UK WealthTech companies have doubled their share of deal activity since 2014

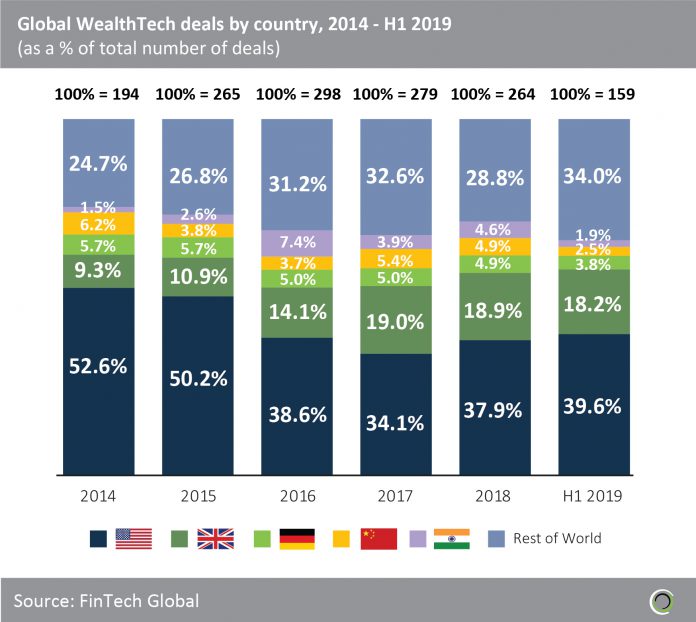

- There have been 1,459 WealthTech deals completed since 2014, with the lion-share of transactions involving companies based in the United States.

- However, US dominance has been slipping over the past five years, falling from more than half of deals in 2014 to less than two fifths in H1 2019, with other parts of the world capturing a greater share of deal activity.

- An explanation for this shift away from the US is that Congress has created a regulatory environment that is conducive for financial incumbents, creating many barriers to entry and heavy financial burdens for innovative FinTech startups. However, this dynamic may change going forward following the introduction of the S. House Financial Services Committee FinTech task force in Q2 2019., whose mandate is to encourage responsible innovation.

- Since 2014, UK companies’ share of WealthTech deal activity has grown faster than any other country, nearly doubling from holding 9.3% of deals in 2014 to almost 18.2% in H1 2019, as the landscape continues to be disrupted by new FinTechs such as challenger banks. Growth in the share of global deal activity can also be seen in the rest of the world, as investors continue to recognize the importance of the WealthTech industry and are discovering opportunities in countries with developing economies.

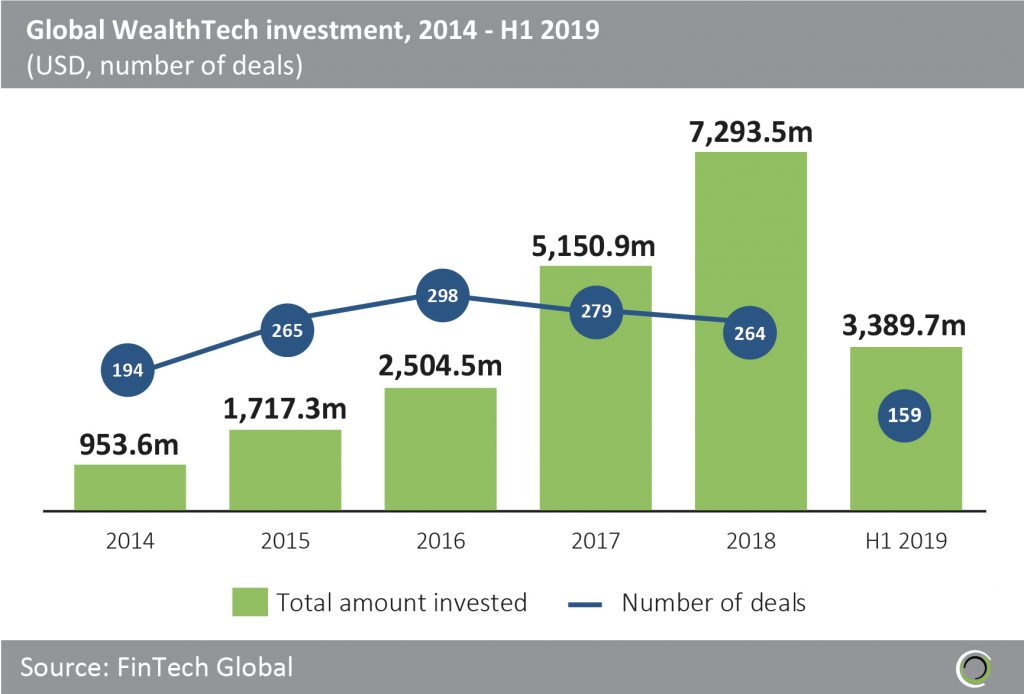

Global WealthTech deal activity in 2019 is on track to surpass that of 2018

- Global WealthTech funding increased year on year from $953.6m in 2014 to $7.3bn last year, at a CAGR of 66.3% during the period.

- Over the past five and a half years, WealthTech companies globally have raised over $21bn, with $6.8bn of this invested in North American companies and $5.8bn invested in companies based in Europe.

- As of the first six months of 2019, WealthTech deal activity is on track to surpass the number of deals completed last year. More deals occurred in H1 2019 (159) than in H1 2018 (142) setting strong expectations for the rest of the year. However, the capital raised in each of the two periods is very similar at just under $3.4bn and $3.5bn, respectively.

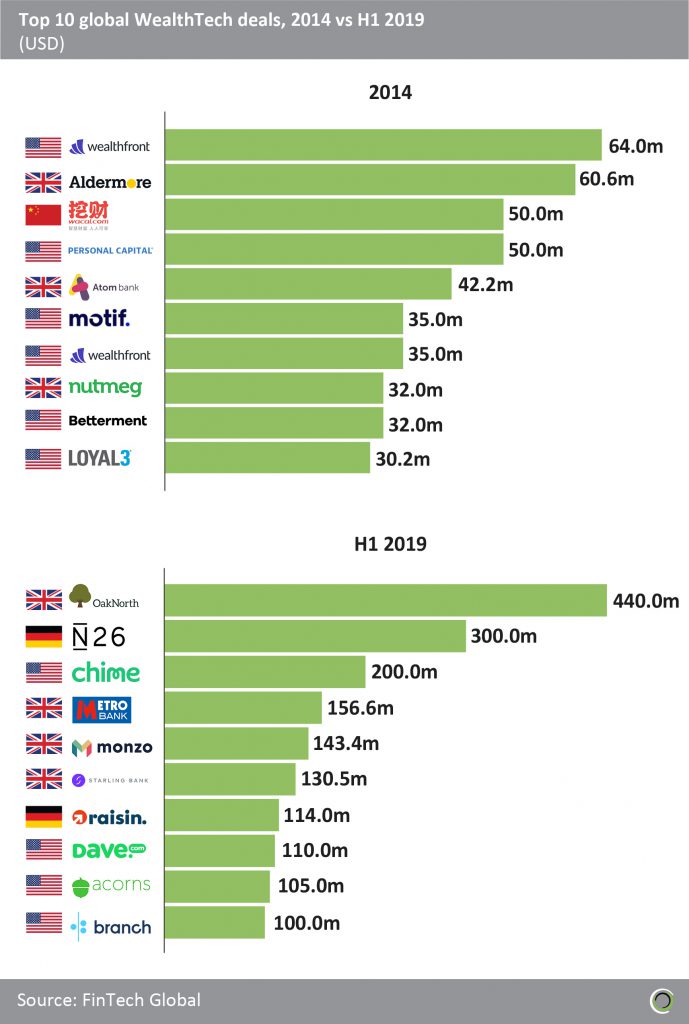

European companies dominate the top 10 WealthTech deals in H1 2019

- There has been a shift away from the North American dominance of deal activity that was prevalent in 2014, with the share of global WealthTech deals involving European companies jumping from 30% in 2014 to 60% in the first six months of 2019.

- The top 10 deals of H1 2019 raised $1.8bn, which is equal to just over half of all the capital raised across the 159 deals that occurred during the period.

- The average deal size of the top 10 WealthTech deals more than quadrupled between 2014 and H1 2019, with each deal in the top 10 in H1 2019 valued at $100m or more.

- The number of WealthTech deals in the top 10 involving companies based in North America also declined from six deals in 2014 to four in H1 2019, with UK and German WealthTech companies capturing first and second positions respectively in the top 10 deals ranking for H1 2019.

- Of the Top 10 WealthTech deals that occurred in H1 2019, seven involved challenger banks and five of these seven are based in Europe, with four based in the UK. OakNorth, a business only challenger bank raised $440m led by Softbank in February 2019, which is the largest WealthTech deal in Europe to date.

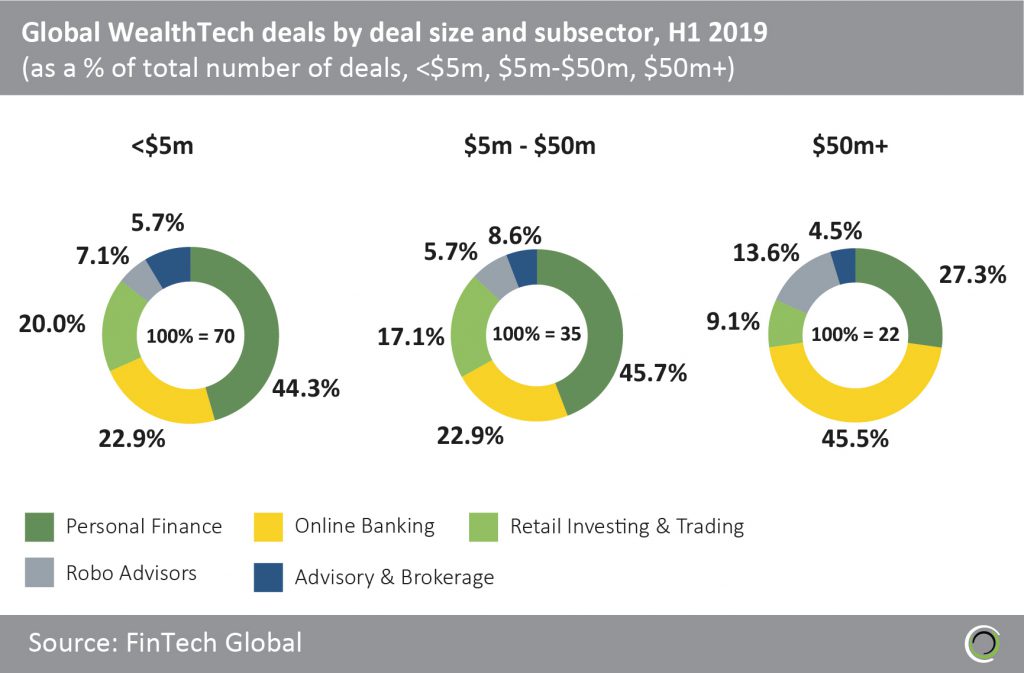

Online banks captured the biggest share of WealthTech deals valued above $50m in H1 2019

- Companies in the Personal Finance subsector of WealthTech captured the largest share of deals in the sub-$5m and $5m-$50m deal size brackets, with 44.3% and 45.7% of deals respectively and the average Personal finance deal size in H1 2019 was $15.9m.

- As the Personal Finance subsector of WealthTech continues to mature, one would expect a shift away from the dominance of sub $5m deals, towards capturing a greater proportion of deals valued above $50m in the future.

- Online banks captured the largest share of WealthTech deals valued at $50m and above in the first six months of the year, indicative of the large amounts of capital required to disrupt legacy banking and take market share away from incumbents.

- Berlin-based N26, a digital only bank that recently launched operations in the UK, raised a $300m Series D round led by Insight Partners in Q1 2019. This was the second largest WealthTech deal in the first half of the year and is the largest WealthTech deal in Germany to date.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global