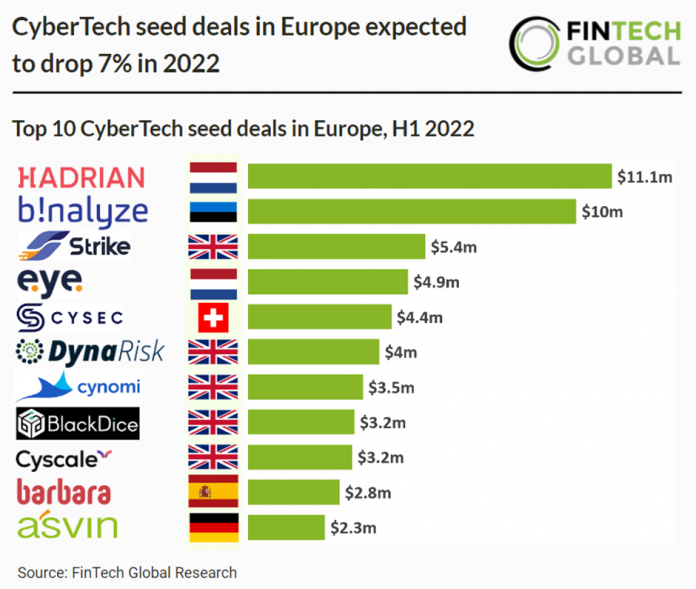

• CyberTech seed deals in Europe reached 31 deals in total for the first half of 2022, a 7% drop compared to 2021 levels. In comparison, European CyberTech deals across all funding stages are projected to drop 17% in 2022 compared to last year’s levels, indicating that investors still have strong appetite for backing new innovative companies in the space. The UK was the most active CyberTech seed country in H1 2022 with 10 deals, a 34% share of total CyberTech seed deals in the region. France was second with 4 deals and Ireland was third with 3 deals.

• Hadrian, an agentless security platform, was the largest CyberTech seed deal in the first half of 2022 raising a large $11.1m in their seed round led by HV Capital. Hadrian will use the funding to onboard new hackers, development and sales talent, consolidate European markets, and prepare for expansion into the US. Hadrian CEO Rogier Fischer said, “As companies are overwhelmed by cybercrime, the unique value of hackers’ outside-in approach to security becomes more important. Our autonomous technology identifies real threats and prioritizes where action is needed, connecting urgent tasks to existing workflow tools and processes so that the important stuff gets handled first.”

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global