H1 2017 saw $34m invested in Italian FinTech companies which is over a third more than last year.

- Satispay was partly responsible for the jump in total investment. The mobile payments provider received a $15.4m series B round in April 2017 courtesy of Iccrea Banca in the firms largest funding round to date. This is the largest deal to an Italian FinTech company since MoneyFarm $17.2 Series A deal in Q4 2015.

- Investments valued under $15m also had a good start to the year with 89.9% of the total invested in 2016 already invested in H1 2017.

- Deal numbers fell by 17.6% in 2016, however this looks set to rise in 2017 as the first half of the year already saw 8 deals closed. If investments continue at the current rate in the second half of 2017 they will be on track to surpass the 17-deal high set in 2015.

Marketplace Lending companies received a fifth of all FinTech deals in Italy since 2014.

- Marketplace Lending companies received the highest number of deals between 2014 and H1 2017. The largest deals to marketplace lending companies in this period went to SME Finance platform InstaPartners and P2P lender Smartika. The companies raised $8.7m and $4.9m in 2016 respectively.

- Despite receiving 4% less deals than Marketplace Lending companies, the Payments & Remittances sector received $3.7m more funding between 2014 and H1 2017.

- More than 50% of deals to Italian FinTech companies went to Funding Platforms, Payments & Remittances, Infrastructure & Enterprise Software and WealthTech companies.

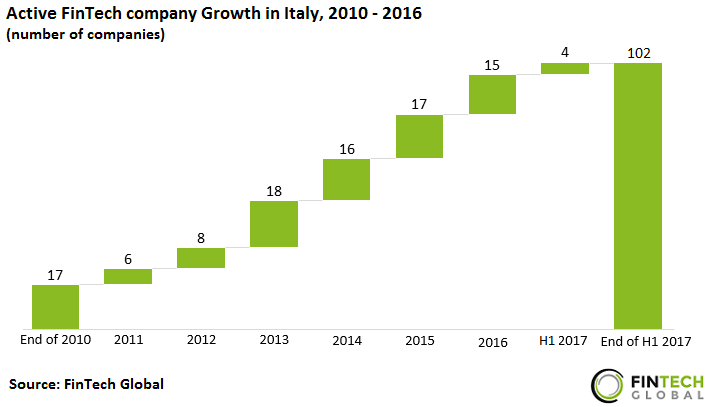

The FinTech ecosystem in Italy has seen consistent growth since 2010 with an average of 12 new companies formed each year

- There are now more than 6 times more FinTech companies based in Italy than there were at the end of 2010.

- Since 2013 the pace of growth has accelerated with double digit increases each year. In the first half of 2017 FinTech global has only identified 4 new FinTech companies however this is likely to increase as the new start-ups this year get more established.

- There are a variety of Italian FinTech companies that have since moved their headquarters out of the country. An example of this is MoneyFarm, which was founded in 2011 by has since moved its HQ to London.

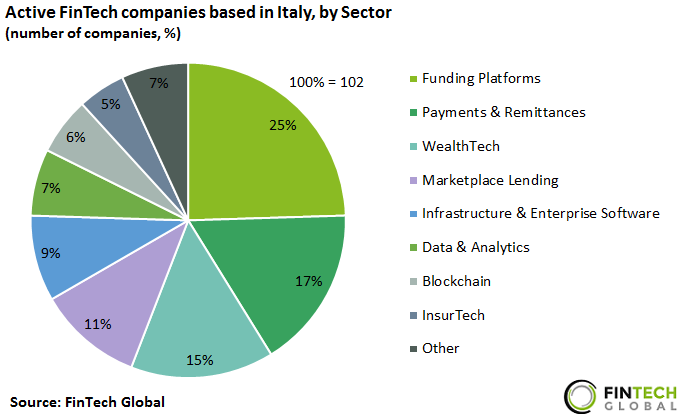

25% of FinTech companies based in Italy are Funding Platforms, despite receiving only 15% of deals and 2% of total investment

- Funding Platforms is the largest FinTech Sector in Italy. 68% of companies operating within the Funding Platforms space are crowdfunding companies while the remaining 32% are Debt/ Equity Financing platforms. The highest funded company in this space is Growish, a crowdfunding platform based in Milan which received a $448.9k funding round from Banca Sella Holding and other Investors in Q2 2017.

- The Other segment includes; Institutional Investments & Trading, Real Estate and Cryptocurrencies. These sectors have the smallest representation in Italy with a combined total of only 7 companies.