Key Latin American FinTech investment stats in Q2 2024:

- Latin America FinTech deal activity dropped by 77% YoY

- Brazil continued to dominate the Latin American market as the most active country in the region with 38% of all deals

- Celcoin secured the biggest deal for Q2 2024 in Latin America with a $125m funding round

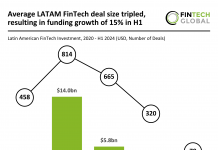

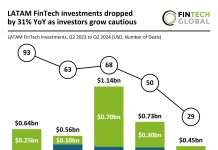

In Q2 2024, the LATAM FinTech industry experienced a noteworthy decline in both deal activity and funding. The region recorded 39 funding rounds, a steep 77% drop from the 169 deals completed in Q2 2023. LATAM FinTech companies raised $444m during the same period, marking a 31% decrease from the $639m raised in Q2 2023. This stark reduction in both deal volume and funding indicates a broader slowdown in the sector as investor activity has contracted considerably compared to the previous year.

Brazil remained the most active FinTech market in LATAM, with companies in the country completing 15 deals (38% share) in Q2 2024. This represents a dramatic 80% decrease from the 74 deals recorded in Q2 2023. Mexico followed with nine deals (23% share), a 70% decline from the 30 deals closed in the same period last year. Chile, completing six deals (15% share), also saw a steep decline of 68% from the 19 funding rounds completed in Q2 2023. Despite these reductions, Brazil, Mexico, and Chile remained the top three most active countries in both time periods, reflecting their continued dominance in the LATAM FinTech landscape, even amidst a broader slowdown in deal activity.

Celcoin, a leading company in the Banking as a Service (BaaS) financial technology market, secured the largest funding deal in Latin America for Q2 2024 with a $125m investment led by global growth equity investor Summit Partners. Known for its partnerships with market-leading FinTech companies such as EngageSmart and Corpay, Summit Partners was joined by existing investor Innova Capital and seasoned FinTech executive John Coughlin in this round. Founded in 2016, Celcoin provides financial infrastructure services for banks, FinTechs, and enterprises, focusing on payments, banking, and lending to enable personalized embedded finance solutions. With over 400 financial industry customers and more than 5,000 non-financial companies leveraging its offerings, Celcoin’s robust platform processes over 200m Pix transactions monthly. The new capital will support Celcoin’s expansion plans, further strengthening its leadership position in the BaaS and embedded finance markets, while driving continued innovation. The investment comes as Celcoin experiences strong momentum, recording $63m in annual recurring revenue in Q1 2024—a 140% increase year-over-year—alongside strategic acquisitions like Galax Pay, Flow Finance, Finansystech, and Reg+.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global