Key FinTech investment stats in Singapore for 2023:

• Singaporean FinTech investment reached $642m in Q1 2023, a 25% drop from Q1 2022

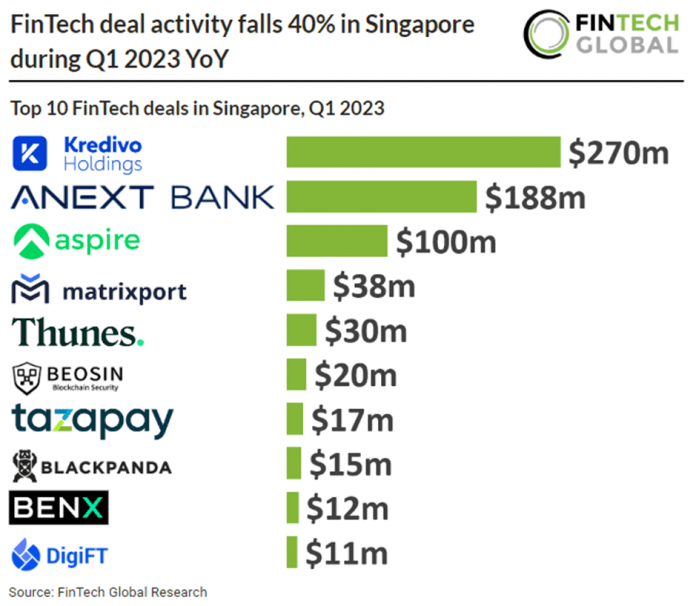

• Singaporean FinTech deal activity reduced by 40% in Q1 2023 YoY, reaching 39 deals during the opening quarter

• Blockchain & Crypto was the most active FinTech subsector in Q1 2023 with 19 transactions, a 48% share of total deals during the first quarter.

The first quarter of 2023 was a negative quarter for Singapore with both deal activity and capital inverted dropping. Investment in Singaporean FinTech reached $642m in Q1, which represents a 25% decrease compared to Q1 2022. FinTech deal activity in the country also decreased by 40% in the first quarter of 2023 compared to the same period last year. In total, there were 39 deals completed during the first quarter of 2023.

Kredivo Holdings, which provide a wide range of financial services including BNPL and loans, was the largest FinTech deal in Singapore during the first quarter of 2023 raising $270m in their latest Series D funding round, led by Mizuho Financial Group. The company says the new capital will be deployed to support its existing ecosystem of digital payments and credit service and to finance the upcoming launch of its neobank Kroo. Akshay Garg, CEO of Kredivo Holdings, says: “Despite challenging market conditions, investors continue to recognize the scale and strength of our business, and our innovation potential. The upcoming expansion into digital banking is deeply synergistic with the existing Kredivo product and also opens up a very promising channel for us to become the digital financial services platform of choice for tens of millions of consumers in Southeast Asia.”

Blockchain & Crypto dominated Singapore’s FinTech sector in Q1 2023 with 19 deals, a 48% share of total transactions during the period. Lending Technology was the second most active FinTech subsector during the opening quarter with five deals and RegTech was third with four deals. Singapore, once known as the “crypto paradise”, is continuing to tighten their Blockchain & Crypto regulation. The Monetary Authority of Singapore (MAS) published a consultation paper in October 2022 suggesting several regulatory measures for digital payment token service providers (DPTSPs) to decrease the possibility of consumer harm from cryptocurrency trading. The proposals target licensed and exempt payment service providers that offer a digital payment token service under the Payment Service Act 2019. Despite recognizing that prohibiting retail access is unlikely to be effective, the MAS’s proposals do not go so far as to impose such a ban.