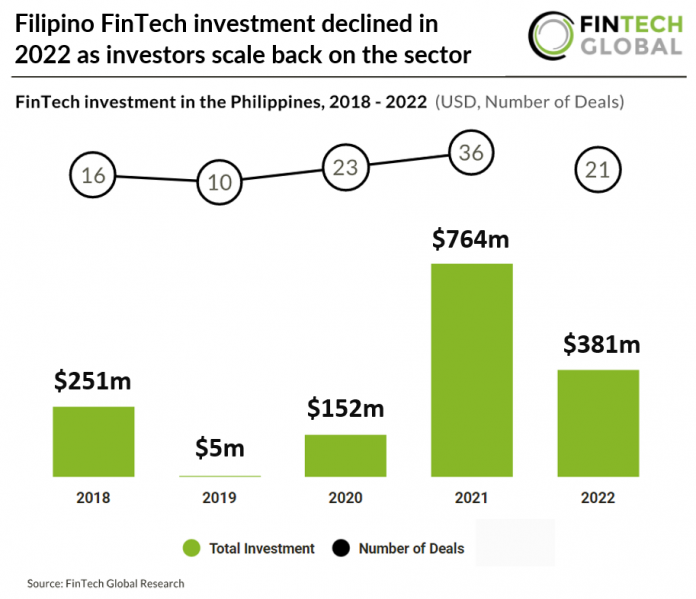

• The Philippines reported its lowest quarter for deal activity in Q4 2022 with only three companies raising deals, a 67% reduction from Q1 2022 activity. FinTech investment in the Philippines reached $381m for the year, a 51% drop from 2021 levels. The country however had a high average deal size at 18m in 2022 signalling investors willingness to back established companies instead of early stage startups.

• Voyager Innovations, which owns payment and financial services app PayMaya and neobank Maya Bank, was the largest Filipino FinTech deal in 2022 raising $210m in their latest funding round led by Susquehanna International Group (SIG). The latest funding brings the company’s valuation to $1.4bn and will be used to launch Maya Bank services, including savings and credit products, through PayMaya, which has over 47m registered users and is one of the most popular financial apps in the Philippines, along with GCash and Coins. Maya Bank secured one of six digital banking licenses from the BSP in September 2021 and started pilot testing Maya Bank in March 2022.

• The Filipino government has committed to ramp up the country’s digital economy. Finance Chief Benjamin Diokno said on Dec 6th 2022 at the Digital Banking Asia 2022 Conference “the Marcos administration would continue to invest in the digital economy amid the important role of technology in finance.” Some financial Filipino digitalization projects include: The Digital Transformation (DX) Program of the Bureau of Internal Revenue (BIR) which aims to transform the agency into a data-driven organization. The Bureau of Customs (BOC) will establish a national action plan for cross-border paperless trade. Finally, the government is also expediting the rollout of the Philippine Identification System (PhilSys) to enable seamless financial transactions and more efficient distribution of social services.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global