Tag: credit cards

Stanbic Bank and Mastercard unveil new elite credit cards with premium...

Stanbic Bank Kenya and Mastercard have recently formed a partnership to cater to the affluent segment of their clientele.

Imprint secures $75m in Series C to revolutionise co-branded credit cards

Imprint, the innovative provider of co-branded credit cards, announced a significant boost in funding with a $75m Series C round.

NatWest and Visa debut new travel reward credit card

NatWest Group, a major player in the UK banking sector, has teamed up with Visa, a global leader in digital payments, to launch a...

NatWest and Reward strengthen ties with innovative travel reward credit card

NatWest, a major player in the banking sector, has expanded its collaboration with Reward, a global leader in customer engagement and commerce media.

FINQY secures $2m to boost FinTech innovation in India

FINQY, an innovative Indian FinTech founded in 2019 by entrepreneur Manish Aggarwal, has announced a new funding round of $2m.

Robinhood expands AI investment strategies with Pluto acquisition

Robinhood Markets, a leader in retail brokerage, has recently finalised the acquisition of Pluto Capital Inc., a prominent artificial intelligence research firm.

Credit cards issued through digital platforms to soar by 170%

The number of credit cards issued via digital card issuance platforms will exceed 321 million globally by 2027, up from 120 million in 2023.

Credit cards on the brink of extinction, claims Brazilian central bank...

The chief of Brazil’s central bank Roberto Campos Neto has said he believes credit cards are on the brink of extinction due to growth in account-to-account based open payments.

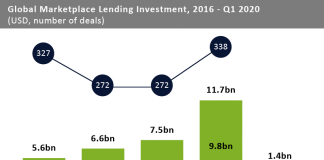

Global Marketplace Lending investment in Q1 2020 declined as economic uncertainty...

Marketplace Lending companies raised $1.4bn in the first three months of 2020, a decline of 35% compared to Q1 last year Total Marketplace Lending funding...

Customers accuse Curve of incurring higher fees by sending them corporate...

UK FinTech is facing criticism again after customers received cards with higher fees than what they asked for.