How money laundering regulations have changed over time

It has been over half a century since the Bank Secrecy Act was passed in the US, which was the first piece of US legislation aimed at tackling money laundering. How have regulations in this area changed over time?

New UK bill set to crack down on fraud and money laundering

The UK government has introduced the Economic Crime and Corporate Transparency Bill in an attempt to drive ‘dirty money’ out of the UK.

Danske Bank fined €1.8m by Central Bank of Ireland

The Central Bank of Ireland has fined Danske Bank €1.8m for three breaches of the Criminal Justice Act 2010.

Hawk AI collaborates with Diebold Nixdorf for AML surveillance

Hawk AI has partnered with Diebold Nixdorf, a leader in driving connected commerce for finance and retail, to expand the reach of the former’s AML solution.

What are the key FAQs around FinCEN’s beneficial ownership requirements?

The use of shell companies and other legal vehicles for illicit purposes is receiving growing international attention, with the importance of beneficial ownership transparency becoming ever more key.

How to ensure casino compliance

As an industry that is constantly bringing in new customers and transactions, the casino sector is a key target for criminals and money launderers, claims Alessa.

How perpetual KYC helps the fight for compliance

Managing risk through a customer’s lifecycle and solving compliance channels is becoming ever more important as more of the world moves into digital. In a...

FCA hands out £2m fine to The TJM Partnership

The Financial Conduct Authority (FCA) has fined The TJM Partnership £2m for failing to ensure it had effective systems and controls to identify and cut the risk of financial crime.

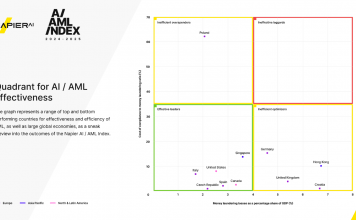

Why the global risk from money laundering is growing

With the world becoming ever more connected and linked in an unlimited number of ways, money laundering is continuing to grow in presence and stature.

How FATF’s ultimate beneficial ownership changes affect your risk-based approach

Earlier this year, the Financial Action Task Force adopted amendments to Recommendation 24 – one of its 40 recommendations that govern global AML policy – making changes to Ultimate Beneficial Ownership. How will this impact your company?