Bookkeeping service provider Bench has closed an $18m Series B-1 funding round led by iNovia Capital.

Existing investors Bain Capital Ventures, Altos Ventures, and Silicon Valley Bank, also participated in the funding round.

Canada-based Bench an online bookkeeping automation platform that helps small businesses to simplify various processes. The company helps to automate bank statements, categorising transactions, and production of monthly financial statements.

Bench has helped to manage more than $19bn in funds and can now automate around 60 per cent of bookkeeping jobs, according to the company.

Equity from the round will be used to accelerate the development of Bench’s automation platform, expand its team and increase the services offered.

iNovia Capital partner Shawn Abbott said, “This new capital will accelerate the development of Bench’s cognitive augmentation platform— a key element of the company’s ability to deliver incredibly high-quality yet cost-effective bookkeeping services. Bench is a fantastic application of iNovia’s future of work thesis. We look forward to working with the team as they advance their product and bring Bench to a broader audience.”

Following the transaction, Abbott will join Bench as a board member.

This Series B-1 round brings the company’s total funding efforts to $53m, with the Canadian company bagging a $16m last year. Bain Capital Ventures led the previous round, with Altos Ventures and Contour Venture Partners also taking part.

Last week, automated bookkeeping solution provider botkeeper closed a $4.5m Seed investment led by Ignition Partners. The company plans to use the proceeds to boost the development of its products and expand its sales and marketing efforts.

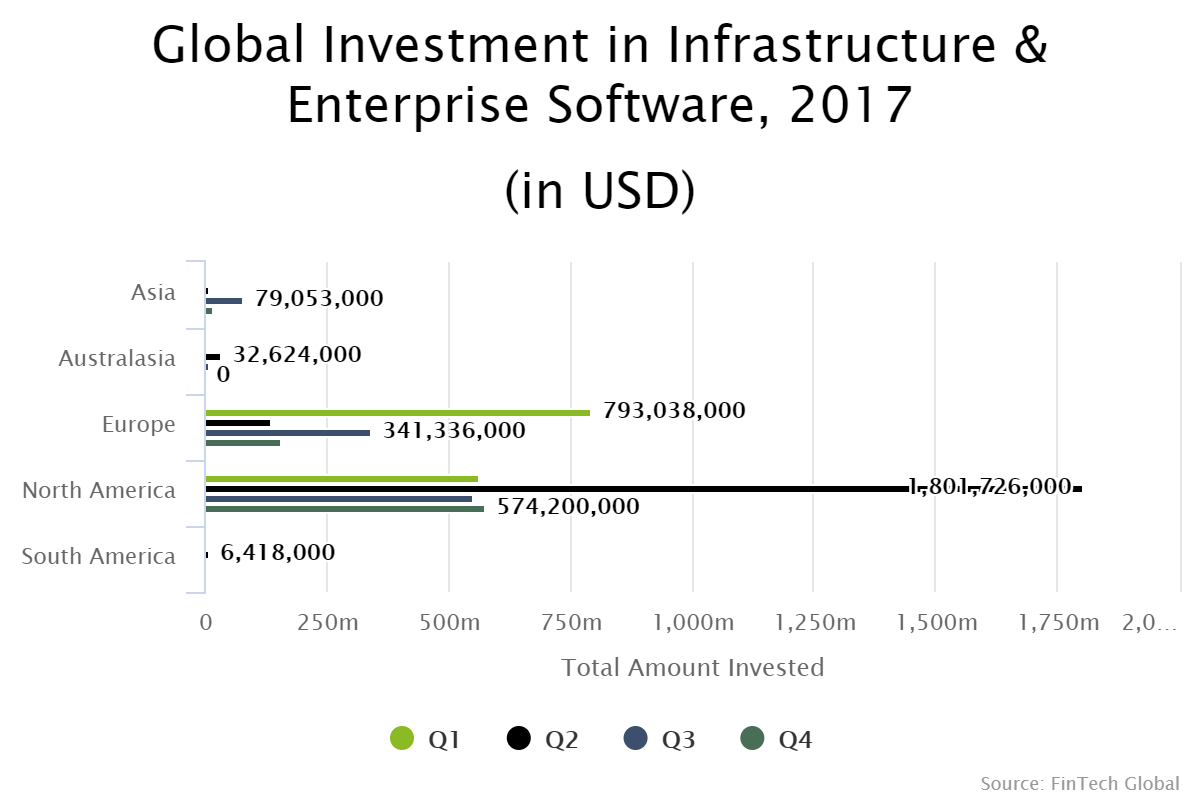

The infrastructure and enterprise software sector was dominated by the North American market last year. The North American region saw more than double the capital invested, than the combined total of the rest of the world. Around $3.4bn was deployed to FinTech companies in the region, while $1.5bn was deployed to companies elsewhere in the world.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global