FinTech in Latin America is getting really hot and RS2 has taken steps to not miss out on the opportunities in the region.

The payment processing and technology provider has now partnered with Colombian transactional network provider MOViiRED to boost its presence in Latin America.

Through the deal, RS2 will be able to deploy its new direct acquiring business for the first time anywhere in the world.

The company’s service is able to acquire transactions in an omnichannel environment, including e-commerce, mail and telephone orders, and point of sale transactions.

RS2’s push into Latin America will also include issuing a number of card products – including prepaid cards, loyalty products, money transfer and gift cards – together with MOViiRED.

“Today’s launch marks the culmination of three years of strategic development for RS2,†said Radi El Haj, CEO of RS2. “We are launching a single global platform with a simple, one-API integration process which will provide consumers and merchants with services in both closed-loop and open-loop environments.

“We are pleased to partner with MOViiRED as the leading challenger bank in Colombia. Our partnership will combine our strengths, with MOViiRED speaking their customer’s language, plus their intimate knowledge of the challenges merchants and consumers face in Colombia today. It’s thanks to the strength of this partnership that we have chosen Colombia for the global launch of our new direct acquiring service, which we expect to roll out in Europe and North America this year, once the German Regulator BaFin has granted an e-money license to our German subsidiary.â€

Hernando Rubio, CEO of MOViiRED, added, “Our goal is to disrupt the current payment system in Colombia. RS2’s new direct acquiring business will enable merchants and consumers to transact using a single digital platform. With RS2, merchants can expect to be up and running inside 24 hours, rather than the usual time of couple of weeks. Ultimately, our objective is to disrupt cash usage in Colombia, working with RS2. We want our customers to pay without lengthy procedures and queues and at the lowest possible cost.â€

Malta-based RS2 is not the only FinTech company to recognise the potential in Latin America. Companies like Salt Lake City-based Galileo, UK challenger bank Revolut and American payment unicorn Stripe are just three examples of companies from abroad looking to tap into the emerging market.

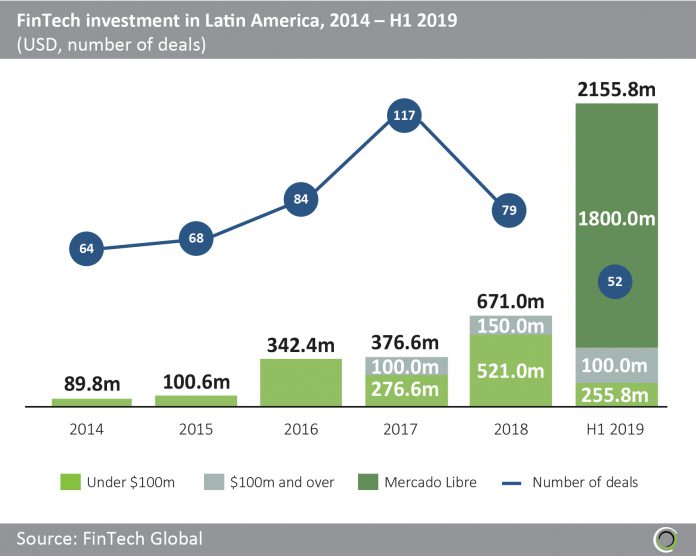

Having only attracted $89.8m in investment in 2014, the first six months of 2019 smashed that figure with a whooping $2.15bn invested in the region during that time, according to FinTech Global’s data.

Brazil, is leading the movement. The nation accounted for 45% of the total cash injected into the region during that period while Mexico and Argentina accounted for 20% an 13% respectively. Colombia was the fourth most popular Latin American FinTech investment between 2014 and the first half of 2019, having drawn in 9% of the money injected into the region during that period.

Copyright © 2020 FinTech Global