Marketplace Lending companies have captured the largest share of FinTech deals in India over the past five years

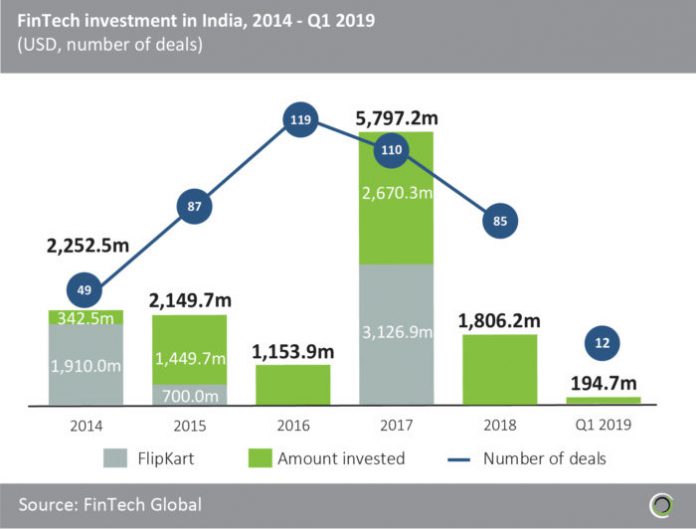

- Investors have poured more than $13.3bn into FinTech companies in India since 2014, with 462 transactions completed in the process.

- Marketplace Lending and Payments companies have dominated deal activity in India as companies look to capitalise on the country’s vast underbanked population.

- It was the late-2016’s demonetisation drive by the Indian government that brought the sector into the national spotlight, with investment surging to almost $5.8bn in 2017 ($2.7bn when excluding the $3.1bn raised by FlipKart that year). Within a few months, a majority of Indian FinTech platforms experienced exponential growth and significantly increased their consumer base.

- FlipKart, an E-Commerce and Payments platform based in Bangalore, has raised a prolific amount of capital over the past five years, having received over $5.7bn from investors since 2014. This is almost 43% of the total capital invested in FinTech companies in India during the period, as FlipKart builds a financial war chest to stave off intensifying competition in the region from Amazon.

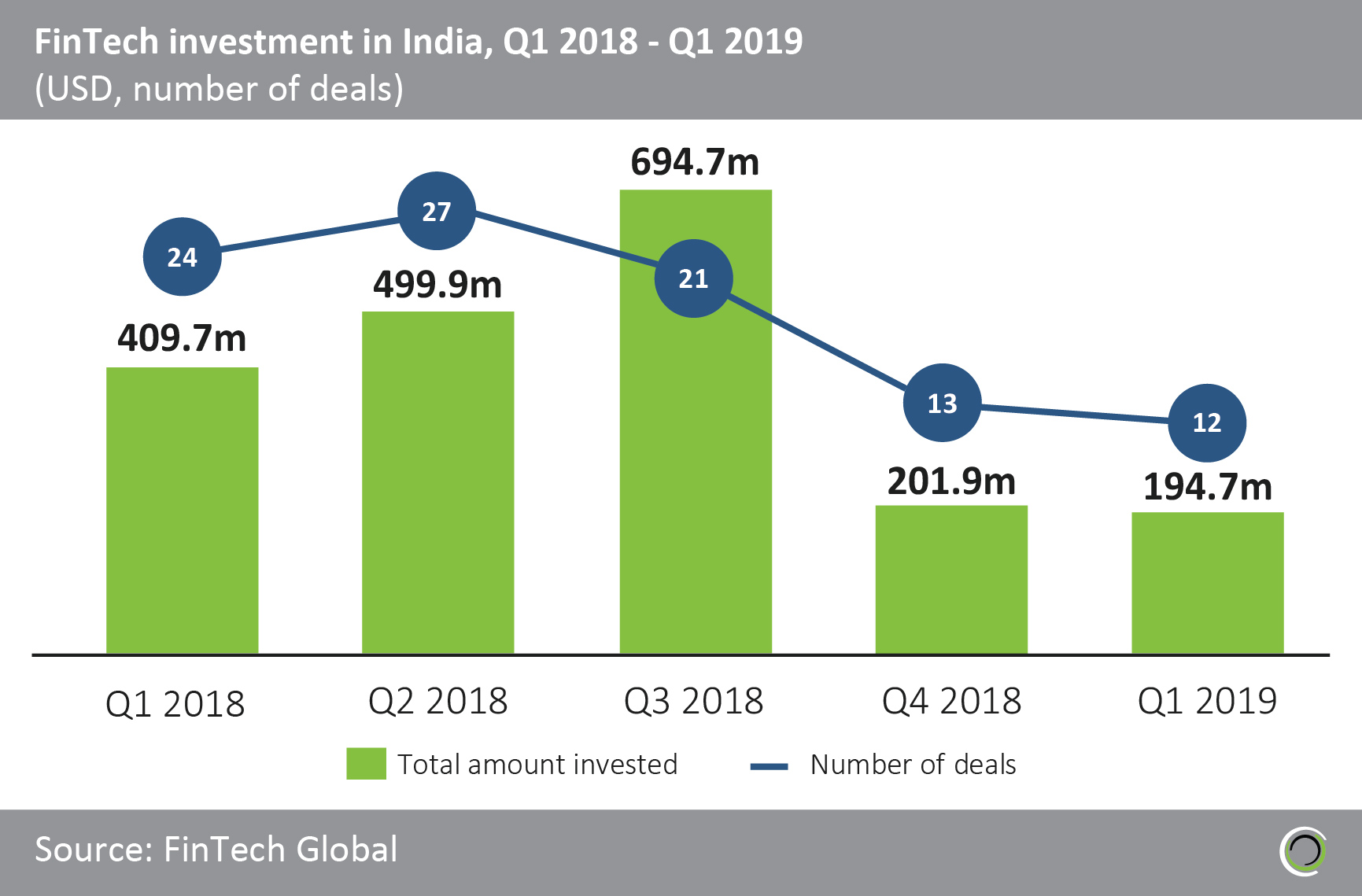

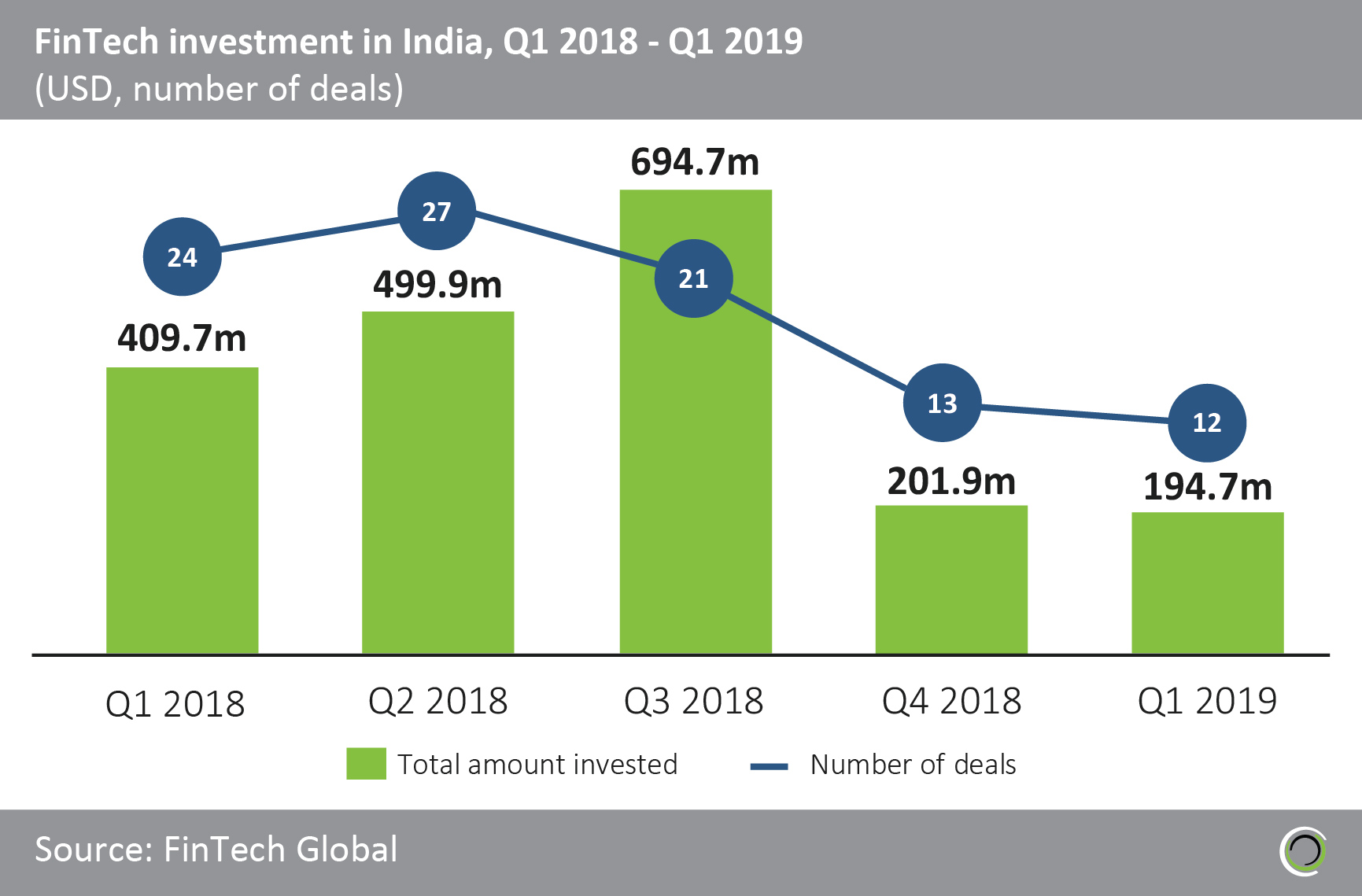

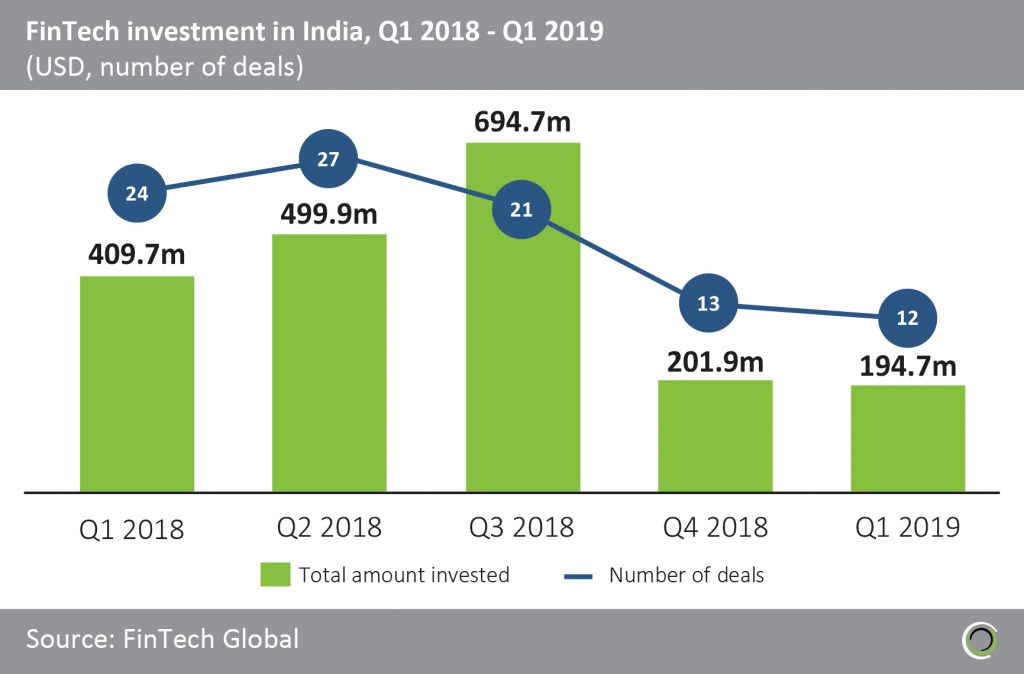

More than half of the deals in the first quarter involved Payments and Marketplace Lending companies

- FinTech funding in India fell slightly from $201.9m in Q4 2018 to $194.7m last quarter, with deal activity falling from 13 deals to 12 during the period.

- Funding in Q1 2019 was less than a third of the capital raised in Q3 2018. However, this strong funding in Q3 last year was mainly driven by the $356m that One97 Communications, a digital payments platform, raised from Berkshire Hathaway in August 2018. The funding will support the long-term vision of bringing 500 million Indians to the mainstream economy through financial inclusion.

- Delhi-based online lending platform Ziploan, raised a $12.6m Series B round in what was the largest marketplace lending deal in India last quarter. Investment was led by SAIF Partners and will enable Ziploan to further support SMEs in India with access to capital. Ziploan now has co-lending and debt partnerships with IDFC First Bank, IndusInd Bank and Caspian Finance.

- Acko General Insurance, a Mumbai-based digital B2C insurer, raised a $65m Series C round in March 2019, which was the largest FinTech deal in India in Q1. This investment was led by Amazon and Acko claims to have distributed insurance policies to over 20m unique customers in its first year of operation.

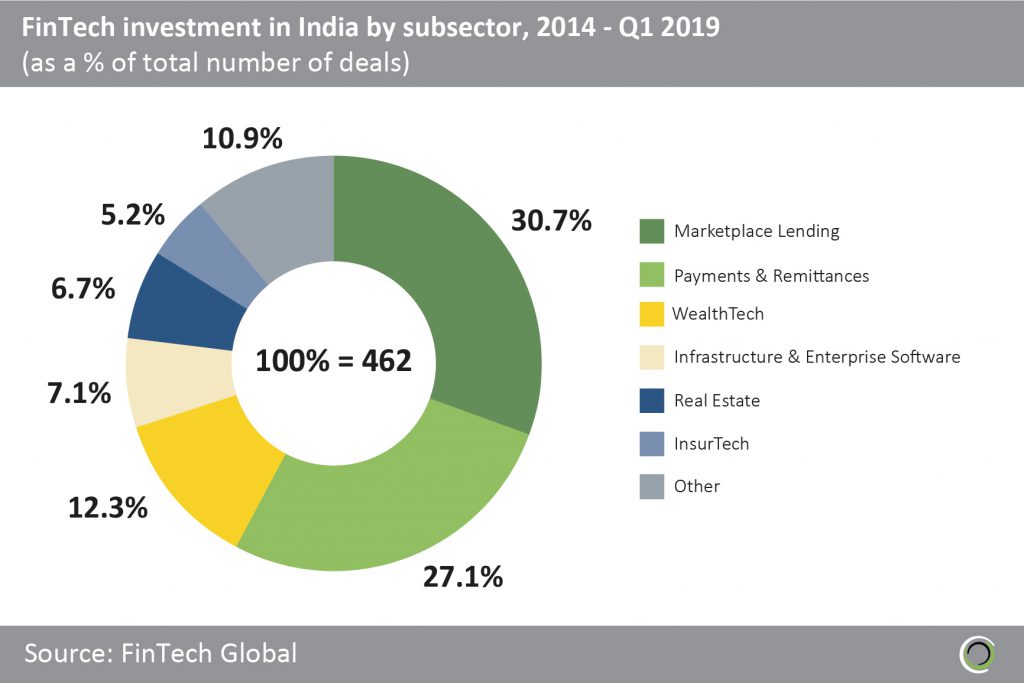

Almost a third of all FinTech deals in India since 2014 have involved Marketplace Lending Companies

- Investors in India have been deploying capital across all subsectors of FinTech over the past five years, with 30.7% of deals involving Marketplace Lending companies, 27.1% involving Payments & Remittances companies and 12.3% of transactions involving WealthTech companies.

- Investors have been attracted to the Indian FinTech ecosystem with a particular interest in Marketplace Lending and Payments deals, as demonetisation efforts by the Indian government to shift merchants away from cash, spawned growth in digital transaction solution providers.

- This investment environment can partly be attributed to some of the innovative programmes launched by state governments in the country such as the founding of Mumbai Fintech Hub by the Maharashtra government and FintechVizag Valley by the Andhra Pradesh government.

- Mumbai-based Mahindra Finance provider loans for utility vehicles, tractors and cars, targeting a rural and semi-urban demographic of borrower. Mahindra went public in March 2006 and raised $100m of Post-IPO equity from the International Finance Corporation in Q3 2018. This is the largest Marketplace Lending deal in India to date and Mahindra Finance’s rural loans have helped over three million Indians from a branch network of over 1,000.

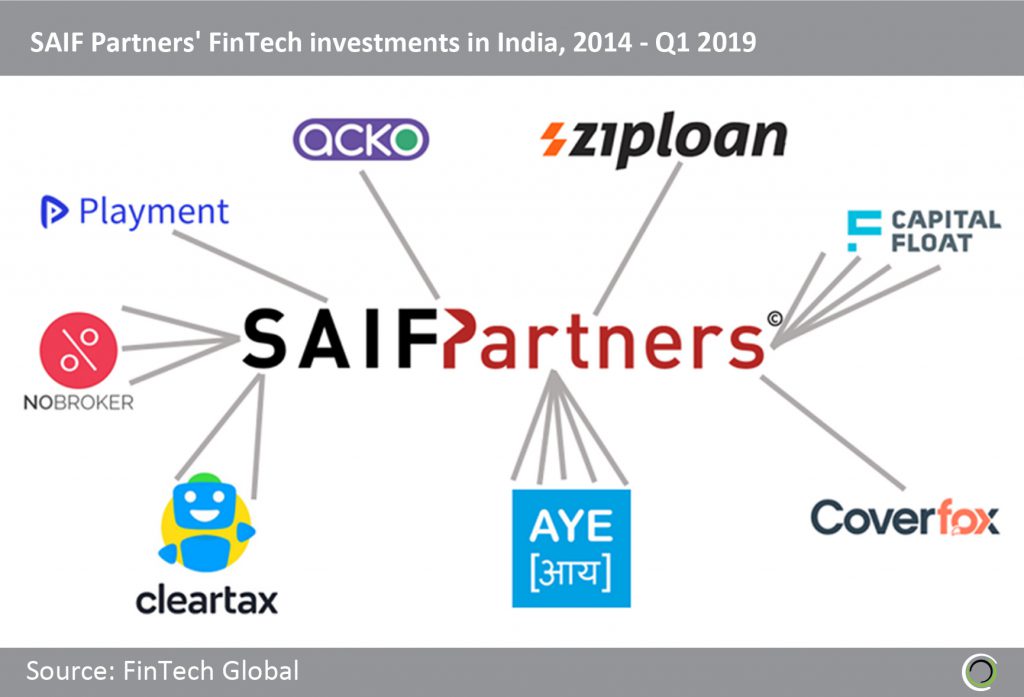

SAIF Partners has been the most active investor In Marketplace Lending companies in India since 2014

- SAIF Partners is a leading private equity firm that provides growth capital to companies in Asia, and has made 18 FinTech investments in India since 2014. SAIF Partners was founded in 2001, currently manages over $3.5 billion in capital, and has become one of the most active funds in the region with local teams in Hong Kong, China, and India.

- SAIF Partners has been the most active investor in Indian Marketplace Lenders over the past five years, having completed 10 transactions across three companies since 2014 and most recently investing in Ziploan’s Series B round in Q1 2019.

- The firm has made five separate investments in Aye Finance, a provider of micro loans to small and micro businesses in northern India. These investments totalled $53.6m, with the largest and most recent being the $21.5m Series C funding that Aye raised from SAIF Partners, Google Capital and LGT Group in Q2 2018.

- SAIF Partners has also made four separate investments in Capital Float, an online platform that provides access to working capital for SMEs in India. SAIF invested in Capital Float’s $45m Series C round in Q3 2017, with participation from Ribbit Capital, Sequoia Capital India and Creation Investments Capital Management. This was the largest investment in Capital Float that SAIF has been involved in, with the Bangalore-based working capital provider dispersing 5,000 loans per month to users in more than 300 cities.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global