Concerted efforts from the government, the Danish finance sector and Copenhagen FinTech, the country’s industry association, are helping to create a strong FinTech ecosystem that is taking a key role in the Nordic region. Amongst the most active sub-sectors that are attracting investors are WealthTech, Payments & Remittances and Marketplace Lending.

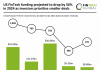

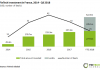

Over the last three years investments in FinTech companies have grown over eight times. Last year a record $50.1m was invested across 13 deals. The record funding last year was mainly driven by the $22.5m raised by Samlino, a financial services comparison website. In addition, Bancore raised $6.7m to expand its mobile payments and remittances solutions to underbanked population in emerging markets. The two biggest deals are representative of the two most active FinTech areas in the country – WealthTech and Payments which accounted for 18 of the 23 FinTech deals in the past three years. The top three investors – SEED Capital, Nova Founders Capital and SEB Venture Capital funded over 40% of the deals in the country since 2014.