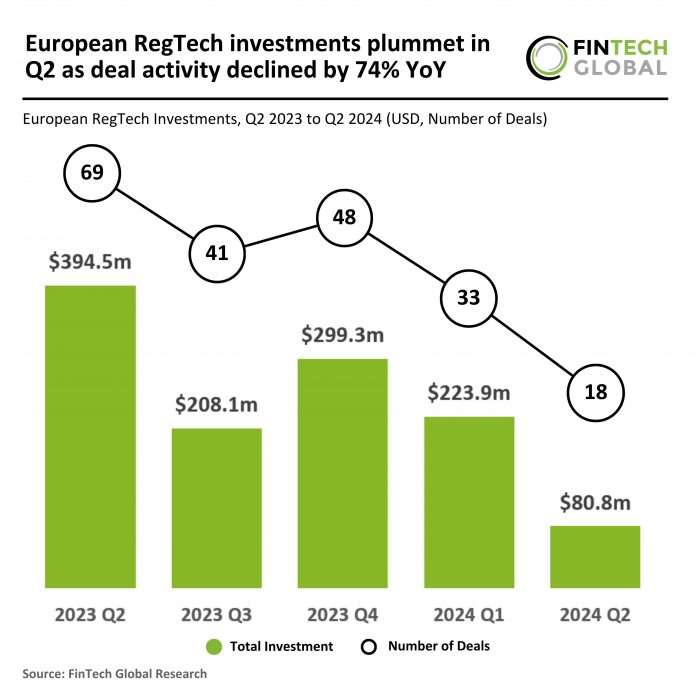

European RegTech investment stats in Q2 2024:

- RegTech deal activity in Europe fell by 74% for Q2 2024 in YoY comparison

- The average deal size decreased by 21% compared to the first quarter of the year

- Fortifai, a startup focused on automating and accelerating (ESG) regulatory compliance, announced its arrival to the European RegTech market with a funding round of $537k

In Q2 2024, the European RegTech sector experienced an impactful downturn in both deal activity and funding. Only 18 deals were recorded in Q2 2024, marking a 74% decrease compared to the 69 deals completed in the same quarter of the previous year. Funding also saw a sharp decline, with European RegTech companies raising just $80.8m in funding during the second quarter, an 80% drop from the $394.5m raised in Q2 2023. Compared to Q1 2024, which saw 33 deals and $223.9m in funding, Q2 2024 represents a 45% drop in deal activity and a 64% decrease in funding.

The average deal value in Q2 2024 was approximately $4.5m, reflecting a 34% decrease from the $6.8m average in Q1 2024 and a 21% decrease from the $5.7m average in Q2 2023. This trend suggests that not only are fewer deals being made, but the investments are also smaller, likely indicating a heightened level of caution among investors in the European RegTech market due to ongoing economic challenges and market uncertainties.

Fortifai, a startup focused on automating and accelerating Environmental, Social, and Governance (ESG) regulatory compliance, announced its arrival with a $537k funding round led by RunwayFBU, Startuplab, and Impact Shakers Ventures. This investment will propel Fortifai’s platform development, allowing it to expand its market presence and enhance its ESG compliance solutions globally. Fortifai is not just another ESG reporting tool; it offers a continuous, real-time compliance management system that transforms sustainability into a strategic advantage rather than an annual checklist. Under the leadership of Abbey Lin, a seasoned expert in global sustainability, Fortifai is already collaborating with multinationals like Telenor and piloting solutions with companies such as Aker Solutions and Hydro Rein. The new funding will enable Fortifai to support its existing pilots, onboard new customers, and integrate AI to make its ESG compliance platform even more impactful, positioning it as a game-changer in the RegTech landscape.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global