Investors have already poured twice as much into RegTech companies this year than they did in 2017

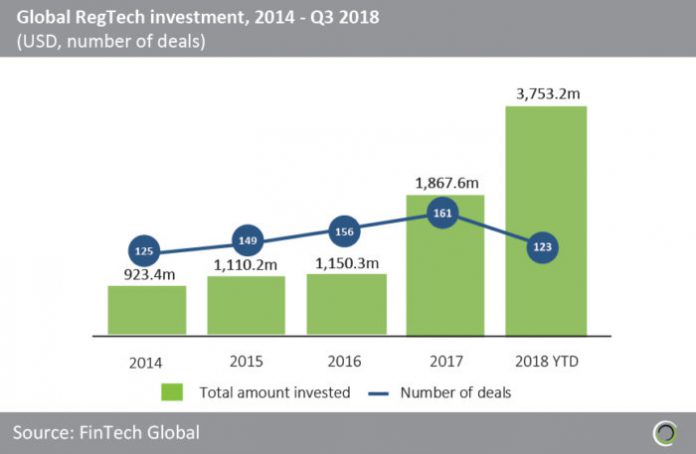

- Just over $8.8bn was raised by RegTech companies globally between 2014 and Q3 2018, with 714 deals completed during the same period. Funding doubled between 2014 and 2017, before jumping to $3.75bn this year.

- When excluding the $1.2bn of funding that facial recognition solution provider SenseTime raised in Q2, 2018 funding is still 47.4% higher than the total funding from last year.

- Annual deal activity has remained above 120 since 2014, reaching 123 transactions in the first three quarters of 2018, setting strong expectations that deal activity will at least match 2017 figure.

Global RegTech investment this year had the top two funding quarters on record

- RegTech investment dipped from $613.5m in Q3 2017 to $343.2m, with deal activity increasing from 28 transactions to 40 during the period. Investment in Q3 2017 was boosted by the $410m Series B round raised by SenseTime, an identification solutions provider based in Beijing.

- Global RegTech investment reached almost $4bn during the first three quarters of the year, setting an annual funding record for the sector. SenseTime raised over $1.2bn across two Series C rounds in Q2, from investors including Alibaba, with the aim of defending its market position against competitors such as Face++; another facial recognition solution provider in China. This pushed the funding for the sector to almost $1.9bn during the quarter.

- Exiger, a New York-based provider of financial crime compliance and risk management solutions, raised an $80m Series A round from Carrick Capital Partners in Q3 2018. This was the second largest deal of the third quarter and will enable Exiger to accelerate its growth by continuing to build out and acquire differentiated technology and technology-enabled solutions.

SenseTime raises another mega round to push RegTech funding to over $3bn

- More than $1.3bn was raised in the top 10 RegTech deals in Q3 2018, equal to 92% of the capital invested in the sector during the quarter.

- AI facial recognition solutions developer SenseTime, raised a $1bn Series D round from SB China Venture Capital in September 2018. This comes off the back of the $1.2bn Series C funding that the company raised in Q2 2018, pushing the company valuation to $5bn.

- Toronto-based Q4, a Communications Monitoring and intelligence platform to help investor relations professionals comply with regulations such as MiFID II, raised a $38m Series C round led by Napier Park Global Capital. The funds raised will be used to further develop the platform, expand global sales and marketing, and pursue acquisitions.

- Forter is an online fraud prevention solution provider based in New York, and the company has raised $100m since 2013. Forter received $50m in Series D funding in September 2018, led by March Capital partners with participation from Sequoia Capital and Salesforce Ventures among others. Forter is not yet profitable but it has tripled its customer base in the last 12 months and the company says that it is on track to grow by more than 150% between 2017 and 2018.

Goldman Sachs and New Enterprise Associates top the list of most active RegTech investors

- As the regulatory landscape continues to evolve, financial institutions have increased their demand for RegTech solutions given the increase in regulatory burden since the financial crisis of 2008, and have also been making investments in solutions providers.

- Goldman Sachs tops the list of active investors between 2014 and Q3 2018, having participated in 10 transactions during the period. The investment bank co-led a $17.4m (?13m) Series A investment in London-based Eigen Technologies, a document compliance automation provider leveraging NLP. This was the largest RegTech deal in the UK in Q2, with funding used to expand business in London, New York, Asia and the Americas.

- New Enterprise Associates (NEA) has also completed 10 RegTech deals since 2014, joining Goldman Sachs at the top of the list. The Menlo Park-based venture capital firm participated in $12m Series B round that Canopy Tax, a tax compliance solution provider, raised in May 2018. Canopy surpassed 5,000 users this year, servicing more than one million taxpayers. NEA also invested in the $50m Series D round that Forter raised in September 2018.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ?2018 FinTech Global