Key FinTech investment stats in Mexico during H1 2023

• Mexican FinTech deal activity reached 29 transactions in H1 2023, 45% drop from H1 2022

• Mexican FinTech companies raised a total of $72m in the first six months of 2023, a 79% drop YoY

• Mexico remains the second most active Latin American FinTech country behind Brazil

Mexican FinTech saw a significant drop in both deal activity and investment during the first half of 2023. In the first six months, the number of deals in the Mexican FinTech sector rached 29, reflecting a decline of 45% compared to the same period in 2022. Despite this drop in deal activity, Mexico remains the second most active Latin American FinTech country as there has been outflow of FinTech funding in the region. During the first half of 2023, Mexican FinTech enterprises secured a total of $72m in funding, marking a significant YoY decrease of 79%.

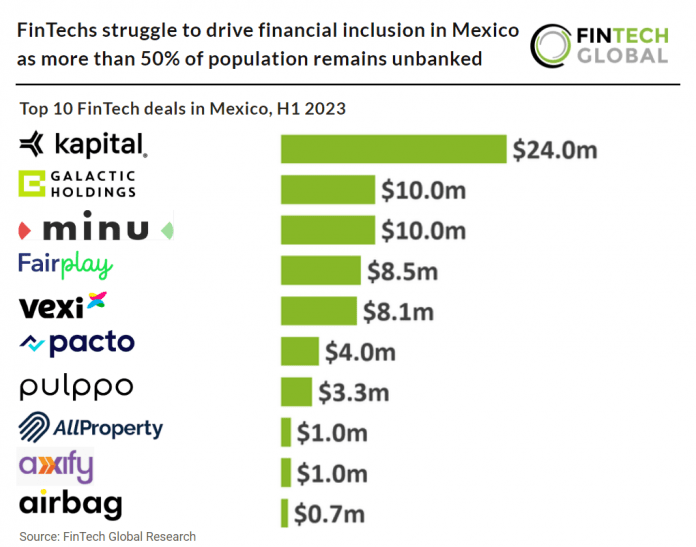

Kapital, an SMB financing platform, had the largest Mexican FinTech deal in H1 2023 after raising $24m in their Series A funding round, led by Niya Partners and Tribe Capital. The fresh funding will fuel product development and support the ongoing expansion efforts in Colombia, as Kapital strives to reshape SMB banking across Latin America. The company, founded by Rene Saul and Fernando Sandoval in 2020, got started after the pair sold their previous business and wanted to build a platform that could provide a way for small and medium-sized businesses across Latin America to have all of their financial needs, including cash flow, credit and investments, all in one place. “You need to organize the business first, and then it’s going to grow,” Saul said in an interview. “That’s what we’re doing. We aren’t just giving you a corporate card or telling you to open your own bank account — we give you the complete solution.” Saul added that he and Sandoval saw companies not having visibility of their finances: Many didn’t even know who they owed money to or who they needed to collect money from.

Despite the promise of FinTech to bring millions of Mexicans into the formal financial system, the progress has been disappointing. Only 3.4m people opened formal bank accounts between 2018 and 2022, raising questions about why FinTech has not reached its potential in Mexico, the second-largest consumer market in Latin America. Despite Mexico’s large unbanked population, FinTech’s impact has been limited. According to Mexico’s National Institute of Statistics and Geography, only 49.1% of adults aged 18-70 had a bank account as of May 2022. This growth of 3.4m accounts since 2018 represents a mere 2% increase. Despite Mexico’s FinTech law being in effect for five years, its goal of significantly expanding financial inclusion has not been realized. Neobanks, credit providers, and payment services have gained traction but failed to bring the expected number of people into formal banking. In fact, if the World Bank’s 2021 Global Findex had included Mexico, Mexico would likely have had the largest unbanked population in the region, surpassing Brazil by over 15m people.