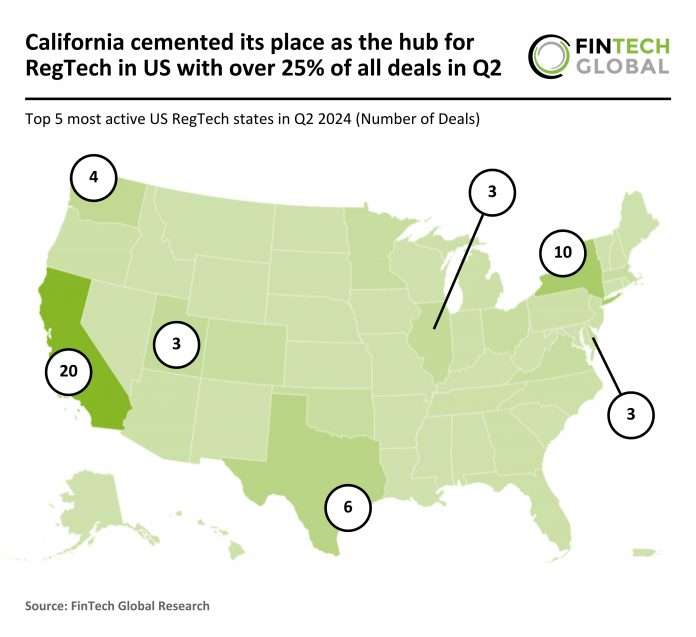

US RegTech investment stats in Q2 2024:

- California continued its domination of the RegTech market with 27% of all US deals in the sector completed in Q2 2024

- Even though the domination continued, the diversification of RegTech through the various states could be seen by the drop in percentages from last year

- KarmaCheck secured the largest deal for the second quarter, with a Series B funding round of $45m

In Q2 2024, the US RegTech sector recorded 72 deals, a drastic drop of 50% from the 145 transactions completed during the same period last year. California led the market with 20 deals (27.8% share), maintaining its position as the most active state but with a reduced share compared to its 39 deals (54.2% share) in Q2 2023. New York followed with 10 deals (13.89% share), down from 21 deals (29.2% share) in the same period last year. Texas completed six deals (8.3% share), a decrease from the 11 deals (15.3% share) recorded in Q2 2023.

While California, New York, and Texas remained the top three states, all three saw a significant reduction in deal numbers. California’s dominance, though still evident, has lessened as its share of the total deals has decreased, mirroring the broader contraction in the RegTech sector across the US. The continued presence of these states at the top underscores their central role in the industry, even as overall deal activity levels have dropped significantly.

KarmaCheck, a trailblazer in technology-driven background checks and credentialing, secured $45m in a Series B funding round, the largest deal during Q2, spearheaded by Parameter Ventures, with additional backing from PruVen Capital, Velvet Sea Ventures, GC1 Ventures, and NextView Ventures. KarmaCheck is renowned for its innovative approach to simplifying and enhancing the background check process. Founded in 2019 by Eric Ly, a LinkedIn co-founder, the company has consistently aimed to dismantle the barriers obstructing the path between talent and professional opportunities. Through its state-of-the-art technology platform, KarmaCheck has redefined the standards for background checks and credentialing services. The fresh capital will be utilised to further refine KarmaCheck’s proprietary technology, scale up service levels to accommodate more customers and candidates, and venture into new industry verticals.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global