How Smart Communications and Guidewire are transforming P&C insurance

Smart Communications and Guidewire have celebrated surpassing 120 mutual customers, a testament to their successful partnership.

Cogo, Eliq partner to help banking customers with climate change

Carbon footprint management company Cogo has partnered with Eliq to help banks and their customers navigate the challenges faced by climate change and the cost of living and energy crises.

Worldline UK&I links with Stabiliti for carbon offset payments

Stabiliti and Worldline UK&I, a global leader in payment and transactional services, have announced a strategic partnership.

Vestas and Mangopay enhance B2B renewable energy marketplaces with refined payment solutions

Sustainable energy giant Vestas, and modular payment infrastructure provider Mangopay, have fortified their partnership.

InsurTech bolttech and Tune Protect Group to offer insurance products in Malaysia

Singapore-based InsurTech bolttech has partnered with digital lifestyle insurer Tune Protect Group to offer device protection solutions in Malaysia.

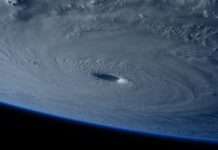

Shaping the future of US hurricane reinsurance: Kettle’s partnership with Reask

Leading ClimateTech firm Reask has announced its partnership with the innovative InsurTech MGA Kettle.

TerraPay and Bancolombia join forces to revolutionise cross-border remittances in Colombia

TerraPay, a global payments network known for its agility and vast reach, has partnered with Bancolombia, Colombia's foremost player in remittances in a bid to revolutionise cross-border remittances in the region.

InsurTech unicorn bolttech partners with Max Solutions

InsurTech unicorn bolttech has partnered with Max Solutions Service, a subsidiary of PTG, to offer insurance on the card’s Max Me application.

PremFina and Blink Intermediary solutions forge innovative finance partnership for UK brokers

PremFina, a leader in premium finance, and Blink Intermediary Solutions, a standout alternative broking network, have announced a partnership aimed at innovating finance solutions across 1,700 UK broking outlets.

Payhawk partners with Lune to help companies hit ESG targets

Payhawk has partnered with Lune to launch a new platform, designed to help companies make more sustainable decisions related to company spending.