Key European WealthTech investment stats in Q3 2024:

- European funding dropped by 91% YoY as investors grow cautious

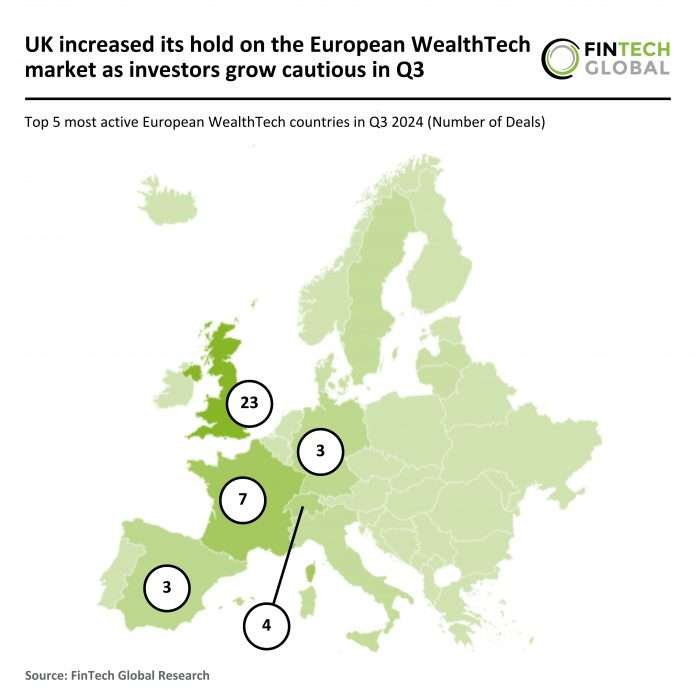

- UK increased its hold on the European WealthTech investment market as it secured 46% of the deal activity in the region

- Twenty7tec, a UK-based digital wealth advice platform, secured the biggest deal in the UK for Q3 with a $21.6m funding round

In Q3 2024, the European WealthTech market experienced a sharp downturn in both funding and deal activity compared to the same period last year.

The sector recorded 38 funding rounds, an 87% decrease from the 300 deals completed in Q3 2023.

WealthTech companies in Europe raised $311m during Q3 2024, marking a significant 91% drop from the $3.41bn raised in Q3 2023.

This pronounced decline in both deal volume and funding underscores the broader challenges faced by the European WealthTech sector as economic pressures and cautious investor sentiment have significantly reduced the flow of capital into the space.

The UK remained the most active WealthTech market in Europe, with companies in the country completing 23 deals (46% share) in Q3 2024, down considerably from the 93 deals recorded in Q3 2023.

Interestingly, the UK’s share of total European WealthTech deal activity increased substantially despite the drop in the number of deals, indicating its continued central role within the sector.

France followed with seven deals (14% share), a decrease from the 24 deals completed in Q3 2023.

Switzerland emerged as the third most active market, closing four deals (8% share) in Q3 2024, replacing Germany, which held the third position in Q3 2023 with 35 deals.

The dominance of the UK, along with France’s stable performance, highlights the concentrated investor interest in these leading markets, even as the overall European WealthTech landscape contracts.

Twenty7tec, a UK-based digital wealth advice platform, founded in 2014, has secured the largest WealthTech deal in the UK for the quarter with a $21.6m investment from BGF.

Serving over 16,000 mortgage, protection, and wealth advisers across the UK, Twenty7tec’s integrated platform streamlines the entire mortgage process, from product sourcing to completion, enabling advisers to meet regulatory requirements efficiently while enhancing client service.

This fresh funding will accelerate product innovation, bolster its tech infrastructure, and support talent acquisition, aligning with Twenty7tec’s commitment to expanding its reach and refining its comprehensive technology offerings for financial advisers nationwide.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global