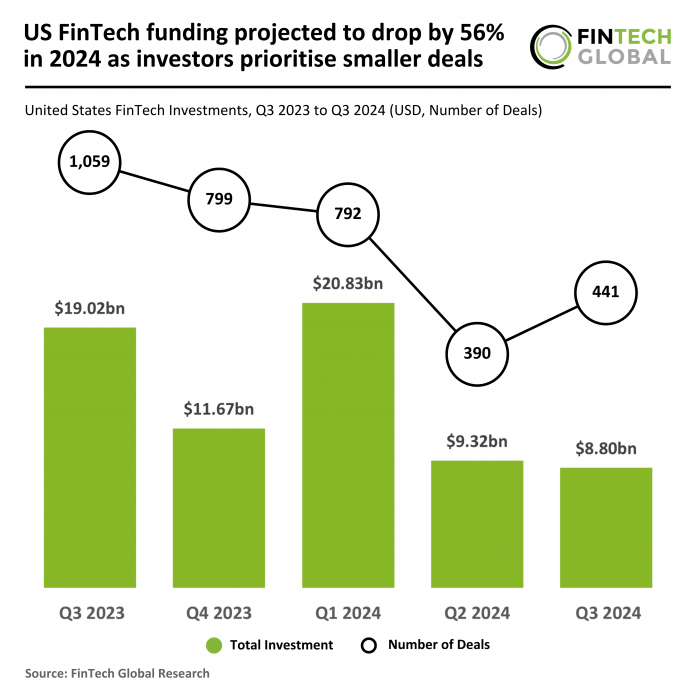

Key US FinTech investment stats in Q3 2024:

- US FinTech deal activity increased by 13% QoQ

- Trend analysis showed a projected 56% decrease in funding for the year as investors prioritise smaller deals

- Fourcore Capital, a rising leader in AI-powered asset and wealth management, secured one of the biggest US FinTech deals in Q3 with a $500m funding round

In Q3 2024, the US FinTech sector continued to see a notable decline in both deal activity and funding compared to the same quarter last year.

Only 441 deals were recorded in Q3 2024, representing a 58% decrease from the 1,059 deals completed in Q3 2023.

Funding also experienced a significant drop, with FinTech firms raising $8.8bn in Q3 2024—a 54% decline from the $19bn raised in Q3 2023.

These figures indicate a challenging environment for US FinTech, as investors demonstrate a marked pullback in their funding commitments on a year-over-year basis.

Comparing Q2 to Q3 2024, there was a slight improvement in deal volume, as the number of transactions increased from 390 to 441, marking a 13% QoQ increase.

However, total funding in Q3 2024 declined by 6% from the $9.3bn raised in Q2, suggesting that, despite a higher deal count, investors are leaning towards smaller transactions or allocating capital more conservatively across deals.

The average deal value in Q3 2024 was $19.9m, a decrease from the $23.9m average in Q2 2024, however it was higher than the $18m average deal value in Q3 2023.

The 2024 trend analysis suggests that deal activity would reach 1,764 deals by year-end, a 58% decrease from the 4,237 deals completed in 2023, while annual funding is set to reach $35.5bn, down 56% from the $80.4bn raised last year.

Fourcore Capital, a rising leader in AI-powered asset and wealth management, recently announced a landmark $500m share subscription facility with GEM Global Yield LLC SCS (GGY), making it one of the largest FinTech deals in US for the quarter.

This substantial investment will drive Fourcore’s strategic acquisitions, enhance AI and blockchain integrations across its platform, and expand its advisor support capabilities by appointing additional management talent.

With a commitment to growth and innovation, Fourcore is focused on delivering tailored solutions that combine advanced technology and disciplined investment strategies, positioning itself as a transformative player in the wealth management landscape as it prepares for a public listing.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global