Latin America-focused venture capital fund alpha4 ventures has raised up to $10m for its maiden fund.

alpha 4 ventures Fund I is looking to raise up to $40m, according to the latest US SEC filing. It is not made clear in the document if this figure is a target or hardcap.

So far, there have been 14 investors registered to the fund.

A minimum contribution size to the vehicle has been set at $250,000.

The firm has four main areas of focus FinTech, e-commerce, marketplace/SaaS and high tech in the Latin American market. alpha 4’s aim is to fill in the Series A funding gap in the region, which at the moment sees mainly seed investments and later stage deals, according to the firm.

Tier I regional markets in the region, such as Mexico and Brazil, have had the lion share of funding but this has been unfocused activity and left a ‘fragmented tech investor ecosystem’, the website said.

The other opportunity lies in Tier II markets such as Colombia and Argentina, which have been undeserved in the investment space.

A statement on alpha’s website regarding its investment overview said, “We get Founders unstuck from the vicious cycle of inexistent Series A financing. Series A checks are deployed with a hands-on approach, with a particular focus towards generating regional exits.

“Focused capital – we help generate exponential growth for our Founders, with strategies that don’t sacrifice sustainability in Latam’s unique operating environment. Unparalleled access to existing funnels of early stage investments for great deal flow.”

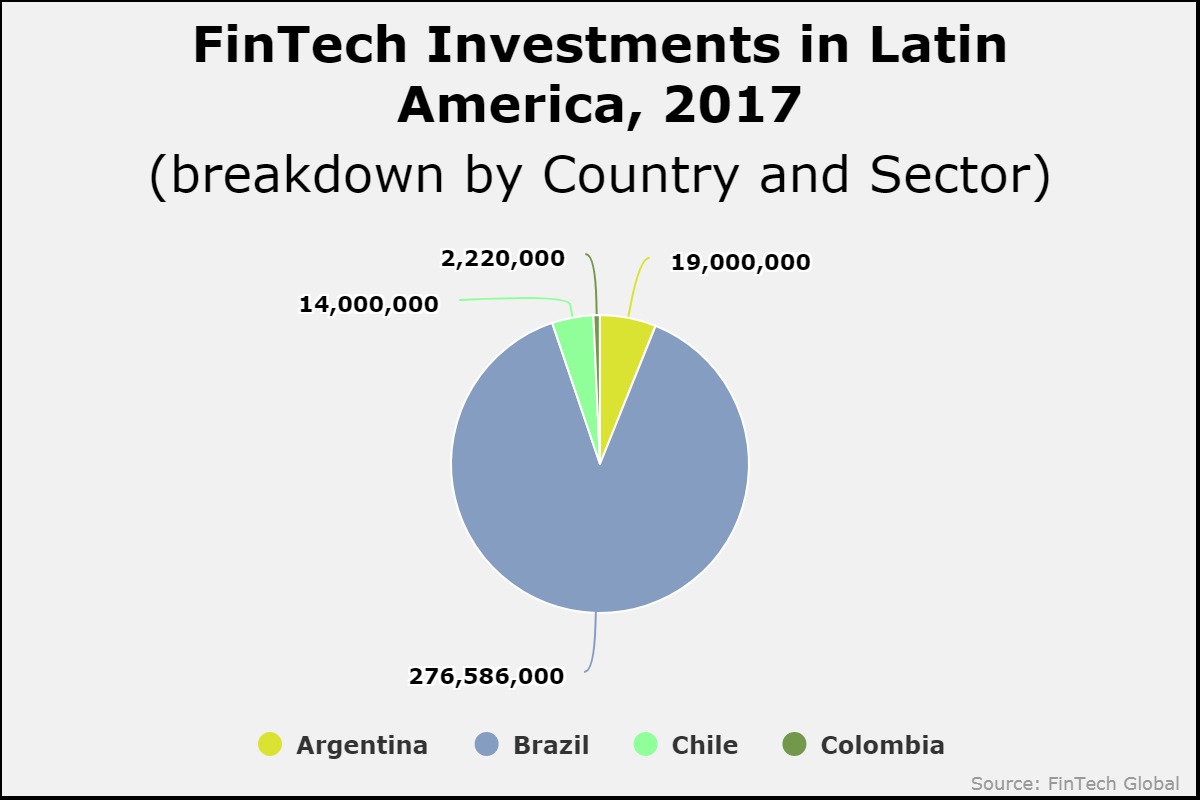

Last year, Brazil’s FinTech sector received $276.5m in funding representing an 88 per cent share of funding to the region, according to data by FinTech Global.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global