Key Swiss FinTech seed investment stats in Q1-Q3 2023:

• Swiss FinTech seed companies raised a combined $73m in Q1-Q3 2023, a 28% drop from Q1-Q3 2022

• Swiss FinTech seed deal activity totalled at 43 transactions during the first nine months of 2023, a 55% reduction YoY

• Blockchain & Digital Assets was the most active Swiss FinTech subsector with 19 deals, a 43% share of all seed deals in Q1-Q3 2023

Swiss FinTech has seen a considerable drop in seed investment and deal activity during the first nine months of 2023 although the average deal size went up. Swiss FinTech startups secured a total of $73m in funding during Q1-Q3 2023, marking a 28% decrease compared to the same period in 2022. The number of Swiss FinTech seed deals in Q1-Q3 2023 amounted to 43 transactions, reflecting a significant 55% YoY decline. The average deal size for Swiss FinTech seed companies during Q1-Q3 2023 was $1.7m, a 29% increase from the same period the previous year.

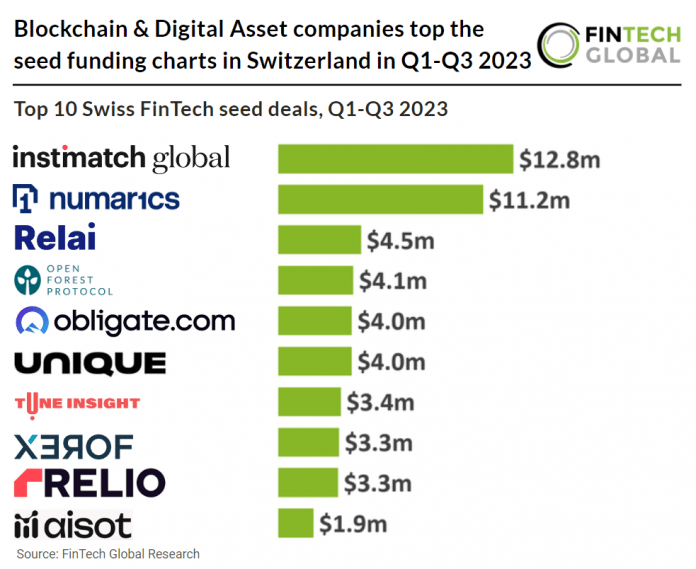

Instimatch a digital cash deposit network for institutional borrowers and lenders, had the largest Swiss FinTech seed deal in Q1-Q3 2023 after raising $12.8m. The financing round was led by existing shareholders, current management team members, business partners and new institutional and private investors. Instimatch plans to employ the recently acquired funds for the purpose of expanding market presence, expediting product development, and introducing new offerings to solidify its position as a frontrunner in the digital trading platform sector. Instimatch Global AG has achieved significant milestones in 2023 such as reaching 63 % customer growth, successful market entrance in four new countries, and the go-live of a repo trading platform, its latest self-developed product. “This strong show of support from both existing and new investors underscores the confidence in our vision and future success and secures us enough time to prepare our Series A in 2024.” said Adrian Edelmann, CEO of the company.

Blockchain & Digital Assets was the most active FinTech subsector for seed deals with 19 funding rounds, a 43% share of all seed transactions in Q1-Q3 2023. One of Switzerland’s plans for a CBDC (Central Bank Digital Currency) comes in the form of Project Mariana, initiated on November 2, 2022, involves collaboration between the Switzerland, Singapore, and Eurosystem Centers, along with the Bank of France, the Monetary Authority of Singapore, and the Swiss National Bank. This project aims to explore the potential of automated market-makers using wholesale CBDCs to enhance the efficiency, security, and transparency of FX trading and settlement while reducing associated risks. Additionally, it investigates cross-border interoperability using standardized technical frameworks for future adaptability. An interim report from June 28, 2023, presented a promising solution design for potential future applications.