Key UK FinTech investment stats in 2023:

• UK FinTech companies raised a combined $4,190m in 2023, a 59% drop from 2022

• UK FinTech deal activity totalled at 396 transactions in 2023, a 31% reduction YoY

• The average FinTech deal size in the UK during 2023 was $10.9m, a 38% decrease from 2022

In 2023, UK FinTech companies experienced a significant downturn in fundraising, raising a total of $4,190m, marking a substantial 59% decline compared to the previous year. This decline in funding was accompanied by a notable decrease in deal activity, with a total of 396 deals recorded in 2023, representing a 31% reduction YoY. Additionally, the average deal size for FinTech ventures in the UK also witnessed a significant drop, declining by 38% to $10.9m in 2023 compared to the figures from 2022.

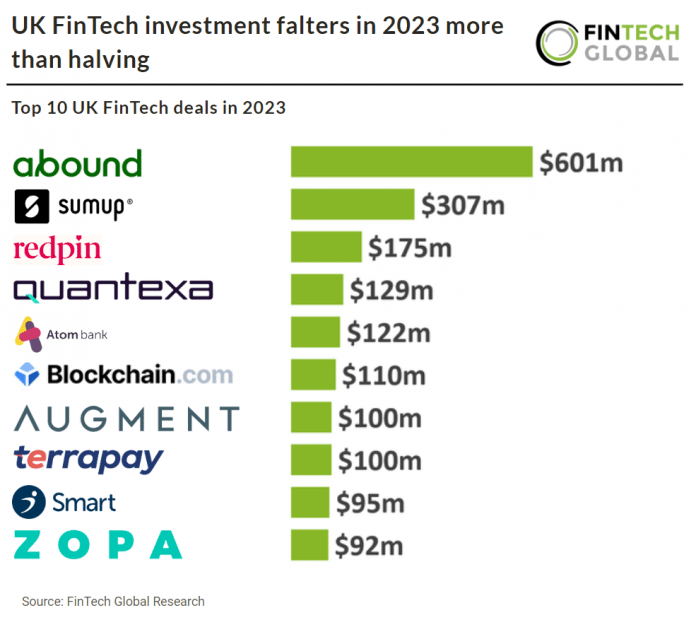

Abound, a consumer lending financial firm, had the largest UK FinTech deal in 2023 after raising £500m ($601m) in their latest venture funding round from K3 Ventures, Hambro Perks Ltd. and SR Ventures. The company intends to use the funds to expand the number of customers it lends to, to grow its headcount, and to develop its business-to-business offer. Established in 2020 under the leadership of Gerald Chappell, who serves as the CEO, and Dr. Michelle He, Abound is a financial service that leverages Open Banking and artificial intelligence to offer loans ranging from £1,000 to £10,000, with repayment terms extending up to 5 years. As of now, the company has experienced consistent monthly growth of 30% and has assisted more than 150,000 customers through its platform. It’s worth noting that Abound operates as the consumer-facing division of Fintern Ltd, which also owns Render, the proprietary technology employed by Abound to facilitate intelligent lending solutions.