Key Australian FinTech investment stats in Q2 2024:

• Trend analysis showed a potential 60% drop-in deal activity in YoY comparison base on deal making pace in the first half of 2024

• Average deal value dropped to $17.6m which could indicate a shift in investment strategies

• Cover Genius secured the largest deal for H1 2024 in the Australian FinTech market with $80m Series E funding

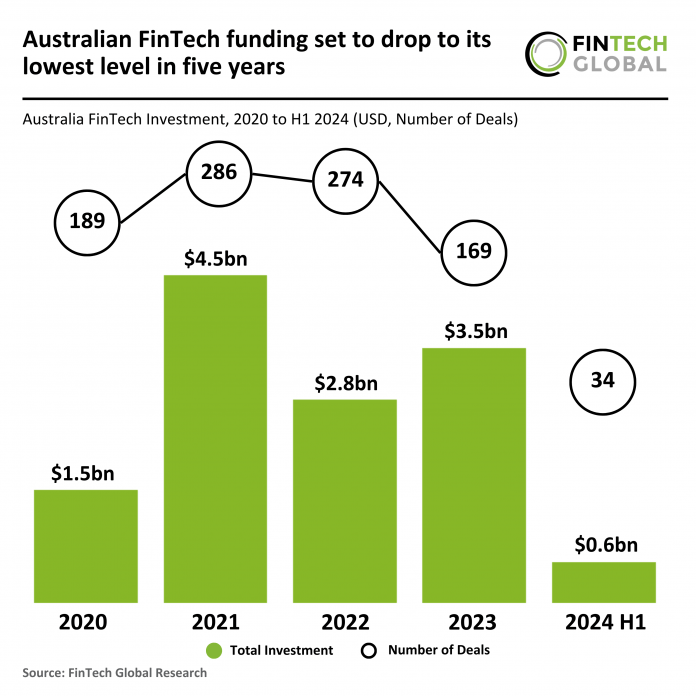

In the first half of 2024, the Australian FinTech sector saw a substantial decline in both deal activity and capital invested. Only 34 deals were recorded in H1, marking a sharp 62% decrease compared to the 89 deals in H1 last year. Funding also experienced a steep drop, with FinTech companies raising just $0.6bn in H1 2024, a 71% decrease from the $2.1bn raised in H1 2023. If deal activity continues at the rate recorded in the first six months of the year, the projected total for 2024 would be just 68 deals, a 60% drop from last year’s total of 169.

Globally, the funding market has been on the decline. However, the average deal value has been following the opposite trend. But, for H1 2024 the Australian FinTech market has gone against the grain where the average deal value decreased to $17.6m from $23.6m in H1 2023. This decline in average deal value suggests that not only has the number of deals significantly decreased, but the size of the investments has also shrunk, indicating a more cautious approach by investors within the Australian FinTech sector.

Cover Genius, a leading InsurTech for embedded protection, raised the largest deal during the first half of 2024 in the Australian FinTech market with a $80m Series E funding round. The funding round was led by Spark Capital with support from existing investors Dawn Capital, King River Capital, and G Squared. Despite a tech funding slowdown, this investment underscores Cover Genius’ position as a global frontrunner in InsurTech. Cover Genius, through its XCover platform, provides seamless, end-to-end insurance experiences for over 30m customers of the world’s largest digital companies. Licensed in over 60 countries and all 50 US states, the InsurTech enables partners to embed and sell multiple lines of insurance, achieving an industry-leading post-claims Net Promoter Score (NPS). The new capital will expedite Cover Genius’ growth plans, enhancing digital insurance distribution solutions, deploying AI claims handling, and expanding protection solutions on the platform. This will support new and existing partnerships, driving the creation of innovative protection products like Cancel For Any Reason (CFAR) and Delay Valet.