Over $3bn was raised by FinTech companies this week, supercharged by a colossal €1.5bn raised by UK-based SumUp.

SumUp raised the funds from private capital lenders led by Goldman Sachs. This deal is one of the largest European private credit deals in recent years and will help SumUp refinance debt and capitalise on growth opportunities. The FinTech company provides merchants with a free business account and card, an online store, an invoicing solution and in-person and remote payment capabilities.

This week’s FinTech funding combined total of $3.2bn is four-times more than last week, where $750m was raised across 31 deals.

While the SumUp deal accounted for a large portion of this week’s funding, there were several other sizable deals. The second biggest deal of the week was another UK-based FinTech, Capital on Tap. The company bagged £350m in its second public securitisation facility, surpassing the initial target of £250m.

the third biggest deal of the week came from US-based Altruist, a modern custodian tailored for RIAs. The WealthTech company raised $169m for its Series E round, which brought its valuation to $1.5bn. This milestone comes after a period of strong growth for Altruist, which saw a revenue surge of over 550% in 2023 and doubled its assets under management for two consecutive years.

There were four other FinTech deals to raise over $100m this week, Corelight, Blend Labs, Capify and Lendbuzz.

While the UK was home to the biggest deals of the week, the US held the title for the most deals for the week, accounting for 15 of the 29 funding rounds. These were Altruist, Corelight, Blend Labs, Lendbuzz, Arbol, Securitize, Elisity, SafeBase, Apptega, Backflip, Baselayer, Insane Cyber, Volta Circuit, StepSecurity and Taxbit. In total, they raised $793.8m

It was a strong week for Europe, accounting for 11 of the deals. Of these, there were six UK companies, SumUp, Capital on Tap, Lendbuzz, Urban Jungle, Ansa and Finalrentals. Denmark saw three deals, Ageras, Pleo and Lunar. The last two European deals were Belgium’s Aikido and Czechia’s Birdwingo.

The other countries represented this week were India with BRISKPE and FlashAid, and Israel with LayerX Security.

In terms of the sectors, CyberTech proved to be the most popular. Of the 29 deals, seven of these were into CyberTech companies. These are, Corelight, SafeBase, LayerX Security, Aikido, Apptega, Insane Cyber and StepSecurity.

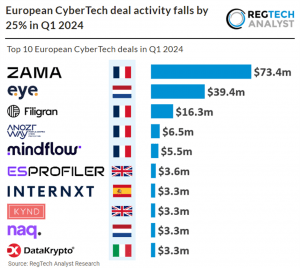

While CyberTech is had a great week for deals, only one of these deals were with a European CyberTech, with the region’s sector seeing some troubles in 2024. A recent report from FinTech Global found that the European CyberTech deal activity reached 42 deals in Q1 2024, a 25% reduction from Q1 2023. The total capital raised saw an even bigger decline, with $168m raised in Q1 2024, a 47% drop YoY. France was the most active CyberTech country during the first quarter, accounting for 12 deals – a 28% share of total deals.

PayTech was the second biggest sector of the week, including the two biggest deals of the week. The PayTechs are SumUp, Capital on Tap, Ansa, Finalrentals, and BRISKPE.

As for the other sectors, there were five WealthTechs (Altruist, Pleo, Lunar, Volta Circuit and Birdwingo), three Infrastructure & Enterprise software companies (Blend Labs, Ageras and TaxBit), three InsurTechs (Arbol, Urban Jungle and FlashAid), two RegTechs (Elisity and Baselayer), two marketplace lending companies (Capify and Lendbuzz), one PropTech (Backflip) and one blockchain business (Securitize).

Here are this week’s 29 FinTech funding rounds we covered this week!

SumUp secures record €1.5bn ($1.6bn) in one of Europe’s largest private credit deals

SumUp, a leading global FinTech company, recently raised €1.5bn from private credit lenders in a significant funding round led by Goldman Sachs. This transaction marks one of the largest European private credit deals in recent years.

The company will use the €1.5bn to refinance existing debt and capitalize on global growth opportunities. The round drew considerable interest and was ultimately oversubscribed, indicating strong market confidence in SumUp’s robust financial foundations and promising future.

SumUp operates a successful business model that has maintained positive EBITDA since December 2022. Over more than a decade, the company has demonstrated sustained growth and financial health, making it an attractive investment for new and existing backers.

The diverse group of new investors includes AllianceBernstein, Apollo Global Management, Arini, Deutsche Bank AG, Fortress Investment Group, SilverRock Financial Services, and Vista Credit Partners. They join long-standing supporters such as Funds managed by BlackRock, Crestline Investors, Liquidity Capital, Oaktree Capital Management, Sentinel Dome, and Temasek.

SumUp CFO Hermione McKee commented, “SumUp has always enjoyed solid and steady support from the investor community, and it’s this continued backing which has enabled us to grow sustainably over the past 10+ years, serving millions of merchants of all sizes globally. As the company scales further and our services and products continue to expand, our requirements from capital markets have evolved.

Capital on Tap secures £350m ($439.2m) in second securitisation to boost SME financing

Capital on Tap, a leading global FinTech, has successfully launched its second public securitisation facility, London Cards No.2.

This new facility, which closed on 16 April 2024, successfully raised £350m, far exceeding the original £250m target due to strong investor demand.

London Cards No.2 marks a substantial growth from the initial London Cards No.1, which previously raised £250m. This expansion is indicative of the firm’s increased credibility and the trust investors place in its ability to serve the UK’s small and medium-sized enterprises (SMEs).

The company specialises in offering innovative financial solutions that are tailored to the needs of small businesses. Through products like London Cards, Capital on Tap provides vital capital that businesses need to thrive and expand. This recent funding initiative is a clear reflection of their commitment to enhancing the economic landscape for SMEs, making essential financial services more accessible to this crucial sector.

The funds from this latest securitisation are earmarked for significantly expanding the accessibility of products that small businesses require for growth. Capital on Tap is dedicated to continuing its support for the SME sector, aiming to broaden its impact and assist more businesses in achieving their developmental goals.

Altruist hits $1.5bn valuation with $169m Series E fundraise

Altruist, a modern custodian tailored for RIAs, has recently announced a significant milestone in its funding journey.

The company has raised $169 million in a Series E funding round, led by ICONIQ Growth, with participation from new investor Granite Capital Management and continued support from existing investors Adams Street Partners and Sound Ventures.

With this latest injection of capital, Altruist’s total funding now surpasses $450 million, propelling its valuation to over $1.5 billion. Yoonkee Sull, General Partner at ICONIQ Growth, will be joining the board of directors as part of the funding arrangement.

Altruist has been making waves in the industry, experiencing remarkable growth with a revenue surge of over 550% in 2023 and doubling assets under management for two consecutive years. This rapid ascent has positioned Altruist as the third-largest custodian, trailing only behind industry giants Schwab and Fidelity, based on RIAs served. Notably, the company has been acknowledged by industry analyst T3 as the leading custodian advisors are considering switching to.

Altruist distinguishes itself by offering a comprehensive platform tailored for RIAs, streamlining administrative tasks and portfolio management through cutting-edge technology. Notably, the company has eliminated software fees for advisors and introduced a transparent fee schedule, fostering a cost-effective environment for independent advisors.

Corelight bags $150m in Series E funding to boost AI security innovations

Corelight, a prominent player in open network detection and response (NDR) headquartered in San Francisco, recently secured a substantial $150m in Series E funding.

The round was led by Accel, a notable first investor, along with significant contributions from Cisco Investments and the CrowdStrike Falcon Fund.

The fresh capital influx aims to significantly propel Corelight’s innovations in AI-driven security. This includes enhancing their cloud-native security features and expanding data fusion partnerships with major cybersecurity platforms. These efforts are designed to augment the capabilities of SOC analysts and incident response teams.

Corelight stands out in the cybersecurity domain, offering an NDR platform that has been adopted by elite cybersecurity teams at organizations like CrowdStrike, Mandiant, and the Black Hat NOC. Their technology and partnerships have skyrocketed Corelight to become the fastest-growing, scaled NDR platform in the industry. Notably, the company has achieved over 40% year-over-year ARR growth and a 300% increase in AI and SaaS-driven NDR solutions.

Blend Labs secures $150m from Haveli Investments to boost financial service innovations

Blend Labs, known for its cloud banking services, and Haveli Investments, a technology-focused private equity firm, have announced a strategic partnership marked by a significant $150m investment in Blend by Haveli.

This investment comes in the form of convertible preferred stock and underscores a mutual commitment to advancing financial services technology.

The partnership and financial infusion will see Blend using approximately $145m of the proceeds to repay existing debts under its credit agreement, with the remainder allocated for general corporate purposes. This financial restructuring is poised to strengthen Blend’s balance sheet and position the company for long-term growth and value creation.

Blend Labs offers infrastructure to support banking. Its clients, which include large banks, FinTechs and credit unions, an out-of-the-box solution for mortgages and consumer banking.

SME lender Capify raises £100m ($125.5m) funding from Pollen Street Capital

Capify, an online SME lender, has secured a significant financial boost with a £100 million credit facility from Pollen Street Capital.

The new credit facility, provided by Pollen Street Capital, will fuel Capify’s ambitious growth plans and serve as working capital to support thousands of SMEs across the UK and Australia in the coming years.

Founded in 2008 by serial entrepreneur David Goldin, Capify emerged during the global financial crisis to address the challenge many small and medium-sized businesses faced in accessing essential funding from traditional banks. Initially established in the United States in 2002, Capify quickly became one of the world’s pioneering online alternative financing platforms for SMEs. In recognition of its contributions to the sector, Capify was honoured as the UK Credit Awards SME Lender of the Year (up to £1m) last year.

Lendbuzz partners with Mizuho to secure $100m for innovative vehicle financing

Lendbuzz, which specialises in improving access to credit for consumers purchasing vehicles, has secured a $100m warehouse facility with Mizuho Americas.

This collaboration marks a pivotal step in expanding and diversifying Lendbuzz’s sources of committed capital. By assessing the creditworthiness of consumers across the credit spectrum, Lendbuzz addresses the needs of individuals often underserved by traditional banks.

Lendbuzz Chief Financial Officer, George Sclavos, highlighted the importance of Mizuho’s role in their strategic growth, stating, “We are excited to partner with Mizuho, further expanding and diversifying our sources of committed capital.

“We look forward to continuing to grow our relationship with a global bank such as Mizuho as a trusted advisor and important provider of capital.”

Danish FinTech Ageras secures €82m ($88.3m) for expansion drive

Danish FinTech Ageras has successfully secured €82m in a recent oversubscribed private placement round, as it looks to drive its global expansion.

The funding round, which exceeded expectations, saw substantial participation from notable investors, including the Norwegian state pension fund Folketrygdfondet, American asset manager Lazard, and leading the round, Investcorp.

Ageras’ CEO, Rico Andersen, expressed excitement about the outcome, claiming that it reinforces the companies desire to “become market leader and then go public.”

Founded in 2012, the firm initially began as an online marketplace connecting small businesses with accountants and bookkeepers. Over the years, it has evolved into a comprehensive FinTech company, offering cloud-based accounting software to over 300,000 active European small businesses.

With approximately 250 employees, Ageras has positioned itself as a significant player in the European FinTech landscape.

The €82m raised marks Ageras’ sixth and largest investment round to date. Andersen revealed that the round was oversubscribed, indicating overwhelming interest from both existing and new investors.

Notably, Investcorp, alongside existing investors and founders, contributed approximately 50% of the round. New investors, such as the Norwegian state pension fund Folketrygdfondet and American asset manager Lazard, further strengthened the investor portfolio.

Ageras intends to utilise the new funding to accelerate its acquisition strategy, aiming to enhance its product offerings and expand its market presence across Europe.

Arbol bags $60m in Series B funding to scale parametric insurance offering

Arbol, a leader in parametric insurance solutions, has announced the successful closure of a $60m Series B funding round.

Co-led by Giant Ventures and Opera Tech Ventures, with participation from Mubadala Capital, this substantial investment reflects the market’s confidence in Arbol’s innovative approach to climate risk management.

The insurance industry is facing mounting challenges due to the escalating impact of climate change, with record losses exceeding $380bn in the past year alone.

Traditional insurance models are struggling to cope with the rapid and severe climatic events, highlighting the need for innovative solutions to streamline claims processing and provide timely financial relief.

Arbol’s core mission revolves around addressing the limitations of traditional indemnity insurance by implementing parametric insurance models.

These models utilise predefined climate data triggers to determine payouts swiftly, eliminating the need for manual damage assessments and ensuring a fair and transparent claims process based solely on data.

Through this tranche Arbol aims to accelerate its strategic initiatives and expand its reach within the insurance sector. The company plans to venture into new markets such as agriculture and renewable energy, areas particularly vulnerable to climate risks yet underserved by traditional insurance products.

The funding will also facilitate Arbol’s global expansion efforts, enabling the company to offer property and casualty (P&C) and home insurance solutions in the U.S. and internationally.

By leveraging advanced technology and broadening its product offerings, Arbol aims to meet the growing demands for innovative risk management solutions.

BlackRock leads $47m funding round for blockchain leader Securitize

Pleo, a leading spend management solution provider in Europe, has recently announced securing a significant €40m in debt financing from HSBC Innovation Banking UK.

Pleo is renowned for its comprehensive spend management solutions, which include seamless card payments and efficient receipt capture systems. The company’s services are crucial for businesses at different growth stages across industries, helping manage their spending more effectively.

The new funding will be used to elevate Pleo’s credit product, Pleo Overdraft, which is already available in Sweden, Germany, the UK, and Denmark, and will soon expand to the Netherlands. This feature offers businesses crucial flexibility, maintaining cash flow and preventing transaction failures due to insufficient funds.

Additional insights reveal that over the last six months, businesses using Pleo have experienced a 6% failure rate in transactions due to insufficient funds, underscoring the necessity for robust credit solutions like Pleo Overdraft.

Boosting identity-based security, Elisity raises $37m from Insight Partners

Elisity, a leading pioneer in identity-based microsegmentation, announced a significant financial boost with a $37m Series B funding round led by global software investor Insight Partners.

This investment marks a substantial commitment to advancing Elisity’s artificial intelligence (AI) capabilities, further enhancing its dynamic, context-aware policy enforcement across diverse network environments.

By abstracting segmentation from network operations, Elisity aims to alleviate traditional project frictions and streamline the deployment of zero trust and other critical capabilities.

SafeBase secures $33m in Series B to revolutionise security reviews

SafeBase, a firm known for enabling friction-free security reviews, announced today it has successfully secured a $33 million Series B funding round.

This injection of capital raises the total funding of the company to over $50 million.

The latest funding was led by Touring Capital and saw participation from Zoom Ventures. Also contributing were existing investors NEA (New Enterprise Associates), Y Combinator, Comcast Ventures, and Cerca Partners. Notably, the round included investments from several top cybersecurity executives, including Jim Alkove, former Salesforce Chief Trust Officer.

SafeBase operates by enhancing how software purchasers conduct risk assessments of vendors, aiming to streamline these essential security reviews. Traditionally, these processes have been cumbersome, creating delays and eroding trust between buyers and vendors. SafeBase’s platform provides a centralised and automated approach to managing trust, ensuring transparency and efficiency.

The newly acquired funds will be used to further develop SafeBase’s Trust Center Platform across the trust ecosystem. The goal is to transform and simplify third-party risk assessments, making them real-time and frictionless.

Additional information about SafeBase highlights its significant growth and industry recognition. The company has seen exponential revenue increases, boasts a client base of over 700 customers with a 98% gross retention rate, and was a finalist in the RSAC Innovation Sandbox. Moreover, SafeBase’s flagship Trust Center product has attracted more than two million views.

LayerX Security raises $26m to fortify browsers against new-gen threats

LayerX Security, a pioneering company in browser security solutions, today announced a substantial $26m in Series A funding.

The round was led by Glilot+, the early-growth fund of Glilot Capital Partners, with significant contributions from Dell Technologies Capital and other investors. The funding will enable LayerX Security to expand its talent pool and enhance its presence in the global market. This investment round brings the total capital raised by the company to $34m.

LayerX Security is at the forefront of the browser security market with its innovative LayerX Browser Security Platform. The platform is designed to protect enterprise employees working from any browser, anywhere, safeguarding them against a wide range of security threats. These threats include data leaks, identity and password theft, malicious browser extensions, phishing sites, and more.

LayerX has already established itself as a leader in browser security by securing more users than any other solution in the market. Their product, the LayerX Enterprise Browser Extension, is compatible with all major browsers and does not require agents, a VPN, or network modifications. This compatibility ensures that security measures are seamlessly integrated into existing corporate infrastructures, allowing for real-time threat monitoring and response without disrupting user experience.

Denmark’s digital challenger Lunar secures €24.1m ($25.9m) to expand across the Nordics

Lunar, a Denmark-based digital challenger bank, has recently successfully secured a funding round of €24.1m.

According to Finextra Research, this significant capital injection, contributed by Lunar’s major existing investors, highlights the continued confidence in the bank’s growth trajectory and strategic direction.

The fresh funds bring the total raised by Lunar over the last four months to an impressive €50.9m. This financial boost comes at a crucial time as Lunar sets its sights on expanding its operations within the Nordic region.

Primarily, Lunar operates as a digital bank that offers a range of financial services tailored to both individual consumers and business clients. The company is particularly focused on enhancing its basic package in Sweden, with plans to evolve it into a full-service banking solution that caters to the comprehensive needs of its customers.

The new funding is earmarked to support this expansion strategy, particularly enhancing Lunar’s product offerings and operational capabilities in Sweden. Moreover, it aims to reinforce the bank’s overall capital position, adhering to regulatory requirements set by the Danish Financial Supervisory Authority.

Lunar’s journey has not been without its challenges, particularly in Norway. The bank’s 2022 attempt to acquire the local lender Instabank faltered due to stringent capital requirements imposed by the Norwegian Financial Supervisory Authority. This setback led to legal proceedings, with the initial ruling not in favor of Lunar. Despite this, the company remains committed to its Nordic strategy and is currently awaiting further legal processes while continuing to strengthen its capital framework.

Aikido clinches $17m Series A to revolutionise developer-focused security

Aikido, a disruptive force in developer security, has successfully closed a $17m Series A funding round.

The round was led by Henri Tilloy from Singular.vc, supported by returning investors Notion Capital and Connect Ventures. This impressive financial injection follows closely on the heels of their $5.3m seed funding, secured just six months prior.

The company has carved a niche for itself by offering an all-in-one security platform tailored specifically for developers. Aikido’s innovative platform integrates necessary code and cloud security scanners into a single, user-friendly interface. This system leverages the best of open source technology, offering a freemium, self-service model that is transparent about costs and inner workings.

The newly acquired funds are earmarked for significant enhancements to the Aikido platform. The aim is to project the company onto the global stage, simplifying security for SMEs and making it more accessible for developers, thereby stripping away unnecessary complexity and industry jargon.

Additional insights into the company’s rapid growth reveal that Aikido is now utilized by over 3,000 organizations and 6,000 individual developers worldwide. A major endorsement came from Visma, which chose Aikido to secure its expansive portfolio of 175+ companies, underscoring the platform’s efficacy and market fit.

Apptega’s fresh $15m funding set to boost compliance and security offerings

Apptega has successfully raised $15m in a combination of growth equity and third-party debt from Mainsail Partners.

According to CRN, this significant financial boost aims to advance Apptega’s development of technology that delivers continuous compliance and enhances in-house IT security and compliance automation.

Apptega specialises in lifecycle compliance solutions tailored specifically for managed service providers (MSPs). The company’s innovative platform helps streamline security and compliance processes, making them more accessible and manageable for MSPs aiming to offer these services to their clients.

The fresh funds are earmarked for several strategic areas, including ramping up the company’s research and development in artificial intelligence. This advancement will allow MSPs to deliver more efficient and profitable security and compliance guidance. “The investment will help take large language models and knowledge-based work and workflows, and the basics of being able to do things through a service provider lens, and invest it in our products so that we can continue to drive costs out,” Apptega CEO Dave Colesante explained.

In addition to enhancing product capabilities, the investment will also support Apptega’s operational expansion with a focus on increasing annual recurring revenue through channel partners. The goal is not only to boost revenue but also to foster better customer retention and improve gross margins for MSPs.

During this period of growth, Apptega has been recognised as a leader in the Security Compliance Software category by G2 for 12 consecutive quarters. The company is also experiencing a significant increase in the number of partners, with the total almost tripling over the past two years. Furthermore, Apptega has ambitious plans for revenue growth, targeting a 30 percent increase in 2024 and aiming to double this figure by 2025.

Backflip secures $15m in Series A to redefine real estate FinTech

Insurance startup Urban Jungle set to announce $14.4m funding raise

Urban Jungle, a London-based insurance startup, is gearing up to announce a substantial funding round of around $14.4m this week, as reported by Sky News.

The investment, sourced from existing backers including Sony Innovation Fund, signifies a significant milestone for the company.

Founded in 2016 by Jimmy Williams and Greg Smyth, Urban Jungle specialises in providing renters and homeowners insurance, catering to a customer base exceeding 200,000 individuals.

The firm sees itself as a “fair” provider of insurance cover, with its pricing point vital to its offering amidst the crippling cost-of-living crisis which is affecting families across Britain.

The firm’s offerings encompass coverage for various possessions, including phones, laptops, furniture, and more, protecting against accidental damage, theft, and loss.

With policies starting at just £5 per month, the company prioritises flexibility, enabling customers to tailor their coverage according to their specific needs.

According to reports, the fresh infusion of capital will fuel Urban Jungle’s expansion into new territories, underscoring its commitment to innovation and growth within the insurance landscape. Prior to this funding round, the company had raised approximately $47m in previous investments.

Ansa raises $14m Series A funding to redefine merchant transaction solutions

Ansa, the FinTech infrastructure solution enabling merchants to launch branded customer wallets, has announced that it has secured $14m in a Series A funding round.

The investment was led by Renegade Partners, with participation from Bain Capital Ventures, B37 Ventures, Box Group, and Wischoff Ventures.

The London-based company, Ansa, specialises in providing FinTech infrastructure solutions, allowing merchants to create branded customer wallets for enhanced payment experiences.

This tranche signals a significant milestone for the company as it continues to expand its offerings in the rapidly evolving payments industry.

Ansa’s core focus lies in empowering enterprise brands to embed customer balances seamlessly while managing various payment challenges, including regulatory and compliance issues.

By offering a comprehensive suite of payment solutions, the firm aims to enable merchants to better engage with their customers and drive increased revenue and loyalty.

Sophia Goldberg, CEO and co-founder of Ansa, highlighted the importance of modernising payment experiences in today’s digital age. She stated, “Commerce has outpaced payments innovation. The technology paradigms we use for payments are decades old. As our world increasingly digitises, consumers demand better experiences as businesses continue to innovate. Both consumers and merchants deserve more flexibility, which is why we built Ansa.

“From marketplaces and micro-transactions to convenience stores and quick-serve businesses, modern commerce has changed. At Ansa, we are excited to pioneer solutions that enable merchants to optimise seamless payment strategies, boosting customer engagement, retention, and frequency for sustained growth in today’s competitive market.”

With the newly secured funding, Ansa plans to further enhance its payment solutions through product development and engineering initiatives. This strategic investment will enable the company to strengthen its position in the market and continue to pioneer innovative payment strategies for merchants.

The funding round was met with enthusiasm from investors, with Renata Quintini of Renegade Partners, who is set to join Ansa’s board, expressing confidence in the firm.

Baselayer raises $6.5m seed round to redefine business risk with AI risk engine

Baselayer, a B2B platform utilising proprietary Graph AI technology, has officially emerged from stealth mode, securing a $6.5m seed round.

Founded by Jonathan Awad and Timothy Hyde, Baselayer boasts an experienced team of compliance and machine learning experts. The platform has garnered attention by acquiring nearly 30 customers in less than six months, including prominent names like Rho and one of the top-five loan infrastructure systems.

Investors in the seed round include Torch Capital, Afore Capital, Founder Collective, Picus Capital, Gilgamesh Ventures, and notable financial industry executives such as Eric Woodward, former President of Early Warning Services, and executives from Stripe, Brex, Valley Bank, and Airbase, among others.

Baselayer’s mission is to streamline business onboarding processes while combating fraud in the banking sector. With the advancement of fraud tactics costing global banks $500bn in 2023, Baselayer aims to simplify the Know Your Business (KYB) review process, which traditionally involves lengthy manual verifications that can take days or even weeks.

Awad’s personal experience, unable to secure a business banking account due to bank failures, led him and Hyde to develop Baselayer. Leveraging AI-generated knowledge graphs, Baselayer can predict and differentiate legitimate from fraudulent patterns, enabling financial institutions to swiftly verify the legitimacy and assess the risk of new business customers in real-time.

Welsh FinTech secures £5m ($6.2m) export deal to kickstart global expansion

A Welsh FinTech firm has secured a milestone £5m export deal, as it looks to kickstart its global expansion plans.

Finalrentals, a digital car rental platform headquartered in Cardiff, clinched the deal, projected to be worth £5m over five years.

Supported by the Welsh Government, this agreement marks a significant step forward for the Welsh FinTech company.

The deal, negotiated at ITB Berlin, the world’s largest travel trade show, will enable Finalrentals to expand its presence across ten key locations in Turkey, including major cities such as Istanbul, Ankara, and Bursa. With access to a network of over 500 vehicles, Finalrentals aims to tap into the competitive Turkish car rental market.

Investing in international trade shows and targeted market visits has been pivotal to Finalrentals’ export success.

Recent visits to San Francisco, Singapore, Madrid, and Berlin have resulted in additional contracts with partners in Turks and Caicos, Bahamas, and Montenegro, amounting to an extra £200,000 in annual revenue.

With eyes set on further global expansion, Finalrentals aims to grow its client base to 100 by 2025, representing a 200% yearly growth. The company attributes its accelerated export success to the unwavering support received from the Welsh Government

PayU injects $5m into BRISKPE, boosting India’s cross-border payment capabilities

BRISKPE, a Mumbai-based cross-border payments platform, has successfully secured a $5m seed investment from FinTech giant PayU.

The investment was made by PayU, the payments and FinTech business of Prosus, marking a significant milestone in BRISKPE’s growth trajectory. This seed round aims to propel the platform’s capabilities in facilitating seamless and cost-effective international transactions for Indian businesses.

BRISKPE operates within the FinTech sector, providing innovative solutions tailored for MSMEs engaging in cross-border trade. The platform addresses common challenges such as high transaction fees and fluctuating exchange rates, thereby enabling exporters to navigate global markets more effectively.

The new funds will be utilised to enhance BRISKPE’s product offerings, expand its team, and extend its market reach. These efforts are directed towards enabling a larger number of Indian businesses to embark on their global journeys, equipped with efficient and reliable payment solutions.

In addition to driving product development and business expansion, BRISKPE remains committed to fostering economic growth and supporting the robust sector of MSMEs, which notably contributed over 45% to India’s exports in the fiscal year 2023-24.

Insane Cyber raises $4.2m to enhance critical infrastructure protection

Insane Cyber, a cutting-edge firm in the industrial cybersecurity sector, has successfully completed a $4.2m early-stage funding round.

The funding round was spearheaded by Paladin Capital Group and saw contributions from a Fortune 200 energy company, along with the Cyber Mentor Fund.

Founded in 2020 by Dan Gunter, Insane Cyber has rapidly become a notable name in the cybersecurity landscape. The company is dedicated to using automation to defend critical infrastructure within the energy, data centers, government, oil and gas sectors, among others.

Insane Cyber is known for its Valkyrie Automated Security platform and the Cygnet Flyaway Kit. Valkyrie offers robust host and network monitoring coupled with automated data analysis, which enhances operational efficiency and security. The Cygnet Flyaway Kit extends these capabilities into a portable solution ideal for on-the-spot incident response.

The newly acquired funds will be utilized to further develop these technologies and expand their market reach. This investment supports Insane Cyber’s commitment to continuous innovation and helps in addressing the escalating challenges in protecting critical infrastructures.

Volta Circuit introduces breakthrough multi-signature wallet with $4.1m seed funding

Volta Circuit, a pioneering FinTech company, has successfully secured $4.1m in seed funding.

This significant financial injection was led by Fika Ventures and Haven Ventures, with additional participation from Soma Capital, Dispersion Capital, and Uphonest Capital.

Volta is revolutionizing the digital asset industry through its flagship product, the Volta Circuit. This cutting-edge, multi-signature, non-custodial platform is setting new industry standards for smart wallet infrastructure, characterized by its speed, ease of use, and enhanced security for self-custody of digital assets.

Volta Circuit is designed to address the pressing need for scalable, secure, and efficient digital asset management without the compromises that have traditionally plagued blockchain technologies.

Cybersecurity firm StepSecurity lands $3m to safeguard CI/CD environments

StepSecurity, a cybersecurity firm specialising in CI/CD pipeline and infrastructure protection, has successfully closed a $3m seed funding round.

The round was led by Runtime Ventures, with contributions from Inner Loop Capital, SaaS Ventures, DeVC, and several high-profile industry leaders as angel investors.

StepSecurity offers a robust platform designed to secure CI/CD pipelines utilised by open-source projects and enterprise environments. Since its founding two years ago by cybersecurity experts Varun Sharma and Ashish Kurmi, the company has become a critical player in the sector. Its services are essential for over 3,000 open-source projects from prominent organisations such as the Cybersecurity and Infrastructure Security Agency (CISA), Google, and Microsoft, among others.

The newly acquired funds are earmarked for significant expansion efforts. StepSecurity plans to invest heavily in its open-source community and broaden its enterprise offerings. Future developments include extending its platform across various CI/CD environments like GitLab CI, Harness, and Azure DevOps. Additionally, the company is actively recruiting for several roles across engineering, sales, and marketing departments to support its growth trajectory.

Mumbai-based InsurTech FlashAid raises $2.5m in Series A

FlashAid, a Mumbai-based healthcare and InsurTech startup has announced a successful raise of $2.5m in a pre-Series A funding round.

The investment was spearheaded by Piper Serica Angel Fund, along with notable participation from global venture capital firm SOSV, according to InsurTech Insights.

Additionally, early-stage investors Z21 Ventures Fund and ZNL Growth Fund joined forces to bolster FlashAid’s financial backing.

Established by Manoj Gupta and Gunjali Kothari, FlashAid is dedicated to revolutionising healthcare accessibility and affordability.

The company’s innovative health solution encompasses proprietary pre-underwritten products, open APIs, and embedded solutions. Formerly known as EasyAspataal, FlashAid operates with the mission to democratise health insurance by prioritising an API-first approach.

With the newly secured funding, FlashAid aims to fuel its growth trajectory and embark on an ambitious expansion plan targeting six additional cities. This strategic move aligns with the company’s overarching goal of extending its reach and impact across diverse demographics.

Birdwingo secures €1.2m ($1.2m) to revolutionise teen financial education in Europe

Birdwingo, a Prague-based FinTech company, has successfully closed a €1.2m funding round.

The funding round was spearheaded by Bienville Capital, a venture capital fund based in New York, according to a report from EU-Startups. Additional contributions came from a diverse group of company founders and bank executives, underscoring the broad interest and confidence in Birdwingo’s mission.

Birdwingo offers a unique service unlike any currently available in the EU. Their mobile application allows teenagers to invest in popular stocks and ETFs, including big names like Apple, Nvidia, and the S&P 500. The platform boasts access to over 12,000 investment options, aiming to fill a significant gap in the market.

Dubbed the “Duolingo for finance,” their academy aims to make learning about finance engaging and relevant for today’s teens, using formats and interfaces that are familiar to them, such as those seen in popular apps like Instagram and TikTok.

Additional features of Birdwingo include a gamified learning experience that rewards teens with cash for their progress in financial literacy. The company also plans to expand its outreach by partnering with high schools and non-profit organisations across Europe to enhance its educational impact.

TaxBit bolsters digital asset compliance efforts with investment

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global