• French FinTech companies announced 36 deals in Q4 2022 which brings the country’s total for the year to 167 deals. FinTech Investment in the country set new records during 2022. French companies in Q4 raised $1.49bn pushing the years total to $4.9bn, increasing 44% from 2021 levels.

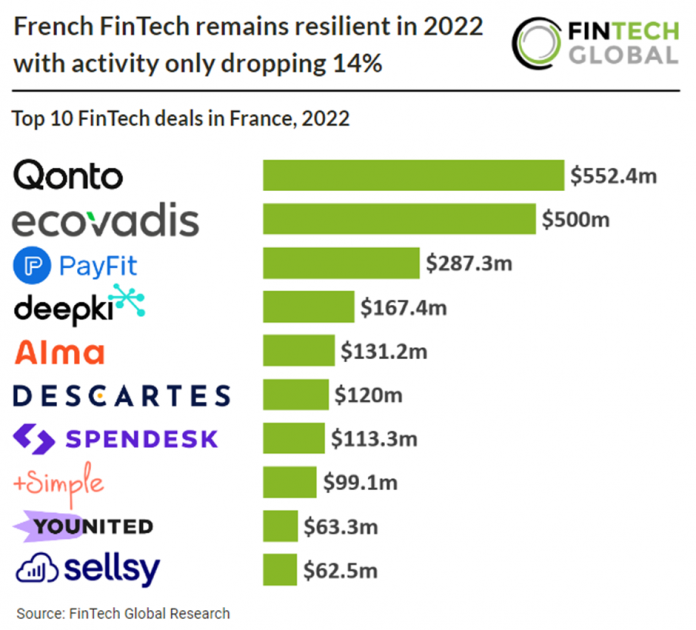

• Qonto, an all-in-one bank account for SMEs, was the largest French FinTech deal in 2022, raising a huge $552m in their latest Series D funding round led by TCV and Tiger Global Management which brought the company’s valuation to $5bn. The capital will be used to expand the company’s product offerings, strengthen market presence in Germany, Italy, and Spain, and new market entries as well as quadruple the headcount to over 2,000 employees by 2024.

• New French FinTech legislation relating to Crypto will go into affect on 1st Jan 2023. France has implemented a specific tax framework for crypto assets via The 2022 Finance bill. Capital gains on crypto-assets will be taxable as non-commercial income for those not managing personal wealth. For individuals exchanges between “qualifying” crypto-assets are tax-neutral. However, taxation is levied at a flat 30% rate upon the conversion of a “qualifying” crypto-asset to fiat money.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global