Key AML and FinCrime statistics 2022:

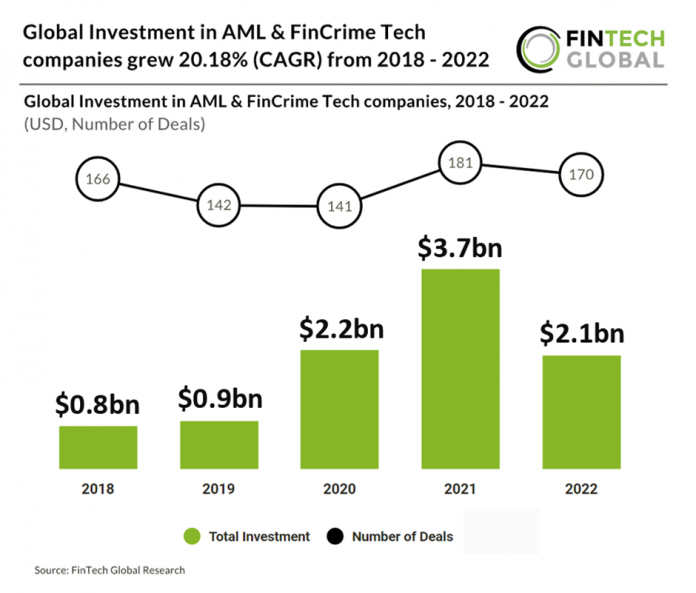

• Global investment dropped 43% in 2022 from 2021

• UK investment increased more than three-fold in 2022 (from 2021) reaching $103m in total

• Global Investment saw a 20.18% compound annual growth rate (CAGR) from 2018 – 2022

• 6% Global deal activity drop in 2022 from 2021

AML and FinCrime companies saw a pull back in funding during 2022 with Global investment dropping 43% compared to 2021 levels. The sector has seen a significant increase in interest from VCs over the last five years. Global Investment in AML and FinCrime companies have grown at a CAGR of 20.18% from 2018 – 2022. Global deal activity in the sector also saw a shortfall in 2022 reaching 170 deals in total, a slight 6% drop.

Snappt, a PropTech AI-enabled fraud detection platform, was the largest AML and FinCrime deal in 2022 raising $100m in their latest Series A funding round, led by Insight Partners. The company’s Series A funding continues the momentum of rapid growth Snappt saw in 2021, including apartment unit and revenue growth of +700%. The new investment will be used to accelerate product development, increase sales and marketing efforts and expand market reach.

Global anti-money laundering fines rose 53% in 2022 with fines for crypto companies up 90%, as regulators tightened control on financial misconduct. Financial institutions faced a total of $5bn in fines in 2022, with the spike tied to heavy fines for crypto firms and sanctions busting commodity trading after the Russian invasion of Ukraine and resolution of legacy issues. The largest AML fine issued by the Financial Conduct Authority (FCA) in the UK was £107.7m, given to Santander for risk of financial crime in the Retail Banking sector.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global