Tag: Klarna

Klarna launches new purchase history dashboard for UK customers

Swedish buy now, pay later giant Klarna has launched a new feature for UK consumers that will let them see their full online purchase history, regardless of whether they are purchased using Klarna.

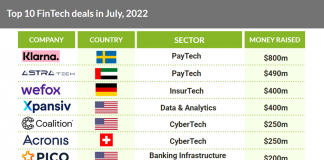

Klarna stars as the largest FinTech deal in July 2022

• Klarna, a buy now pay later (BNPL) platform, was the largest FinTech deal in July 2022 raising $800m in its latest venture round...

Klarna blames worst market in 50 years for 85% drop in...

Swedish buy now, pay later giant Klarna has suffered a colossal downround, with its valuation dropping by 85% to $6.7bn.

Klarna rival Zilch extends Series C to support growth in the...

UK-based buy now, pay later (BNPL) unicorn Zilch has raked in an additional $50m for its Series C round, bringing the round’s total to $160m.

Swedish BNPL giant Klarna faces colossal downround to $15bn valuation

Swedish buy now pay later (BNPL) unicorn Klarna is reportedly facing a hefty downround, which would put its valuation at a third of its previous.

Klarna could face $30bn down round

European FinTech giant Klarna is reportedly about to suffer a valuation drop of $30bn as it seeks fresh investment.

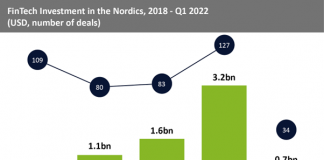

FinTech investment in the Nordics projected to decrease 25% in 2022...

Nordic FinTech deal activity in Q1 2022 indicates another strong year for the region with total deal activity expected to rise 7%. Overall...

Vast majority of Brits back retailers regularly investing in new tech

Research by Klarna has found that up to 80% of UK shoppers believe retailers should continuously invest in new technology to meet evolving consumer demand.

Klarna to take on Amazon, Google and Facebook following PriceRunner take-over

Global retail bank and Buy Now, Pay Later (BNPL) provider Klarna, has completed its acquisition of comparison shopping service PriceRunner.

Klarna launches dedicated open banking unit

Global retail bank, payments and shopping service Klarna, has launched Klarna Kosma, a sub-brand and business unit to harness the growth of its open banking platform.