Key Asian FinTech investment stats in H1 2024:

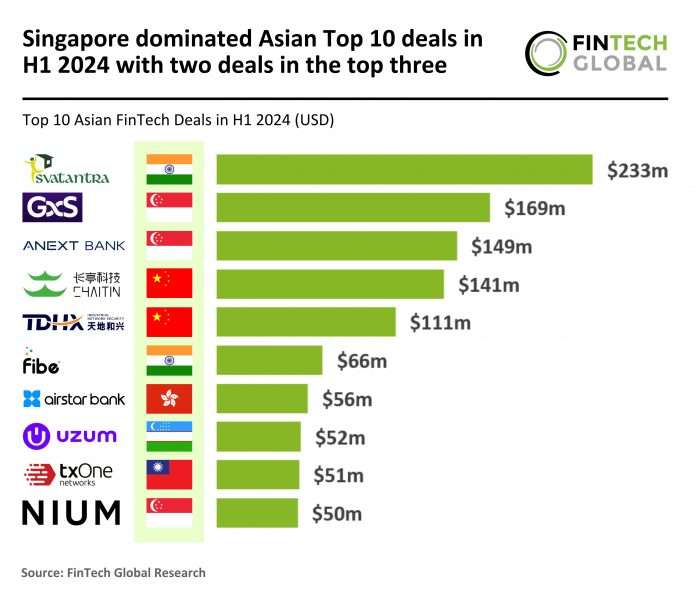

- Singapore dominated the top 10 deals in Asia after securing three of the top 10 deals, with two of them being in the top three

- Asian FinTech investments dropped by 70% in YoY comparison as fundraising became more challenging

- Svatantra secured the largest FinTech funding round in Asia with a $230m private equity investment deal

The distribution of the top 10 deals in H1 2024 highlighted a shift in the geographic concentration of major FinTech activity. Singapore emerged as a leader with three top deals (two of them being in the top three), up from two in H1 2023, while India and China each secured two deals. Notably, India, which had two top deals in H1 2023, saw a mixed performance with only one in H1 2024. Meanwhile, Uzbekistan and Hong Kong appeared in the top 10 for the first time, replacing Saudi Arabia and Israel, which were among the leaders in H1 2023. This changing landscape underscores the evolving dynamics within the Asian FinTech sector, with traditional powerhouses like Singapore and India maintaining strong positions while new players such as Uzbekistan and Hong Kong begin to make their mark.

In the first half of the year, the Asian FinTech sector recorded 514 transactions, representing a decline of nearly 47% from the 969 deals completed during the same period in 2023 and a 36% drop from the 808 funding rounds in H2 2023. The total FinTech funding in H1 2024 amounted to $7.4bn, a steep drop of 70% from the $24.4bn raised in H1 2023 and a 48% drop from the $14.3bn raised in H2 2023. These figures indicate a marked slowdown in both deal activity and the overall volume of funding, reflecting a challenging environment for the sector across Asia.

Svatantra, an Indian based technology driven microfinance company secured the biggest deal in Asia with a $230m private equity investment deal. The company provides affordable financial and non-financial solutions to women entrepreneurs, it has emerged as one of the most differentiated process and technology-driven microfinance entities in India. Svatantra, along with its wholly owned subsidiary, Chaitanya, has a team of more than 17,000 employees and serves over 4.2m customers across 20+ states. Svatantra offers microcredit at affordable rates and has been a first mover and shaker of the industry by being the first MFI with 100% cashless disbursements since inception, and also the first to roll out an extensive customer-facing app that is conducive to client social behaviours.

In the first half of 2024, India continued to dominate the Asian FinTech sector as a whole with 149 deals, representing 29% of all funding rounds, although this was a decrease from 262 transactions (27% share) completed in H1 2023. China maintained its second position with 85 deals, holding steady at a 17% share, down from 168 deals during the same period the previous year. Singapore secured the third spot with 75 deals, accounting for 15% of the total, a slight drop from 138 deals (14% share) in H1 2023.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global