The UK leads the way in a slow week for FinTech, with just 16 deals completed globally and a total of $557.5m raised.

In a rare instance, the US was not the leader in FinTech deals this week. There were three deals completed in the country, just one behind the UK, which led the pack with four deals.

The four UK companies were Carmoola, TrueLayer, BMLL and Atomos, while the US FinTechs were Torq, Harmonic Security and Apono.

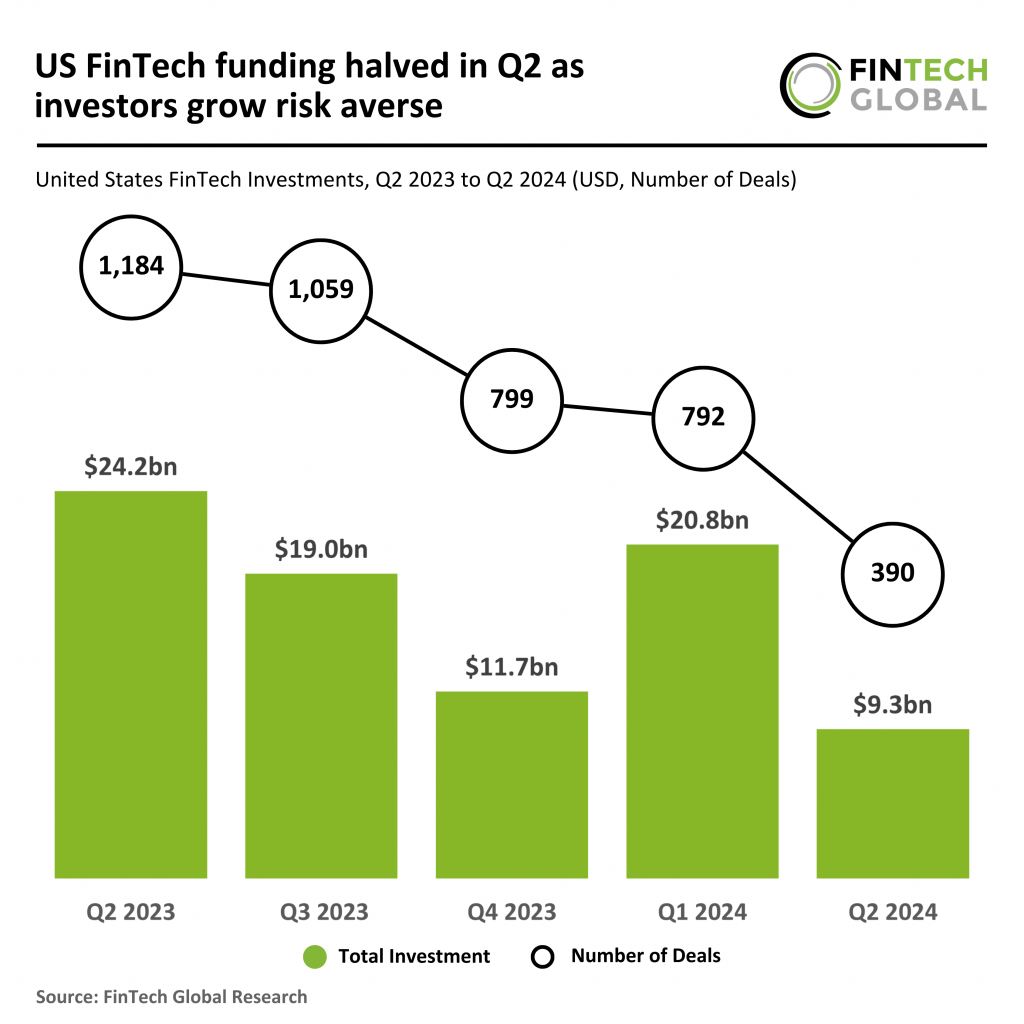

The FinTech sector in the US had a tough second quarter of 2024. Research from FinTech Global found that US FinTech deal activity halved in Q2 from the opening quarter of the year, going from 792 to 390. It was an even bigger decline from Q2 2023, which recorded a total of 1,184 deals.

Funding also dropped sharply, with US FinTech companies raising just $9.3bn in Q2 2024, reflecting a 62% decline from the $24.2bn raised in the same quarter last year. It was also down 55% compared to Q1 2024, which saw $20.8bn in funding. Despite the drops in funding, average deal size was slightly up. It was $23.8m in Q2 2024, up from $23.2m in Q1 and higher than the $20.4m average in Q2 2023

Going back to this week’s deals, the remaining nine deals were spread across the world, with Canada (KOHO), the Philippines (Salmon), Israel (Air Doctor), Germany (Atlas Metrics), Hong Kong (RD Technologies), Indonesia (Rey), the Netherlands (Plumery), Lithuania (AMLYZE) and Ivory Coast (Daba) each housing one deal.

Despite it being a slow week for deals, there were a couple of sizable deals. The biggest deal of the week was closed by Canadian WealthTech company KOHO, which raised $190m to support its growth. The investment round comprised $40m in equity and $150m in debt. Its investors included PROPELR Growth, Rockefeller Capital, Drive Capital TTV, and BDC.

The second biggest deal of the week was secured by UK-based marketplace lending platform Carmoola. The car financing company raised $131m in debt from NatWest. The funds are designed to help more people find and buy cars, with Carmoola expecting to deliver billions of pounds worth of originations in the next five years.

Only six of this week’s deals were under $10m.

Funding was notably down from last week, which saw nearly $1bn raised across

In terms of sectors, it also proved to be relatively diverse. WealthTech was the most popular sector, with four deals (KOHO, Plumery, Daba and Atomos) and followed by CyberTech (Torq, Harmonic Security and Apono).

The remaining deals comprised of two marketplace lending (Carmoola and Salmon), InsurTech (Air Doctor and Rey) and RegTech (RD Technologies and AMLYZE) deals. As well as one deal in each of the following sectors PayTech (TrueLayer), ESG FinTech (Atlas Metrics) and Data and Analytics (BMLL).

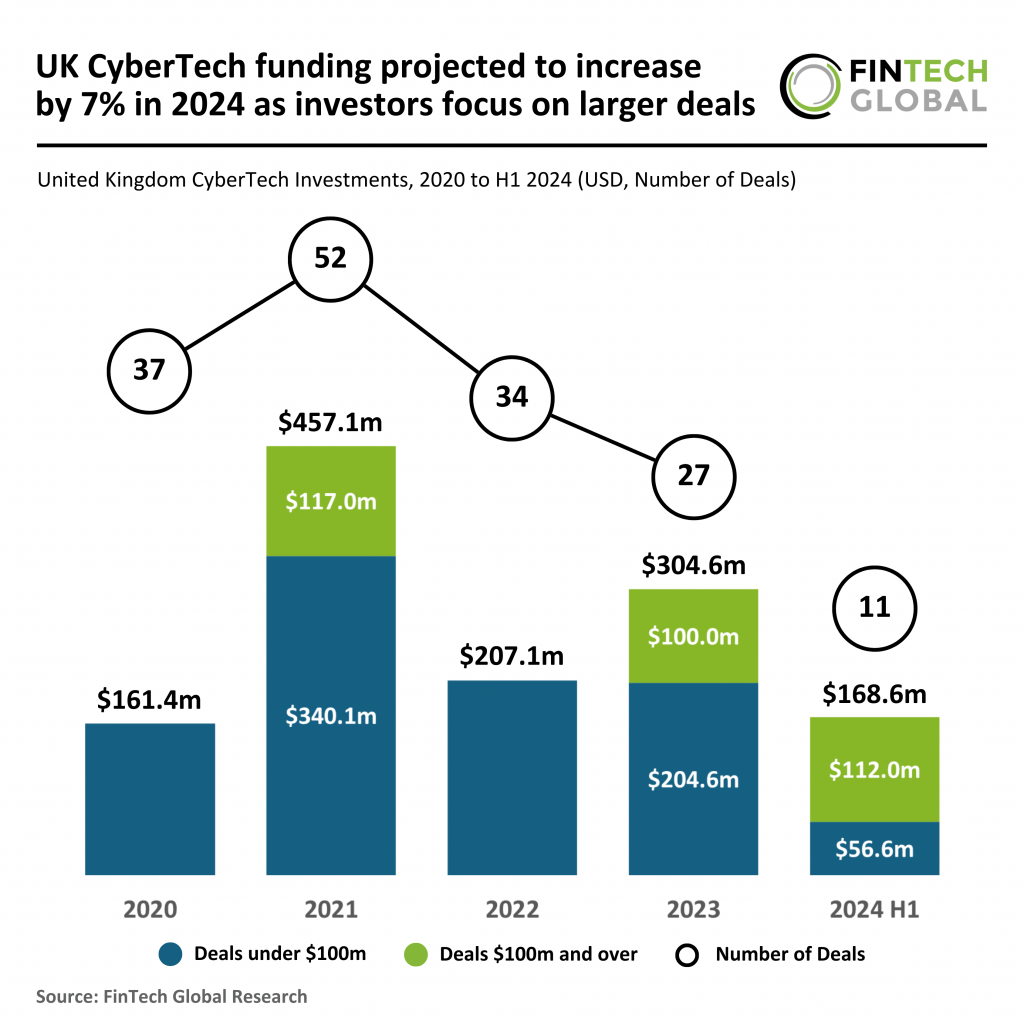

Recent research from FinTech Global found that UK CyberTech funding is projected to increase by 7% in 2024. During H1 2024, the UK CyberTech sector experienced a 15.4% drop in deal activity, going from 13 to 11. However, total funding rose to $168.6m in the first six months of 2024, a modest 5% increase from $160.6m in H1 2023, and a notable 17% rise from $144m in H2 2023.

If trends continue, the projected number of deals for 2024 could be around 48, a 26% decline from the 65 deals completed in 2023. In terms of funding, the year is projected to close with $675m, a 7% increase from the $632m raised in 2023.

Without further delay, here are the 16 funding rounds covered on FinTech Global this week.

KOHO raises $190m to fuel expansion and pursue bank license

KOHO, a prominent Canadian FinTech company, has successfully secured a substantial $190m in fresh capital to propel its growth.

This significant financial boost comprises $40m in equity and $150m in debt. The latest funding round was led by PROPELR Growth, with new contributions from Rockefeller Capital. Returning investors, including Drive Capital, TTV, and BDC, also played key roles in the funding process. This round sees an extension of credit in collaboration with both new and existing partners.

Established as a leading player in the financial technology space, KOHO offers a range of innovative financial solutions designed to enhance financial security and empower Canadians. The company is particularly noted for its user-friendly financial products and services that cater to the everyday financial needs of its customers.

The influx of capital will be strategically used to expand KOHO’s lending book, introduce new innovative products, and continue its pursuit of a Schedule 1 bank license. These initiatives are expected to significantly enhance KOHO’s service offerings and market position.

In addition to its ongoing projects, KOHO has a robust product roadmap, hinting at an array of exciting new products soon to be launched. These forthcoming offerings are poised to further solidify KOHO’s reputation for innovation and customer-centric solutions in the FinTech sector.

Carmoola secures £100m ($131m) NatWest deal to revolutionise UK car finance rates

Carmoola, a UK-based FinTech company focused on car finance, has entered into a significant debt deal with NatWest, valued at £100m.

According to Tech EU, this strategic financial boost is set to transform the way consumers in the UK finance their vehicles.

The investment totals £100m and involves NatWest as the primary investor. This substantial capital injection underscores NatWest’s confidence in Carmoola’s innovative business model and its potential to reshape the car finance landscape.

Carmoola operates by providing direct car financing to consumers, bypassing traditional intermediaries like dealerships. This approach not only simplifies the financing process but also aims to offer more competitive rates and transparent terms to customers. By eliminating middlemen, Carmoola cuts down on hidden fees and unnecessary commissions often associated with car loans.

The new funds will be utilised to further Carmoola’s mission of transforming the car finance industry. Specifically, the company plans to leverage this capital to increase loan originations, expecting to facilitate billions of pounds in loans over the next five years. This will enable Carmoola to offer even more competitive rates and expand its reach among consumers seeking fair and straightforward financing options.

Additionally, this partnership is indicative of a broader regulatory shift towards more transparent and consumer-friendly car financing solutions. By integrating advanced technology, Carmoola enhances the efficiency of the loan application process, vehicle checks, and the final purchase, thereby providing a seamless experience for car buyers.

Torq bags $70m in Series C to propel Gen AI in security operations

Torq, a pioneering leader in AI-driven security hyperautomation, has successfully closed its Series C funding round, amassing $70m.

This substantial investment was spearheaded by Evolution Equity Partners and saw significant participation from notable firms including Bessemer Venture Partners, Notable Capital, Greenfield Partners, and Strait Capital.

This round of funding adds to an impressive year for Torq, which included an expanded Series B in January, bringing its total raised in 2024 to $112m. Since its inception in 2020, Torq has secured $192m in funding.

Torq is at the forefront of revolutionizing security operations platforms by leveraging cutting-edge generative AI. The firm’s flagship product, the Torq HyperSOC, employs Natural Language Processing (NLP) to automate critical security operations center (SOC) tasks.

This innovative solution helps streamline security event investigation, triage, and remediation, significantly reducing alert fatigue and improving response times. Torq’s technology also provides comprehensive case management capabilities, enabling security teams to automate complex processes with unprecedented ease.

The latest funding will be utilized to fuel Torq’s expansion across EMEA and APAC regions, and to enhance their world-class engineering, R&D, and sales teams. Additionally, Torq plans to double down on generative AI enhancements, reinforcing its commitment to advancing cybersecurity solutions.

Moreover, Torq has demonstrated extraordinary growth in revenue and customer base for the second consecutive year, tripling its figures annually. This growth underscores the increasing enterprise adoption of the Torq HyperSOC, designed to address the dynamic challenges of modern cybersecurity environments.

TrueLayer lands $50m boost to pioneer pay-by-bank innovation in Europe

TrueLayer, recognised as Europe’s premier pay-by-bank network, has recently completed a significant fundraising milestone by securing an additional $50m.

This latest capital injection, part of an extended Series E round, brings the total raised in this series to $180m.

The funding was spearheaded by Northzone, with contributions from longstanding backers including Tencent, Tiger Global, Temasek, and Stripe. This round serves as a robust endorsement of TrueLayer’s strategy to transform the digital payments framework and lead the development of pay-by-bank solutions.

TrueLayer has established itself as a pivotal player in the European market for pay-by-bank payments. The company has experienced a meteoric rise in its operations, reporting a 200% increase in revenue in 2023 alone. It has also significantly expanded its customer roster, strengthening collaborations across various sectors with notable partners like Stripe and lastminute.com, alongside servicing major fintechs like Revolut, Zopa, Coinbase, and Robinhood.

Currently, TrueLayer handles over $50bn in total payment volume annually, facilitating 150 million transactions. Notably, the company has achieved a landmark by exceeding one million variable recurring payment transactions each month, a first on a global scale.

The freshly acquired funds will fuel TrueLayer’s ongoing mission to challenge traditional payment mechanisms and enhance its footprint, particularly within the e-commerce sector. By advancing pay-by-bank technology, TrueLayer is enabling merchants to lower payment processing costs while providing consumers with greater value.

Salmon secures $30m in Series A-2 funding to expand financial services in Southeast Asia

Salmon, a leading FinTech firm, operates a licensed bank in the Philippines and is known for its innovative consumer lending products.

The company announced today the successful completion of its $30m Series A-2 equity financing round, which was significantly oversubscribed.

The funding round saw substantial contributions from existing investors, including the International Finance Corporation (IFC) and Lunate of Abu Dhabi. Both investors committed funds well above their initial rights.

Salmon is dedicated to addressing the financial needs of over 50 million Filipinos who are underserved by traditional banking systems. The firm offers a range of financial services designed to provide more accessible credit solutions to this significant market segment.

The newly acquired funds will be utilized to further scale Salmon’s profitable lending operations and introduce new products tailored to the dynamic needs of its customers. Additionally, the company plans to enhance its marketing efforts across thousands of retail locations in the Philippines and expand its online services.

Pending regulatory approvals from the Bangko Sentral ng Pilipinas (BSP), a portion of the investment will also be used to strengthen the capital base of the Rural Bank of Sta. Rosa (Laguna). The aim is to boost the bank’s total capital to PHP 1.2bn by the end of 2025, supporting its continued growth and performance. Over the past six months, this bank has become the fastest-growing in the country, achieving one of the highest returns on equity among regulated financial institutions in the Philippines.

BMLL secures £16m ($21m) in strategic funding to enhance global data analytics

BMLL, a firm specialising in data and analytics for global equity and futures markets, has secured a £16m strategic investment.

According to Business Cloud, leading the investment round was Optiver, alongside new investor CTC Venture Capital, with continued support from existing stakeholders such as Nasdaq Ventures, FactSet, and IQ Capital’s growth fund.

The company offers a unique value proposition by providing clients, including banks, brokers, asset managers, hedge funds, and global exchanges, with deep insights through its order book data and analytics. These tools allow clients to derive predictive insights, backtest strategies, and understand market behaviors effectively.

The new funding will primarily be directed towards expanding BMLL’s data feed business, enhancing futures coverage, and broadening its product offerings on a global scale. Over the past 18 months, BMLL has significantly expanded its datasets, now covering 98% of the MSCI All Country World Index, and recently inaugurated a new office in New York.

HealthTech startup Air Doctor secures $20m in Series B funding

Air Doctor, an Israeli HealthTech startup providing a platform that connects travellers with medical professionals globally, has raised $20m in a Series B funding round.

The investment round was led by aMoon, a venture capital firm focused on health and life sciences, with participation from Tokio Marine Holdings, Samsung Ventures (SVIC), and previous investors Lightspeed Venture Partners, Vintage Investment Partners, Phoenix Insurance, and Munich Re Ventures, according to Tech Crunch.

The new funding will be used to expand Air Doctor’s global network of doctors, further enhance its platform’s capabilities, and continue its partnership efforts with insurance companies.

Currently, the company has a network of 20,000 doctors across 84 countries and contracts with 18 major health insurance providers, catering to over 80,000 users.

Founded by Jenny Cohen Derfler and her son, Yam Derfler, Air Doctor offers a platform that helps travellers find vetted doctors for in-person or remote consultations in over 84 countries.

The platform is designed to match customers’ insurance policies with services rendered, managing reimbursement payments to doctors from insurance companies.

The service claims to provide significant cost savings on outpatient claims, medical assistance, and administrative handling times.

In a statement, Air Doctor CEO and co-founder Jenny Cohen Derfler said, “the potential is much larger,” as she referenced the growing number of international travellers in 2024, which is projected to increase substantially according to UN estimates.

Air Doctor’s product has seen rapid growth since its initial focus on business-to-consumer (B2C) services, and now operates a B2B2C model with insurance companies referring travellers to the platform.

Apono secures $15.5m Series A funding to innovate cloud access security

Apono has announced a significant boost in its growth trajectory with a successful Series A funding round that garnered $15.5m.

The round was spearheaded by New Era Capital Partners and saw participation from Mindset Ventures, Redseed Ventures, Silvertech Ventures, along with initial seed investors and more.

The company, which specializes in AI-driven solutions for secure and efficient management of cloud access, has now raised a total of $20.5m, reflecting strong investor confidence. Apono’s platform offers next-generation solutions tailored for the dynamic needs of enterprises, enhancing both security and operational efficiency in cloud environments.

The influx of funds is earmarked for advancing product development and accelerating Apono’s growth. Specifically, the company aims to enhance its AI capabilities and expand its footprint in identity security, ensuring robust protection for organizations’ cloud operations. Apono plans to use the investment to scale up its US sales and marketing teams and boost its research and development efforts.

Following a 300% revenue increase in recent quarters, Apono is also enhancing its customer support infrastructure. This includes tripling its sales engineering and customer success teams in the US and establishing enterprise support teams to meet the needs of new and existing customers. These enhancements are part of Apono’s commitment to providing seamless service and support, ensuring effective adoption and integration of its solutions across client enterprises.

Harmonic Security secures $17.5m in Series A to transform data protection

Atlas Metrics secures €12.2m ($13.3m) in Series A to transform ESG compliance in Europe

Atlas Metrics, a trailblazer in ESG compliance solutions, has recently closed a Series A funding round, amassing €12.2m.

The round was spearheaded by MMC Ventures, with notable contributions from existing backers Cherry Ventures, b2venture, and Redstone. This financial injection is poised to fuel Atlas Metrics’ ambitious expansion plans and bolster its ESG compliance and performance management offerings.

The company, deeply entrenched in the ESG domain, leverages cutting-edge technology to aid mid-sized companies and financial institutions in navigating the complexities of CSRD reporting and regulatory compliance. By automating and streamlining these processes, Atlas Metrics significantly curtails both the financial and legal burdens associated with ESG compliance.

With the fresh capital, Atlas Metrics is set to enhance its product suite. The goal is not only to simplify the ESG compliance process but also to transform sustainability data into a strategic asset that offers competitive advantages. This initiative comes at a crucial time as the EU ramps up its regulatory demands for ESG reporting, affecting over 62,500 organisations by 2025.

Atlas Metrics has already made significant strides in the market, evidenced by its adoption by major entities such as KfW Capital and through strategic partnerships with firms like DG Nexolution. Additionally, leading consultancies including PwC Belgium and TK Moore have integrated Atlas Metrics’ solutions into their sustainability services, further validating its effectiveness and market relevance.

RD Technologies secures $7.8m to expand its FinTech bridge between Web2 and Web3

RD Technologies, a pioneering FinTech firm, has announced a successful $7.8m Series A1 financing round.

This latest financial injection comes from a notable consortium of investors, including HongShan, Hivemind Capital, Aptos Labs, Hash Global, SNZ Capital, Solana Foundation, Anagram, and Upward Capital.

The company specialises in creating a seamless interface between the traditional Web2 environments and the emerging Web3 spaces. By leveraging cutting-edge technologies, RD Technologies provides robust financial solutions that are both innovative and compliant with current regulatory frameworks.

The funds from this Series A1 round will be allocated to further enhance RD Technologies’ financial platform, which is crucial for fostering the development of the Web3 ecosystem in Hong Kong. This initiative is set to not only expand their services but also strengthen Hong Kong’s position as a global leader in blockchain and financial technology.

Adding to their achievements, RD Technologies recently celebrated the admission of its subsidiary, RD InnoTech, into the stablecoin issuer sandbox regulated by the Hong Kong Monetary Authority (HKMA). Another subsidiary, RD Wallet Technologies Limited, has also started its operations, having secured a Stored Value Facility (SVF) license from the HKMA.

Previously, RD Technologies raised significant capital in its seed round, supported by influential stakeholders such as ZhongAn Digital Asset Group Limited and HashKey Group. This backing has provided RD Technologies with a suite of strategic resources, including access to a regulatory-compliant trading platform and advanced Web3 infrastructure.

Jakarta-based InsurTech Rey secures $3.5m funding round

Jakarta-based InsurTech startup, Rey, has secured an additional $3.5m in funding as it seeks to expand its AI-powered health insurance platform.

The investment round was backed by CyberAgent Capital, Arthazen Capital, and Gametraco Tunggal, along with participation from existing investors, according to InsurTech Insights.

Rey, founded in 2021 by former Sequis head of digital channel Evan Tanotogono and lead engineer Bobby Siagian, offers a digital health insurance platform.

The company provides health memberships that cover both outpatient and inpatient care, as well as wellness programmes aimed at improving overall health management. Chief business officer David Nugrho, an insurance industry veteran, also joined the leadership team to help steer the company’s growth.

The startup plans to use the $3.5m to enhance its AI tools for claims processing and underwriting.

Rey’s digital platform has already reached over 50,000 people and more than 100 organisations, demonstrating significant traction. Additionally, its claims management system boasts a loss ratio much lower than the industry average, showcasing the platform’s efficiency in handling insurance claims.

Digital banking platform Plumery raises $3.3m in latest funding round

Plumery, a digital banking experience platform that focuses on delivering true customer-centric banking solutions, has announced that it has secured an additional $3.3m in funding.

The latest funding round was led by early-stage investor DN Capital and Fontes, managed by the renowned global VC firm QED Investors.

This new capital brings Plumery’s total funding to date to $7.8m as it gears up for a larger Series A round planned for 2025.

Founded in 2022, Plumery has been dedicated to providing a digital banking platform that allows organisations to quickly deploy and customise their banking capabilities.

The company focuses primarily on the small and medium enterprise (SME) sector, as well as consumer banking and lending, ensuring that its platform meets the needs of diverse clients.

Its innovative approach enables banks and lenders to innovate without the disruption of overhauling existing legacy systems.

The funds will be utilised to bolster Plumery’s sales and marketing efforts, enhance global partner management, and improve the product’s features for SMEs and consumer segments.

Furthermore, the company plans to increase headcount in critical areas such as product development, engineering, and commercial operations.

AMLYZE garners €2.35m ($2.5m) in seed funding to combat financial crime

AMLYZE, a RegTech company, has successfully closed a €2.35m seed funding round.

The funding round was spearheaded by Practica Capital, a prominent venture capital firm in the Baltics.

It also saw contributions from FIRSTPICK, an early-stage venture capital fund and accelerator, and Coinvest Capital, a sovereign VC fund. Other participants included a group of accredited private co-investors such as Gintas Balčiūnas, CEO of Dokobit, and Donatas Dailidė, CEO and Chairman of DOJUS Group, as well as the Lithuanian business angel syndicate NGL, comprising 33 business angels. International institutional investors, including Advanzia Bank, a European digital bank based in Luxembourg, also joined the round.

AMLYZE is set to accelerate the development of the world’s first cross-border information-sharing platform for anti-financial crime, which will utilize artificial intelligence and synthetic data. This innovative platform aims to enhance the company’s existing suite of solutions, improving compliance processes and boosting efficiency for financial institutions globally.

Daba Wins $50k at Ecobank FinTech Challenge

In a significant achievement for African FinTech, Daba has clinched first place at the 2024 Ecobank FinTech Challenge.

The prestigious event, hosted at the Ecobank Pan African Center in Lomé on September 27, saw Daba outperform a host of early-stage and mature startups, securing a $50,000 prize and a spot in the Ecobank FinTech Fellowship programme.

This year’s challenge, the seventh edition, drew participation from a broad spectrum of FinTech startups across Africa, all eager to forge a partnership with Ecobank, a leading pan-African banking group. Daba’s standout strategy to democratise investment opportunities in Africa and emerging markets distinguished it from its competitors.

As the challenge winner, Daba now has the chance to explore various partnership avenues with Ecobank, potentially integrating products and tapping into Ecobank’s expansive banking network, which spans 35 sub-Saharan African countries, along with its commercial and service provider partnerships.

The Ecobank FinTech Challenge has been a catalyst for numerous successful FinTech innovations since its inception, thanks to its rigorous selection process. This year’s competition attracted over 5,500 contestants from 64 countries, highlighting its importance in shaping the African FinTech landscape.

Daba’s unified investment platform comprises a diverse suite of products tailored to a broad investor base, including real investing apps for individual investors, services for fund managers and professional investors through Daba for Institutions, and investment intelligence and analytics through Daba Pro. Moreover, Daba for Issuers and Daba APIs and SDK facilitate connections between capital seekers and providers, integrating savings and investment products for tech companies.

WTW bolsters UK wealth management influence with strategic stake in Atomos

WTW has announced its acquisition of a stake in Atomos, a prominent, advice-led wealth manager operating in the UK.

The investment marks a pivotal development in a partnership that began in late 2022, enhancing Atomos’ ability to offer diverse, multi-asset investment solutions.

The partnership, supported by funds managed by Oaktree Capital Management, has empowered Atomos to deliver investment choices that were previously exclusive to institutional-sized investors. With this investment, WTW not only secures part ownership of Atomos but also injects additional capital to support its continued growth.

Atomos operates within the UK’s wealth market, currently valued at £2.2trn. This strategic move by WTW is designed to expand its footprint in the UK wealth sector, where it has already seen considerable growth.

The funding from WTW will enable Atomos to broaden its reach and cater to the evolving needs of UK savers, particularly those managing their retirement through various savings schemes. WTW’s vast experience in occupational pensions will now benefit Atomos’ individual clients, enhancing the firm’s offering.

Keep up with all the latest FinTech news here

Copyright © 2024 FinTech Global