German neobanks have grown in popularity within the country and has the second largest neobanking transaction value which reached $50 billion in 2021. Despite the increasing prominence of open banking and the integration of digital-only neobanks into the European Union’s financial landscape, these FinTechs have encountered challenges in achieving sustained profitability. Some have even faced issues related to anti-money laundering regulations. Furthermore, neobanks have not yet reached critical mass, considering that even the largest players have only attracted a few million customers out of the estimated 284 million adults in the EU.

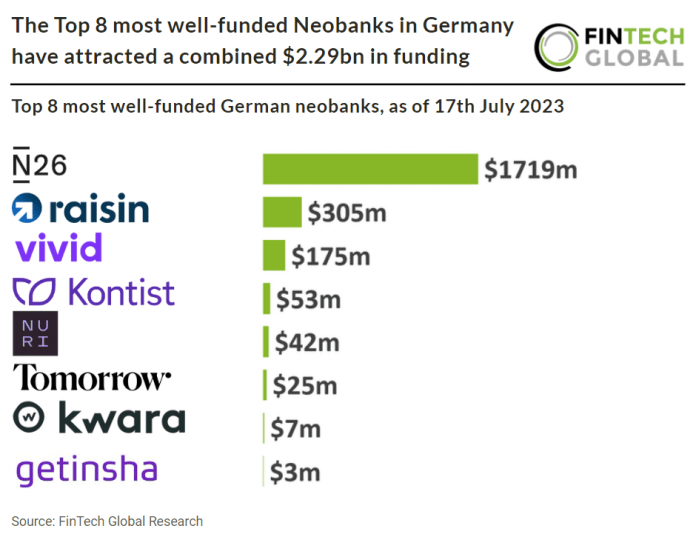

N26, a financial services company that offers mobile banking solutions, is currently the most well-funded German neobank, as of 17 July 2023, with $1.7bn raised. N26’s latest funding was in October 2021 when it raised €775M in their Series E funding round, led by Coatue and Third Point Ventures. Allianz X, the venture capital arm of Allianz, recently instructed advisors to sell its 5% stake in N26 at a valuation of $3 billion, which is a significant decrease compared to the end of 2021. N26 had also faced fines from German regulators for inadequate anti-money laundering controls during the same period. Although N26 has exited the US market and shifted its focus to Europe, currently serving 8 million customers in 24 countries, achieving profitability remains uncertain. The company’s CFO, Jan Kemper, has refrained from setting a specific timeline, emphasizing the unpredictable nature of their path to profitability. In contrast some other European neobanks such as Monzo and Starling Bank are profitable or set to be profitable soon. The boss of Monzo said the UK digital bank will be profitable in 2023, marking a turnaround from 2021 when its auditors flagged “material uncertainties” over its ability to remain in business. Starling Bank reports its first full year of profitability in 2022. The digital bank swung to a pre-tax profit of £32.1 million for the financial year ending 31 March 2022 from a pre-tax loss of £31.5 million for the period to 31 March 2021.

The German neobanking market is experiencing significant growth, with transaction value projected to reach $95bn in 2023. This upward trend is expected to continue, with an estimated annual growth rate of 19.72% (CAGR 2023-2027), resulting in a projected total transaction value of $196bn by 2027. In 2023, the average transaction value per user in the neobanking market is approximately $28k. German neobank user share currently stands at 4.2% in 2023, is expected to increase to 6.3% by 2027, indicating a growing adoption of Neobanking services.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global