Tag: Quantexa

The missing link to data management

It is critical for organisations to foster a data-centric culture that drives business value. The key to this, Quantexa argues, is a contextual approach to master data management (MDM).

Why insurers are failing to meet maximum value from mergers and...

While there continues to be huge numbers of mergers and acquisitions (M&A) in insurance, Quantexa feels many are not meeting their full potential.

Digital underwriting: the race is now on

Insurance underwriting processes are undergoing a period of transformation. With the explosion of data and growing important of customer experience, insurers must act now.

40% of banks in panic mode as unprepared for effective data...

Four in ten banks and financial services lack necessary infrastructure for a strong data foundation and 37% of firms are still reliant on manual data processes, global data and analytics software company Quantexa revealed.

Quantexa updates data analytics platform to help firms tackle growing data...

Data and analytics software business Quantexa has unveiled the latest release of its data analytics platform to help companies tackle the rapid proliferation of data.

Quantexa, KPMG partner to uncover hidden risks in finance

Data and analytics software company Quantexa has formed a deal with KPMG in the UK, which will see it deploy its technology to help the auditing giant with combating international financial crime.

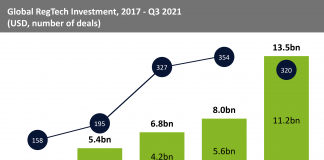

Global RegTech funding in the first three quarters of 2021 is...

RegTech companies raised $13.5bn across 320 deals in the first nine months of the year driven by large transactions over $100m

Why decision intelligence is the future of underwriting

Underwriting is one of the most important parts of insurance. Improving this process will help an insurer better evaluate risk and offer better prices. The key to this is correctly leveraging the magnitude of data that now exists.

Quantexa rounds off Series D with BNY Mellon backing

Data and analytics software firm Quantexa has closed off its Series D funding round with a strategic investment from investment banking company BNY Mellon.

Why behavioural analytics should be a top priority for insurers

With customer demands changing to become more focused on flexibility and personalisation, behavioural analytics is the key to help insurers meet this need.