Global RegTech investment surged towards $4bn in the first half of 2019

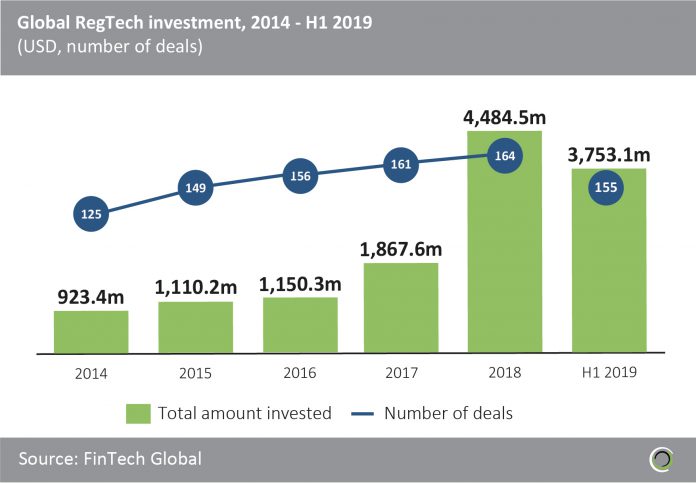

- RegTech companies have raised almost $13.3bn since 2014, across more than 900 transactions. Nearly two thirds of this funding was raised in the past 18 months, which saw the introduction of two major pieces of regulation; MiFID II in January 2018 followed by GDPR in May 2018.

- Investment has been in an upward trend over the past five years, growing almost five-fold between 2014 and 2018, as funding increased from $923.4m in 2014 to $4,484.5m last year.

- More than $3.7bn has been invested in RegTech companies during the first half of 2019 across 155 deals, the strongest start to a year to date in terms of both deal activity and funding, setting strong expectations for the rest of 2019.

Funding in Q2 2019 hit a five quarter high up 30% from the same quarter last year

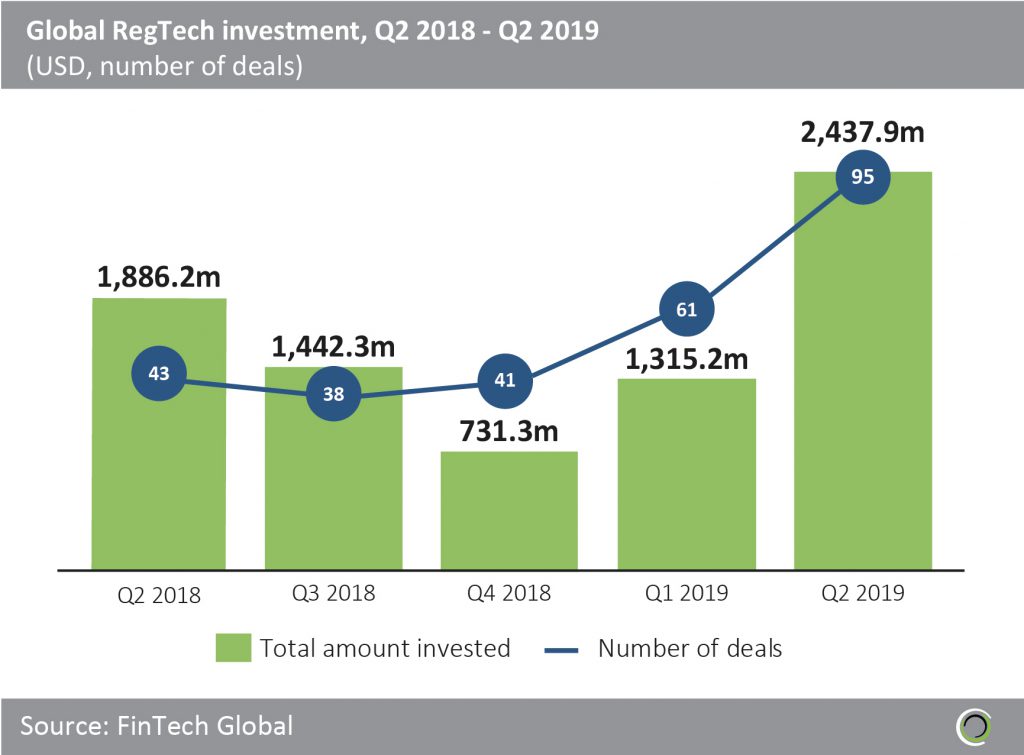

- RegTech investment in Q2 2019 set a record, with funding almost doubling from the opening quarter of the year and 29.2% higher than in Q2 2018.

- Funding has been in a upward trend over the past three quarters, rebounding from $731.1m in Q4 2018 to more than $2.4bn last quarter. More than $3.7bn was invested in H1 2019 and of this, 64.9% ($2.4bn) was raised in Q2 2019, with 95 transactions completed during the quarter.

- This surge in investment was boosted by an increase in the number of large deals, with eight deals valued at $100m and above in Q2 2019, compared to just three deals in the previous quarter.

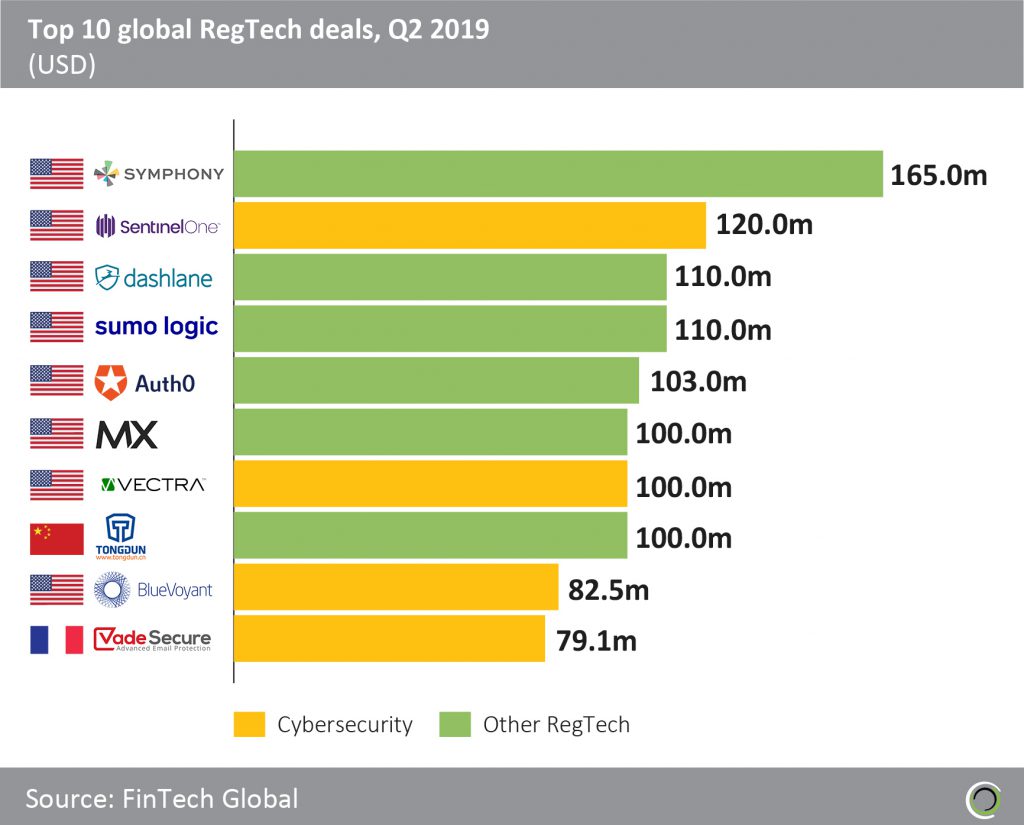

- Symphony is a New York-based platform that allows users to communicate securely and effectively with integrated messaging, file sharing, audio/video conferencing and screen sharing. The communications monitoring solution provider raised a $165m Series E round from Standard Chartered and Mitsubishi UFJ in June 2019.This was the largest RegTech deal of Q2 2019, and Symphony now has over 430,000 licensed users across 60 countries.

Recent growth in the share of Cybersecurity funding led RegTech investment towards the $4bn mark in H1 2019

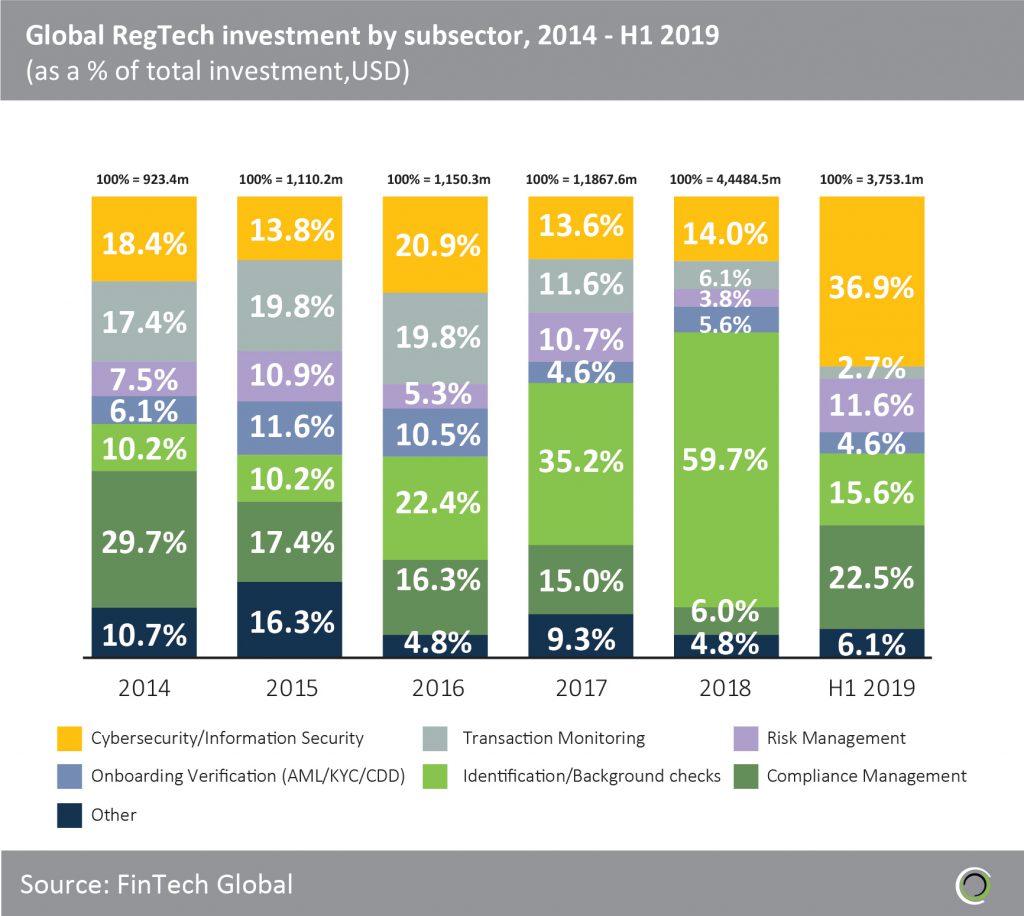

- Investors have allocated capital right across the RegTech value chain over the past five years, with 21.3% ($2.8bn) of all RegTech investment during the period going to cybersecurity companies. Cybersecurity companies within RegTech provide software and technology solutions that specifically addressing the challenges of financial regulations such as KYC and GDPR.

- The share of investment going to Cybersecurity companies increased from 18.4% in 2014 to more than a third of RegTech funding in H1 2019, with investors pouring almost as much capital into the subsector in the first six months 2019 (nearly $1.4bn) as they did in the previous five years.

- Despite capturing only 14% of the total capital invested in RegTech in 2018, cybersecurity companies raised $627.3m that year, up from $170.1m in 2014.

- Geographically, there were 39 cybersecurity deals in North America in H1 2019, one in Asia, eight in Israel and six in Europe, with French companies capturing half of these deals.

- Vade Secure, an email security solution provider based in France, raised a $79.1m Series A round from General catalyst in June 2019. This was the largest RegTech deal in Europe last quarter and Vade plans to use the funds to build out its go-to-market strategy focused on servicing business customers through Managed Service Providers.

RegTech companies based in the US dominate the top 10 deals list for Q2 2019

- Almost $1.1bn was raised in the top 10 global RegTech deals of Q2 2019, with eight of the 10 companies in the list based in the United States. This dominance has been consistent, with US companies claiming eight of the top 10 deals last quarter, and more than 60% of the total capital raised in the subsector since 2014 has gone to US-based RegTech companies.

- Although there is limited geographic diversity among companies in the list, there is some subsector diversity with four cybersecurity solutions providers (SentinelOne, Vectra AI, BlueVoyant and Vade Secure), three Identification/Background Checks companies (Dashlane, Auth0 and MX Technologies), two Risk Management solution providers (Sumo Logic and Tongdun Technology) and Communications Monitoring solution provider; Symphony.

- Previously mentioned Symphony raised the largest RegTech investment of the quarter, and the company now counts some of the largest financial institutions such as Barclays, HSBC and JP Morgan as investors.

- Tongdun Technology provides risk control and anti-fraud solutions for fraud management applications in financial services, leveraging AI and big data analytics. The Hangzhou-based RegTech company raised a $100m Series D round in April 2019 from China Merchants Capital, China Everbright Limited, GGV Capital, Cinda Sinorock Capital and Guotai Asset Management, and was the only company not based in the US to be listed in the top 10 deals list of Q2 2019.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global