Key Global InsurTech investment stats in Q3 2024:

- Global InsurTech deal activity dropped by 49% YoY

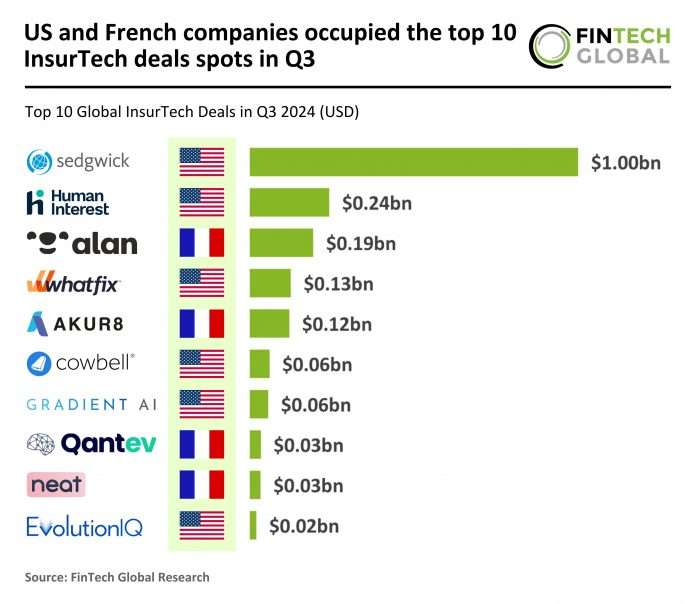

- US and French companies completed all of the top 10 deals list with six and four transactions, respectively

- Alan, the French insurance unicorn known for its streamlined health insurance and digital health services, secured a $193m Series F funding round to be the biggest InsurTech deal in France for the quarter

In Q3 2024, the global InsurTech sector recorded 53 deals, reflecting a 49% decline from the 104 deals in Q3 2023, but remaining steady compared to the 52 funding rounds completed in Q2 2024.

Total funding for Q3 2024 reached $2.38bn, a 55% increase from the $1.53bn raised in Q3 2023, and a 66% rise from the $1.43bn in Q2 2024.

However, this surge in funding was heavily influenced by the $1bn Sedgwick deal, which acted as a significant outlier.

Excluding the Sedgwick deal, Q3 2024 funding would total $1.38bn, reflecting a 10% decrease compared to the same period in 2023.

This recalculation highlights that while large-scale deals are impactful, the broader funding environment remains constrained, with smaller investments dominating the landscape.

The top 10 deals in Q3 2024 were dominated by the United States and France, with the US securing six top deals, an increase from the five recorded in Q3 2023.

France emerged prominently with four top deals, a notable shift as it had no presence in Q3 2023’s top 10 list.

This development underscores France’s rising stature in the InsurTech ecosystem.

By contrast, the United Kingdom, which had two top deals in Q3 2023, and other countries like Singapore, India, and Belgium, were absent from Q3 2024’s top 10 list.

This concentration of large deals in the US and France suggests a geographic shift in InsurTech leadership, with the US maintaining its dominance and France emerging as a key player in the global InsurTech landscape.

Alan, the French insurance unicorn known for its streamlined health insurance and digital health services, has solidified its market expansion with a $193m Series F funding round led by Belgium’s Belfius Bank, positioning Alan as the biggest InsurTech deal in France for Q3.

Initially established to complement France’s national healthcare with a user-friendly, automated claims experience, Alan has since broadened its offerings to include doctor consultations, mental health resources, and more through its mobile app.

The Belfius partnership will not only provide fresh capital but also bring Alan’s health insurance products to Belfius’ extensive corporate client base in Belgium, driving Alan’s user growth beyond its existing half-million insured members.

Keep up with all the latest FinTech research here

Copyright © 2024 FinTech Global