Cryptocurrency exchange goNumerical (Coinsquare) has closed a new $30m round of funding led by Canaccord Henuity Crop.

Canada-based Coinsquare is an online exchange platform for cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dash and Dogecoin. The platform offers a customisable trading interface, charts and graphs showing the markets, and a platform instant token trading.

This batch of capital will be used by the company to fuel its global growth plan and diversification strategy to make its platform more effective for users. The company currently has 90 members of staff, and hopes to expand to 200 by the end of Q2.

Some plans for future growth include strategic investments into digital currency mining companies, launching a group of funds for investing in digital tokens, and forming a trading and arbitrage division for exchange opportunities.

To help with growth plans, Coinsquare has hired investment banking veteran Ken Tsang as CFO, Robert Mueller as the COO and Lewis Bateman as the chief business officer.

Coinsquare CEO Cole Diamond said, “We have seen tremendous investor confidence in the Coinsquare business model, having raised a total of $47.3 million in just over four months – notable for this industry. We take a very different view than your typical digital currency trading platform.”

Late last year, Coinsquare completed a CAD$ 10.5m funding round, at a post-money valuation of CAD $110.5m. The investor to the previous round was not named; however, the company states they are a ‘prominent global asset manager.’

Last year, Singapore-based cryptocurrency exchange platform Kryptos-X netted a $1m Seed round from Fatfish Internet Group. The company hopes this funding will support its expansion to new geographies with similar regulatory framework.

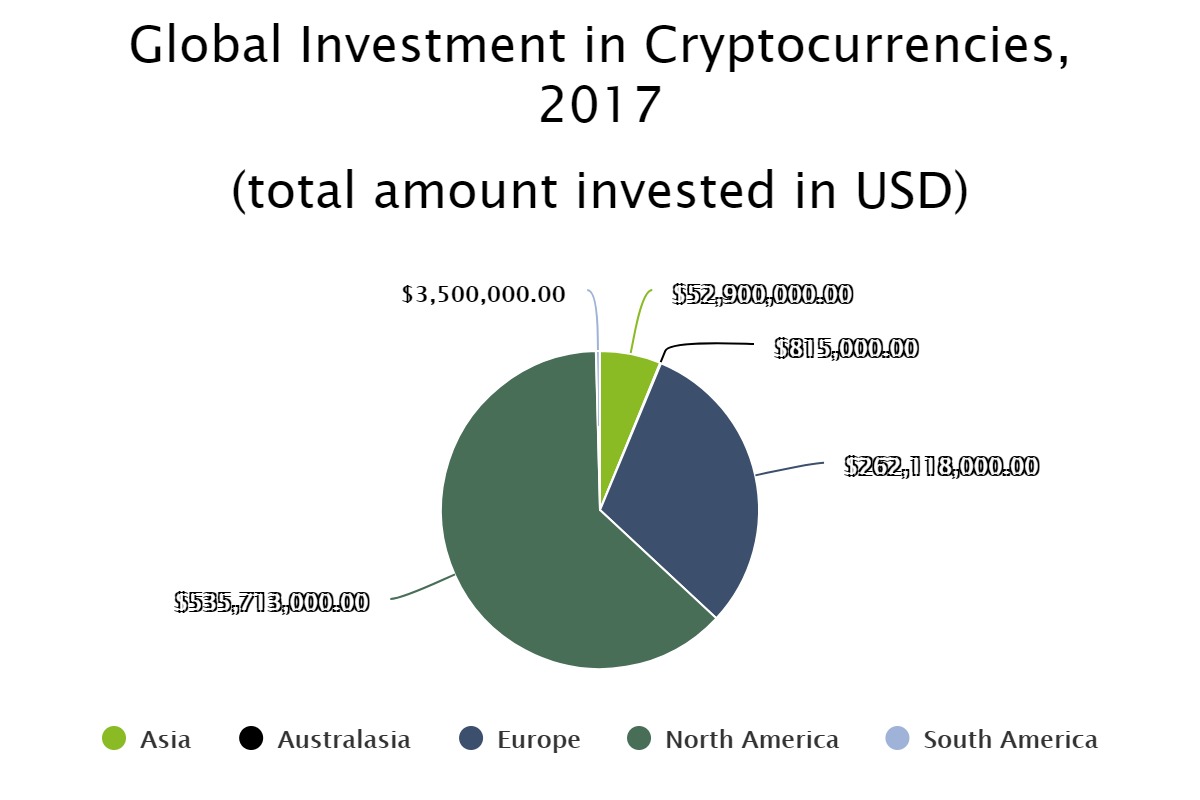

Around 63 per cent of the capital invested in companies developing cryptocurrency solutions, went to ones based in North America. The global sector saw $855m invested, of which, $535m went to the North American businesses.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global