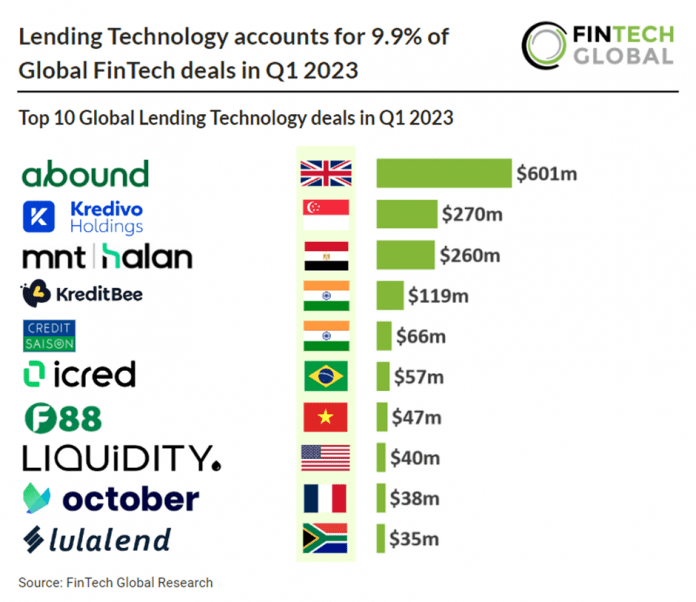

Key Lending Technology stats in Q1 2023:

• Overall there were 134 Lending Technology deals globally in Q1 2023, a 9.9% share of total deals

• The US was the most active Lending Technology country in Q1 2023 with 44 deals

• A combined $2.2bn was raised by Lending Technology companies in Q1 2023

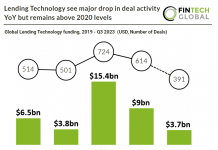

The Lending Technology Sector continues to see a large amount of activity and Funding in Q1 2023 fuelled by high interest rates. This combined with high inflation means consumers will likely take out more loans and lenders with have better margins, a recipe for good profitability. Overall there were 134 Lending Technology deals globally in Q1 2023, a 9.9% share of total deals.

Abound, a personal loan provider, was the largest FinTech deal raising $601m (£500m) in their latest Venture funding round. The latest funding round for Abound, consisting of both debt and equity financing, included debt financing from Citi and clients of Waterfall Asset Management, as well as equity investors such as K3 Ventures, GSR Ventures, and Hambro Perks. The funds raised will be utilized to increase Abound’s customer base, expand its workforce, and develop its business-to-business offering, making its technology accessible to other banks and lenders. Abound is confident in its ability to lend to many borrowers typically overlooked by traditional banks while reducing the associated risk. The company is projected to have £1 billion on its balance sheet by 2025 and has already experienced monthly growth of 30%, serving over 150,000 customers.

The US was the most active Lending Technology country in Q1 2023 with 44 deals, a 32.8% share of deals. India was the second most active Lending Technology country with 12 deals, a 9% share of deals. The UK was the third most active country with eight deals, a 6% share of deals.

Peer-to-peer lending platforms are leading the Lending revolution by matching borrowers with investors online instead of traditional finance providers. These platforms use digital algorithms to screen borrowers’ loan applications, and the entire lending process is automated. Peer-to-peer lending offers faster and cheaper access to credit relative to banks and promotes access to credit for individuals and businesses that are geographically distant from bank branches. The use of digital algorithms reduces discrimination in lending, but investors’ preference for funding loans to borrowers with similar characteristics may offset this benefit. Peer-to-peer lending appears to have wider economic effects, such as promoting entrepreneurship and business creation, particularly in traditional industries.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global