Tag: Stone Point Capital

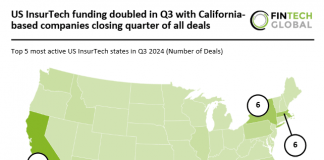

US InsurTech funding doubled in Q3 with California-based companies closing quarter...

Key US InsurTech investment stats in Q3 2024: US InsurTech funding doubled in Q3 YoY

California continues to dominate the US InsurTech space after...

Sedgwick strengthens global capabilities with strategic investment from Altas Partners

Sedgwick, a global leader in claims management, loss adjusting, and technology-driven solutions, has formed a strategic partnership with Altas Partners, a prominent North American private equity firm.

Eden Health nets $25m for its Series B round

Heathcare and insurance company Eden Health has bagged $25m in its Series B round, which was led by Flare Capital Partners.

Home and auto InsurTech Branch looks to bolster US expansion with...

Home and auto insurance platform Branch is continuing its expansion efforts having netted $24m in its Series A round.

CyberCube extends Series B round to hit $40m

CyberCube, which offers risk modelling and underwriting applications, has extended its Series B round with a new investment from MTech Capital.

InsurTech Bold Penguin reportedly raises $32m in its Series B round

Commercial insurance technology provider Bold Penguin has reportedly collected $32m in a Series B round.

KKR, Elliott Management sell stake in Mitchell International

KKR and Elliott Management have sold their stakes in Mitchell International, a technology provider for property and casualty claims and collision repair companies.Private equity...

Capital One supports the $190 recapitalisation of Situs by Stone Point

Capital One has led a $190m secured credit facility to aid the recapitalisation of Situs Holdings by Stone Point Capital.

Stone Point Capital exits Access Point Financial in $350m+ deal

Stone Point Capital has exited lending platform Access Point Financial to WCP Investments, in a deal worth over $350m.

Thomas H. Lee Partners acquires majority stake in Ten-X

Private equity firm Thomas H. Lee Partners has acquired a majority stake in online real estate marketplace Ten-X, in undisclosed deal.