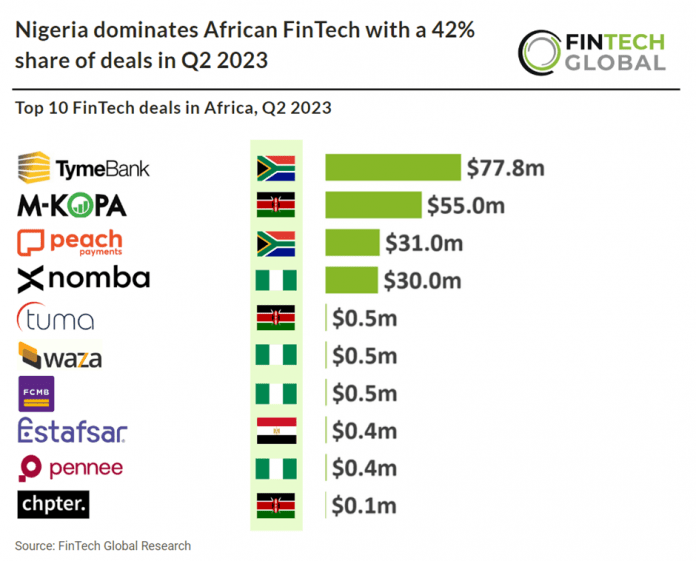

Key African investment stats in Q2 2023:

• African FinTech deal activity reached 59 transaction in the second quarter, a 31% drop YoY

• African FinTech companies raised a combined $189m in Q2, a 64% reduction from the same period in 2022

• Nigeria was the most active FinTech country in Africa with 25 deals, a 42% share of deals

In Q2 2023, African FinTech deal activity witnessed a decline of 31% compared to the previous year, with a total of 59 funding rounds completed. African FinTech companies collectively raised $189m during Q2 2023, marking a significant 64% decrease compared to the funding raised in Q2 2022. Africa’s general deal activity for all sectors reached 306 deals in Q2 2023, down 34% from Q2 2022 indicating that FinTech has been slightly more resilient compared to other sectors.

TymeBank, a digital retail bank based in South Africa, had the largest FinTech deal in Africa during Q2 2023, after raising $77.8m in their latest pre-Series C round, led by Tencent. With the new funding, Tyme intends to accelerate its operations in South Africa and the Philippines (where it operates GoTyme Bank, a new digital bank), and plot its expansion across Southeast Asia. The company intends to close its Series C funding later in the year. According to David Moore, principal of funds and co-investments at Blue Earth, Tyme’s retail partnership model is described as “innovative” and facilitates “affordable access to first-class banking products for all consumers, including the most vulnerable or those living in remote locations.” In January, Tyme made the decision to utilize Mambu’s core banking technology for GoTyme Bank and other future banks operating in the Asian region.

Nigeria was the most active FinTech country in Africa with 25 deals, a 42% share of all transactions. Kenya was the second most active with 13 deals, a 22% share of total deals and South Africa was third with seven deals.

PayTech was the most active FinTech subsector in Africa during Q2 2023 with 16 deals, a 27% share of deals. African total transaction value in the payments technology market is projected to reach $146bn in 2023. African total transaction value is expected to show an annual growth rate (CAGR 2023-2027) of 16% resulting in a projected total amount of $265bn by 2027.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global