BlockFi, which is a digital lender for cryptocurrency holders, has collected $1.55m in funding.

Contributions to the investment came from ConsenSys Ventures, Kenetic Capital, PJC, SoFi, Purple Arch Ventures and Lumenary.

New York-based BlockFi is a non-bank lender that provides dollar-based loans to crypto asset holders. The platform, which is live in 35 states, works by a consumer sending their cryptoassets to BlockFi’s secured storage, and in turn receiving funds in their bank account. Monthly interest repayments are then paid in either dollars or cryptos.

Loans can be taken for a 12-month period and on a 12 per cent interest rate. Both individuals and corporations can apply for loans on the platform, helping to diversify investments, getting potential tax benefit or supporting finances.

Capital from the round will be used to bridge the gap between traditional debt capital and cryptos.

BlockFi CEO and founder Zac Prince said, “Cryptoassets are natively digital and global by design, which creates opportunities that haven’t existed before from a lending perspective.

“By bringing institutional quality technology infrastructure, data science, risk management and operations to the cryptoasset market, we aim to be the leading lender in the cryptoasset market and a leading provider of low cost credit globally.”

Last year, wholesale energy system Grid+, which is a member of ConsenSys Lab, raised $40m in its pre-ICO sale.

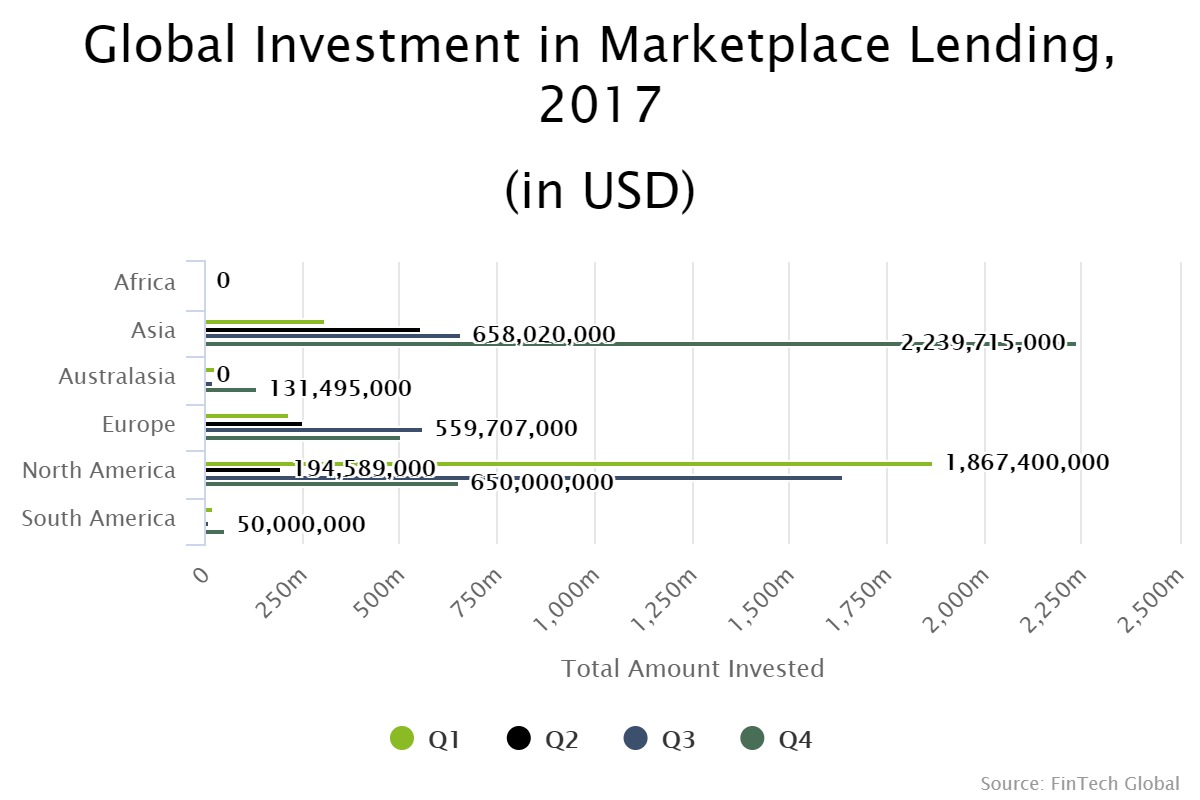

Around 44 per cent of the capital invested in to the marketplace lending sector last year, went to companies based in North America. The region saw $4.3bn injected into companies, and the next biggest area for funding was Asia, which bagged $3.7bn.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global