South African neobanks TymeBank and Discovery Bank have onboarded more customers during the Covid-19...

South African challenger banks TymeBank and Discovery Bank has reportedly thrived during the country's coronavirus lockdown.

FinTech unicorn Marqeta prepares for IPO

Rumours about Marqeta going public have found new energy as sources say the payment card issuing startup is in talks with investment banks for an initial public offering (IPO).

27 FinTech rounds from the last week you can’t afford to miss

Our weekly roundup of the big FinTech trends from the past seven days is all you need to keep yourself updated on what's happening in the industry.

Railsbank launches US operations and announces Unifimoney as its first customer

Open banking startup Railsbank has announced that it has launched in the US and that it has already signed up digital banking platform Unifimoney as its first customer.

Growers Edge Financial raises $40m in its Series B round as it looks to...

Growers Edge Financial has raked in $40m for its Series B round, which will help it to grow into new markets in the US.

AccessFintech secures $20m in its funding round

Data and analytics platform AccessFintech is looking to capitalise on the drive on digitalisation caused by the pandemic, after the close of a $20m round.

Deutsche Bank and Google Cloud team up to bolster the bank’s tech and financial...

Deutsche Bank and Google Cloud have joined forces by forming a strategic partnership that aims to redefine how the bank develops and offers its financial services.

WEX closes $400m investment from private equity firm Warburg Pincus

WEX, which builds simplified payment systems for businesses, has closed a $400m investment from private equity firm Warburg Pincus.

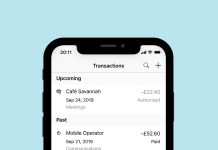

Holvi is back up and running after being forced to shut down its services...

Holvi customers can now use their cards again after the Finnish digital banking service for freelancers suspended its services on the back of the Wirecard scandal.

Axiata Digital receives $70m in funding to support the expansion of its digital financial...

Axiata Digital, the digital service division of telecommunications conglomerate Axiata Group, has received $70m in funding to support the growth of its digital financial services.