeks to achieve profitability, after having lost about 2 million euros in 2022 and just over 6.4 million in 2021 . The business plan involves reaching a profit of 30 million euros in four years (2026).

Lending Technology was the most active Spanish FinTech subsector in Q1 2023 with five deals a 35% share of deals announced. Banking Infrastructure was the second most active with three deals, a 21% share of total deals. PayTech and Blockchain & Crypto were the joint third most active with two deals each.

The most recent FinTech regulation changes in Spain targets crowdfunding platforms and crypto publicity. As of November 2022 crowdfunding platforms must follow the EU’s regulation on European Crowdfunding Service Providers. Crowd Funding platforms have 24 months to update their current practises from Spain’s current domestic regulation. Spain also established rules regulating publicity of crypto assets in January 2022. These rules require providers of crypto asset services and certain other legal and natural persons, among other obligations, to inform the National Securities Market Commission (CNMV) of crypto asset publicity campaigns that target more than 100,000 investors 10 days in advance and to include risk warning disclaimers.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global